Two stocks to buy and one to keep hold of

This sector has taken a hit, and investors looking for bargains need to proceed with caution, says overseas investing expert Rodney Hobson.

13th December 2023 10:17

by Rodney Hobson from interactive investor

American retailers had a torrid time of it in the first few months of the year as interest rates rose steadily. But with the American economy performing well, consumer spending holding up and unemployment staying low, they have entered the crucial Christmas period in better shape than one might have expected.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

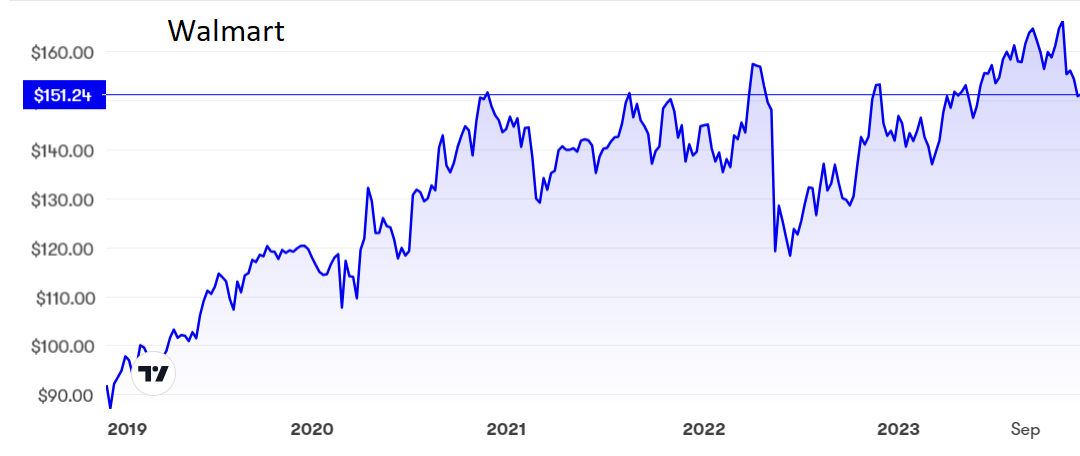

For example, Walmart Inc (NYSE:WMT) produced a strong set of third-quarter results and raised its full-year guidance in sharp contrast to seriously disappointing figures issued at the end of May. Perhaps the fact that it operates as a one-stop shop offering the lowest-priced goods has appealed to consumers in these more straightened times. It also reported a good start to the holiday season.

However, Walmart shares have failed to respond. See the expert analysis from Graeme Evans on 16 November: Why Walmart shares just slumped to five-week low. Since then the shares have slipped another $5 to around $151, where the price/earnings ratio is still heavy at 25.1 and the yield rather miserly at 1.5%.

Source: interactive investor. Past performance is not a guide to future performance.

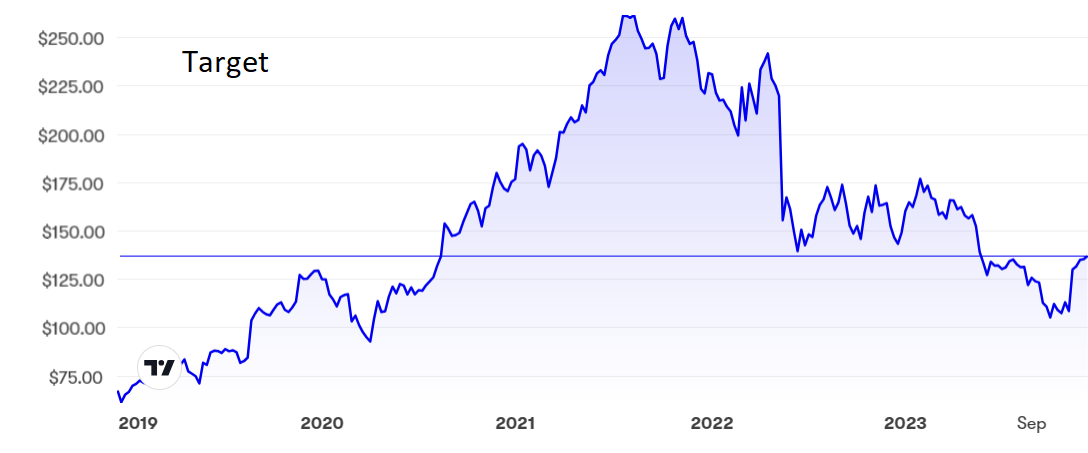

An alternative for investors is smaller rival Target Corp (NYSE:TGT), which also aims to sell home goods and household essentials at competitive prices but also adds trendy clothing to the mix. It has lagged Walmart and online shopping channels in providing same-day or quick delivery services but it has been playing catch-up since around 2017, when it paid $550 million for delivery service Shipt. This Christmas its delivery service is on a par with retail rivals but it has been built at a fraction of the cost.

Third-quarter figures were not exactly a runaway success with same-store sales down 4.9% on the previous year. Total revenue slipped 4.2% to $25.4 billion, with digital sales disappointingly down 6%, although that may reflect a general trend in recent months for shoppers to go back to real stores after a long surge in online retailing. On a more positive note, earnings per share at $2.10 were 36% higher than in the same quarter of 2022 and well above analysts’ expectations as margins improved considerably.

Source: interactive investor. Past performance is not a guide to future performance.

The company admitted that higher interest rates, the resumption of student loan repayments, increased credit card debt and lower savings had all conspired to persuade shoppers to delay spending wherever possible. That could mean higher spending closer to Christmas than in previous years, although alternatively it could mean that spending is on a lower scale than in recent Decembers.

The shares are way down from the peaks at $260 in 2021 and currently trade at $136. The p/e is more reasonable than Walmart’s at 17.22 and the yield better at 3.23%.

Hobson’s choice: shares in retailers are generally well down, and for good reason, so investors looking for bargains need to tread carefully. Walmart will bounce back but could have further to fall in the short term so I remain cautious, as I was in May when the shares were around current levels. On balance I rate Walmart a buy but I still prefer Target, which I first recommended at $86.50, and thus retain my buy rating.

Update: two existing shareholders in department store Macy's Inc (NYSE:M) have joined together to make a $5.8 billion offer to take the company private. The bidders, property investor Arkhouse Management and asset manager Brigade Capital Management, are offering $21 a share. This is not great news, neither for the staff who would be at the mercy of owners more interested in the bricks and mortar than in retailing, nor for shareholders who deserve a higher price.

The property portfolio alone is estimated to be worth $31 a share.

Last month, Macy’s easily beat analysts’ quarterly forecasts but that has not been reflected in the share price, allowing an opportunist offer. The shares trade at $19.30. If you are a shareholder, hold on in the expectation of a substantially higher offer.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.