UK bank sector results: challengers rally

Still reeling from the crash, smaller lenders attracted investor buying after these results.

6th May 2020 15:21

by Graeme Evans from interactive investor

Still reeling from the crash, smaller lenders attracted investor buying after these results.

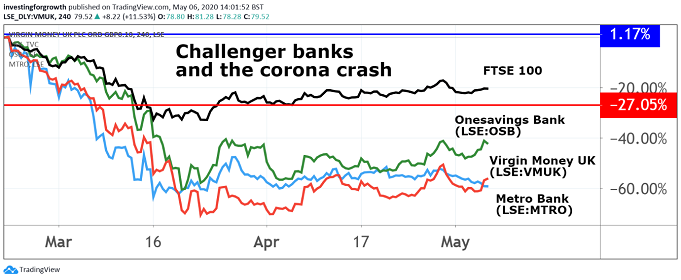

Virgin Money (LSE:VMUK) and Onesavings Bank (LSE:OSB) succeeded where their bigger rivals failed last week, as the sector's results season ended with big rises for shares in the challenger banks.

The half-year figures from Virgin were significant for being much closer to City expectations, with sharply lower profits of £120 million among the key metrics in line with forecasts.

The 58% year-on-year drop reflected a £232 million charge against future loan losses, with Covid-19-related bad debt provisions split between £110 million for business, £39 million for personal lending and £15 million in mortgages.

The company's guidance on its capital position also reassured analysts, with the all-important Common Equity Tier One (CET1) ratio - a key measure of financial strength - of 13% higher than the City's forecast of 12.8%. This resilience helped Virgin shares jump 13%, although at 80p they are still far from the 180p seen in mid-February.

Source: TradingView. Past performance is not a guide to future performance

Analysts at UBS are holding out for shares to recover to 170p, but admit much will depend on the potential downside for loan losses in 2020, plus the outlook for income next year as slower loan growth and persistently low interest rates make their presence felt.

With industry dividends having been suspended, last week's first-quarter results from the blue-chip banking sector was predictably grim as profits at the likes of Lloyds Banking Group (LSE:LLOY) and Royal Bank of Scotland were obliterated by rising bad debt provisions.

Lloyds shares were still trading at close to 30p today, having fallen from 35p in the wake of last week's results. Virgin, which used to be known as CYBG, moved in the opposite direction today. Investors liked a defensive loan book with 82% high-quality mortgages and no material exposure to the business sectors most directly impacted by the Covid-19 lockdown.

There was a similar message at OneSavings Bank, whose shares climbed 5% today after it said it had entered 2020 with an “extremely strong” CET1 at 16%. While highlighting its operational resilience, the specialist mortgage lender warned that current economic forecasts could result in a doubling of its expected credit loss provision from £42.9 million at the end of December.

A much shorter quarterly update from Metro Bank (LSE:MTRO) focused on its key metrics of assets, loans and deposits, which were all broadly close to where they were at the end of 2019. The bank, which has recently embarked on a restructuring under new CEO Dan Frumkin, said its capital ratios were in excess of minimum regulatory requirements.

Shares still fell 3% following the update to near their low for the year at 84p, having been one of worst performing of all mid-cap stocks during 2019. Last year's 88% slump came after the revelation of a major accounting error where some commercial loans on its balance sheet were wrongly classified in risk terms.

- Lloyds Bank shares: what you need to know after Q1 profits dive

- Richard Buxton interview: Lloyds Bank's results and dividend optimism

- Bank dividend cuts: top analysts give their opinion

- Take control of your retirement planning with our award-winning, low-cost self-invested personal pension (SIPP)

Frumkin set out plans in February to make Metro the UK's best community bank, an ambition he said today had never been more important.

Metro's product offering will also be enhanced and broadened with the aim of driving revenues and improving a net interest margin (NIM) that fell to 1.51% in 2019 from 1.81% a year earlier.

Since then, the industry's NIM benchmark has come under further pressure following the latest cut in UK interest rates. Virgin said today that it expected NIM for this financial year to be between 1.55% and 1.6%, compared with 1.62% in the half-year and 1.71% a year ago.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.