UK bank shares: Q1 2025 results review

With the big UK-listed lenders soon reporting latest quarterly results, City writer Graeme Evans reveals what some of the Square Mile’s analysts expect to happen.

22nd April 2025 14:46

by Graeme Evans from interactive investor

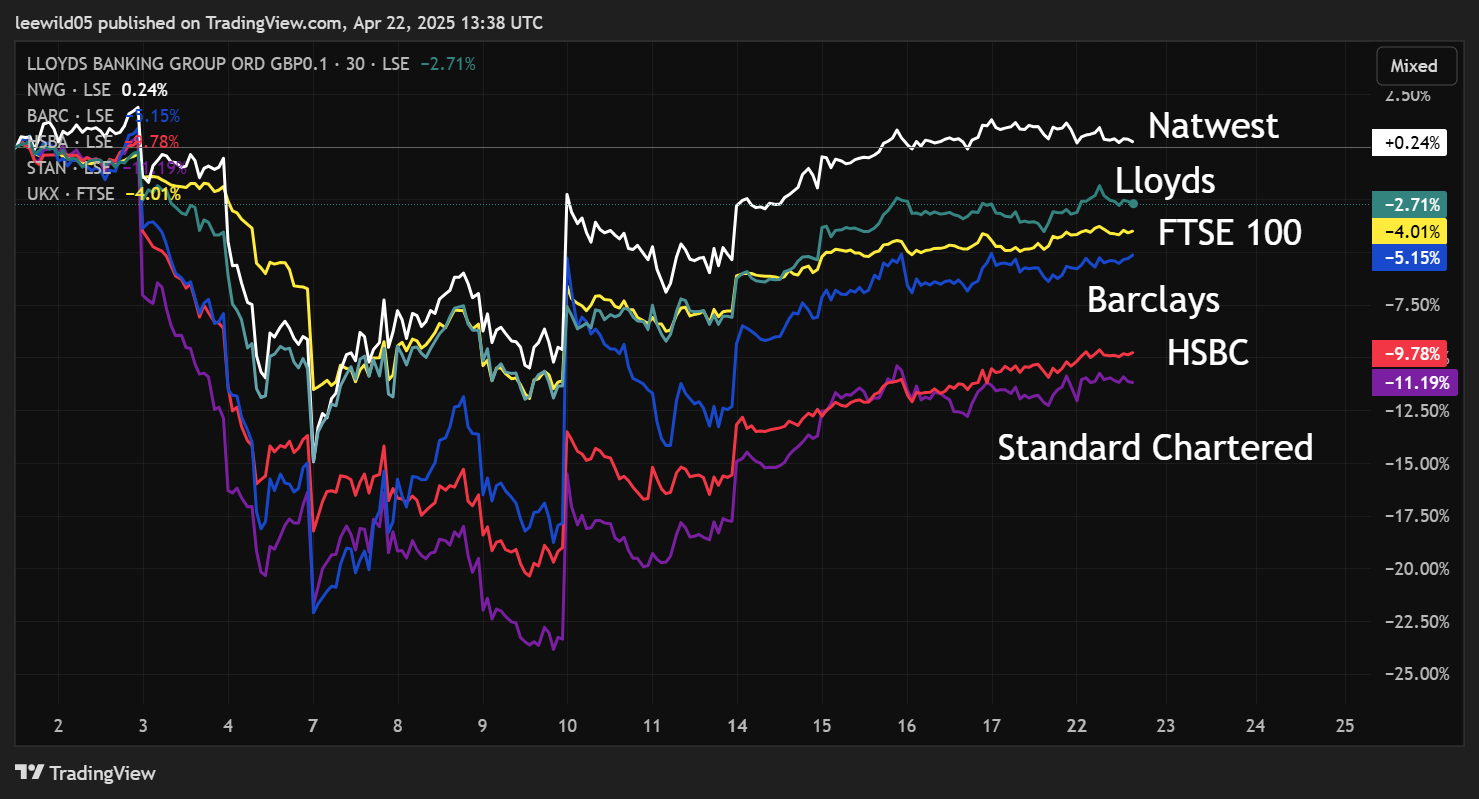

Lloyds Banking Group (LSE:LLOY) and NatWest Group (LSE:NWG) approach their earnings season as the best performing of the UK-listed banks after tariff uncertainty hit Barclays (LSE:BARC), HSBC Holdings (LSE:HSBA) and Standard Chartered (LSE:STAN).

