UK banks: what City experts think of Lloyds, Barclays, RBS and HSBC

Find out why UK bank shares have hit harder than euro peers, plus the outlook for Q2 results in July.

19th May 2020 12:00

by Graeme Evans from interactive investor

Find out why UK bank shares have hit harder than euro peers, plus the outlook for Q2 results in July.

The new normal for UK banks is still far from known, but that has not stopped one City firm taking a positive longer-term view on Lloyds Banking Group (LSE:LLOY) and rival lenders.

UBS sees domestic banks as attractively valued compared with European counterparts, leading to potential upsides for shares in Lloyds, Barclays (LSE:BARC), Royal Bank of Scotland (LSE:RBS), and smaller challengers Paragon (LSE:PAG) and Virgin Money (LSE:VMUK).

Much, though, will depend on the duration of the UK lockdown and how capital buffers and consumer spending patterns are changed by the Covid-19 crisis. And, if we thought the sector's recent quarterly results were bad, there is much worse to come when figures for the current three-month period show how movement restrictions have impacted the top-line.

The knock-on effect for net interest margins following the Bank of England's emergency 0.65% interest rate cut, and the cost of Covid-19 related customer assistance, means Lloyds and Barclays are facing a 15% quarter-on-quarter decline in net interest income, according to UBS analysts.

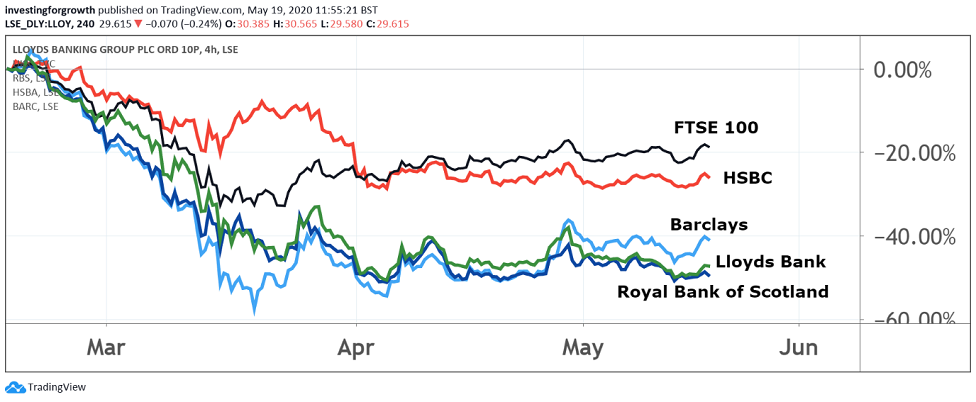

The UK banking sector's shares have performed particularly poorly this year, with only HSBC on the top 10 list of the most robust European banks, following a 32% share price decline. RBS, Virgin Money, AIB and Bank of Ireland all make the bottom 10.

This follows first-quarter results in which a surge in credit impairments meant all three major UK-facing banks missed underlying profits targets by some distance, despite better-than-expected revenues in the case of Barclays and RBS.

Source: TradingView. Past performance is not a guide to future performance.

UBS banking analyst Jason Napier sees several reasons why UK banking shares have been hit harder, such as the absence of a short-selling ban compared with many other countries. Income funds also account for a bigger proportion of the UK market, leaving banks vulnerable after their dividends were cancelled in March.

And the FTSE 100 index's overweight position on financials and energy stocks — 29% compared with 17% globally — is also likely to have been a turn-off for exchange-traded funds.

Napier, however, sees a number of strengths for UK banks relative to much of the European universe. Chief among these is the higher UK interest rate, which is still positive at 0.1% compared with minus 0.5% at the European Central Bank. There's also a greater probability of the UK seeing higher rates at some point than the eurozone.

The analyst also highlights the UK's more favourable market structure, as well as a higher ROTE (return on tangible equity) for retail and commercial banking through the cycle.

What matters more for the longer-term fundamentals of the UK banks, Napier notes, is whether there is a leg-up for the sector beyond 2021 from normalising loan losses, as long as this is not offset by worse-than-expected revenue declines.

It is unlikely, however, we will get a clearer picture around the depth and duration of the credit cycle until lockdowns materially ease over the summer months.

For now, there is significant uncertainty. The Bank of England's own desktop forecasts point to impairments at triple UBS's forecasts and for the sector to be loss-making in 2020 and 2021. The central bank also cut capital buffers to 11% from 14.8%, driven by risk-weighted assets.

UBS estimates that about a fifth of UK mortgages, a tenth of car finance agreements and perhaps 5% of cards are on payment holidays, making it hard for banks to know what sort of financial shape their customers are in. And there is no way of knowing accurately how many workers will be re-employed once the lockdown is over and furlough schemes have ended.

While more visibility on loan losses will probably have to wait until the second half, the upfront costs of lower interest rates and some of the customer support provided by banks will be apparent when the sector reports second-quarter results in July.

This will contribute to the poor share price performance for UK banks in the near term, although Napier thinks a sector on 6.4 times 2021 earnings per share offers longer-term value.

He added:

“Much depends on how far capital ratios fall in this crisis and how much customer patterns have changed for good.”

UBS has a price target of 140p on Barclays for a capital upside of 44%, with Lloyds seen at 45p for a potential rise of 58%. Shares in the latter have struggled to break back above the 30p threshold since hitting a multi-year low in early April. They were at 62p at the start of 2020.

The note from UBS also has a 39% upside for RBS to 145p, with Paragon up 35% to 435p and Virgin Money shares seen as potentially more than doubling to 160p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.