Two US corporate bidders I’d buy shares in

23rd March 2022 08:03

by Rodney Hobson from interactive investor

UK companies have long attracted the attention of American corporations with deep pockets, and now is no different. Our overseas investing expert thinks these acquisitive US firms are attractively valued.

Two American companies attempting to take over London-listed companies are not particularly well known on this side of the Atlantic, but it is always worth taking notice when companies display international intentions.

Logistics giant GXO Logistics (NYSE:GXO) has had a short life but a highly promising one. It was spun out of XPO Logistics at the end of July 2021, and it handles supply chains and warehousing for clients including clothing companies Gucci, Nike and H&M, a pretty solid and impressive bunch. For good measure it also delivers beer in the UK.

It has set its sights on Clipper Logistics (LSE:CLG), which would make an excellent fit. Clipper handles orders for retail chains such as Asda, ASOS (LSE:ASC) and John Lewis. Crucially, it has experience of handling returns, an essential ingredient of online shopping but an area where GXO is lacking exposure.

Clipper was floated eight years ago and you can see why it has attracted GXO’s attention. The shares have risen from an initial 100p to just over 600p on the London Stock Exchange’s Turquoise platform which caters, among other securities, for less well traded shares.

No formal bid has yet been put forward formally, and will not be until due diligence is completed and finance is in place, but the plan is to offer just under £1 billion in cash and shares. To win the backing of the Clipper board, the intended price has been set at 920p a share, a 49% premium over the previous stock market price, but that is a price worth paying for such a good fit. The combined group will be going places.

- F1 shares: more gains to come after Bahrain boost?

- How and where to invest £50k to £250k for income

- Shares, funds and trusts for your ISA in 2022

- Want to buy and sell international shares? It’s easy to do. Here’s how

GXO shares started life at $60 and topped $100 before last year was out. After some pretty sharp movements, they have settled around $77. There is no dividend and there probably won’t be one for the foreseeable future as the group goes through a big strategic upheaval. Subsidiaries accounting for about 70% of revenue will be sold or spun off, which will reduce debt and pay the cash side of the Clipper acquisition but will put tremendous strain on management

Source: interactive investor. Past performance is not a guide to future performance.

In the second proposed acquisition, cybersecurity specialist NortonLifeLock (NASDAQ:NLOK), is offering just over $6 billion for rival Avast (LSE:AVST). This is an equally good fit as GXO-Clipper. In fact, it may be too good a fit because there are few serious competitors in this highly specialized and potentially lucrative field.

The UK Competition and Markets Authority (CMA) has had a poke around and isn’t sure it likes what it sees. It has asked both companies to submit proposals to alleviate its concerns, otherwise there will be a lengthy inquiry.

- Video: Richard Hunter's ISA pick for Tax Year End 2022

- How to invest for difficult times

- Fundamentals: How to invest £100,000

One never can be sure with competition inquiries, but it should be possible to sort this out. After all, the CMA’s counterparts in the United States, Germany and Spain have raised no objections. However, the deal will no longer go though next month as planned and it could be towards year end before Avast shareholders finally cash in.

They will then have a choice of taking 90% in cash and 10% in Norton shares or an alternative of 31% cash and 69% shares. Either way, the premium is only around 20%, which from Norton’s point of view is pretty cheap.

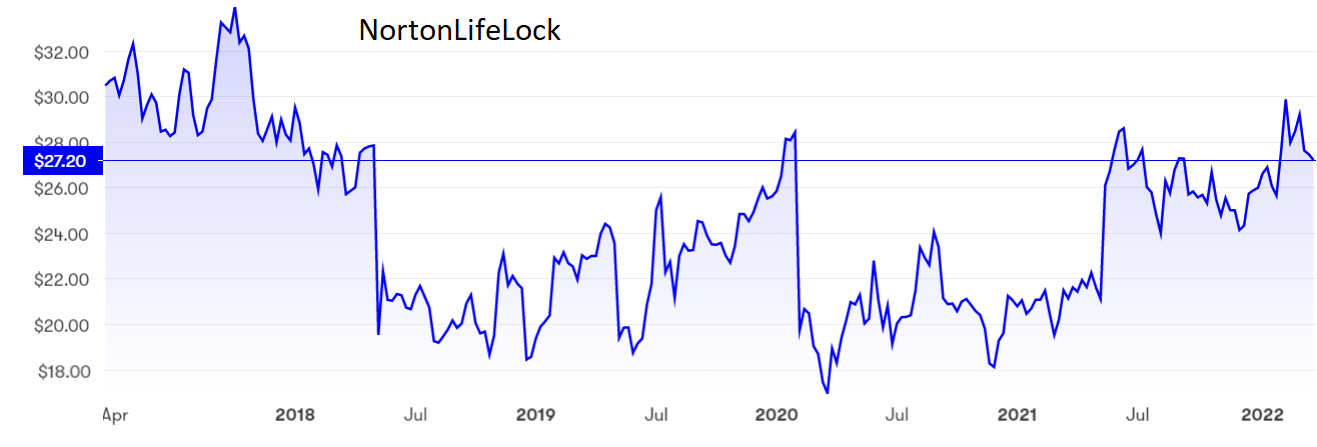

Norton shares have wobbled between $34 and $16 over the past five years and currently stand at $27.40 despite taking a knock when the deal was delayed. The yield is 1.82%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: GXO hasat last settled around a sensible price and is worth considering as a buy despite the considerable uncertain surrounding its future shape as the strategic review unfolds. It should have no difficulty in absorbing Clipper.

Norton is worth buying whether the deal goes through or not and Avast shareholders should consider the option that includes more shares to take advantage of the opportunities that will be available to an enlarged group.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.