The shares of Lloyds and NatWest traded well in the first quarter and have recovered much of the ground lost in the aftermath of Donald Trump’s Liberation Day bombshell on 2 April.

Their resilience reflects optimism that the growth shock to the UK economy is likely to be lower than for the eurozone, while robust industry fundamentals should offer support.

- Invest with ii: Open an ISA | ISA Investment Ideas | ISA Offers & Cashback

As long as the UK interest rate outlook doesn't change significantly, UBS regards the UK domestic banks as attractively valued for their good top-line growth that’s been underwritten by structural hedge returns and balance sheet expansion.

It added in a note published earlier this month: “We see the industry dynamics as attractive: strong balance sheets, banks that have distributed all capital to their CET1 targets for many years, signs emerging of a somewhat more pro-growth regulatory regime, accelerating loan growth (especially corporate and household unsecured) and rational pricing.”

Source: TradingView. Past performance is not a guide to future performance.

Previewing the first-quarter results season, the bank said it continued to regard NatWest among its UK top picks based on a target price of 500p and 2025 forecast dividend yield of 6.5%. Morgan Stanley also expects a solid set of results, but keeps its Equalweight rating given it believes peak net interest income (NII) growth is behind us.

UBS also highlighted the appeal of a “very cash generative” Lloyds but has a Neutral stance pending greater clarity from the forthcoming Supreme Court adjudication on car finance. However, analysts at Morgan Stanley make Lloyds their top pick, given they expect NII to beat consensus estimates. They’re also looking out for any commentary on motor finance but think litigation will be manageable.

Sterling strength and exposure to the US in the case of Barclays and to Asia for Standard Chartered and HSBC, mean their shares are down between 6% and 11% since 2 April.

Having delivered an 80% total return in 2024, Barclays fell from 296p to 241p in the days after the tariffs announcement as investors worried about a weaker US dollar, slower investment banking activity and softer outlook for US consumer credit.

There’s been a recovery in recent sessions to 277p after sentiment benefited from the read-across to this month’s forecast-beating Wall Street banking sector results.

- Which of these four bank stocks should you be buying?

- 10 hottest ISA shares, funds and trusts: week ended 18 April 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Morgan Stanley told analysts that the tariff uncertainty and subsequent market volatility had disrupted near-term deal activity, but that its pipelines had not meaningfully changed since the beginning of the year and remained robust.

It added that while the timing of deal execution remains sensitive to market conditions, there continued to be demand for strategic advice and capital raising. But the broker keeps its Overweight rating on the stock despite the obvious short-term macro impact.

Barclays is the other UBS Buy recommendation, noting that it trades well below the price/earnings multiples of its US investment banking peers and short of its UK counterparts NatWest and Lloyds. It has a price target of 360p, with a forecast 2025 dividend yield of 3.6%.

UBS believes that the market will take some time to gain confidence around HSBC's new divisional modelling and the near-term impacts of its new strategic plan.

It added: “While we see a path to a more positive view on the stock, we think greater clarity around China-US trade relations will be required for substantial relative progress to be made.”

- Stockwatch: loss of intelligence behind short selling

- Heavyweight investors switch from US stocks to gold and cash

- Five ways to make the best start to new tax year

HSBC kicks off the results season on Tuesday 29 April, followed by Barclays on 30 April and Lloyds on 1 May before NatWest and Standard Chartered on 2 May. The outlook for post-tariff trading rather than what is expected to be another set of solid earnings figures will be the focus.

Standard shares were the hardest hit of the UK-listed banks in the market turmoil, falling from 1152.5p to as far as 878.8p on concerns over the impact of US and China tariffs for credit quality, interest rates, loan demand, investment bank trading volumes and Wealth revenue growth.

Having updated its forecasts to incorporate lower projections for net interest income and Wealth revenues and higher provision charges, UBS has reduced its target to 1,310p from 1,440p previously. It notes a projected dividend yield of 3.8%.

The bank’s other price targets for the UK’s big five lenders show HSBC at 820p with a forecast 6.9% dividend yield and Lloyds Banking Group at 72p and 5.4%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.