Two quality high-end stocks that ooze style

Both these companies come with a hefty price tag, but then you wouldn’t expect to find a bargain here. Overseas investing expert Rodney Hobson explains why he’d love to own them.

21st February 2024 09:32

by Rodney Hobson from interactive investor

Despite talk of global economic gloom and recession hanging over Europe, there is always someone somewhere who wants and can afford luxury. Look at sales figures from Lvmh Moet Hennessy Louis Vuitton SE (EURONEXT:MC), the luxury goods sector’s bellwether, with its Bulgari and Tiffany jewellery and Tag Heuer watches.

The last three months of 2023 saw organic sales rise 10% to €24 billion (£25.5 billion), up slightly from 9% growth in the third quarter. Analysts had expected a fallback in growth. The figure for the whole year thus came out at a 13% improvement to €79.2 billion.

- Invest with ii: Buy International Stocks | Most-traded US Stocks | Cashback Offers

Critics can reasonably carp that the second half showed a marked deterioration from the first, when sales by the French group were racing 17% ahead, but that earlier speed was never likely to be sustainable, and double-digit sales growth is perfectly acceptable in any line of business. Europe, Japan and the rest of Asia reported 10% organic growth or better in the final three months.

All parts of the group did well last year apart from wines and spirits, which was up against tough comparatives, with customers still holding high inventories this time. Even this arm saw sales jump 26% towards year-end after declines in the previous quarters.

The star performer was the largest part of the business, fashion and leather goods, which gained market share across the world to achieve record revenue and profits. Another highlight was in fragrances and beauty, where Dior’s Sauvage remains the world’s best-selling fragrance.

Group profits for the year were up 8% to €22.8 billion, a considerable achievement given that the important Chinese market with its growing middle class has been stagnant for some time now.

Inflation and the cost of living crisis in major markets have reduced demand for companies in the $350 billion global luxury goods market. LMVH management is confident that despite the uncertain political and economic background, the group will continue to grow. There is no reason to believe that they are wrong.

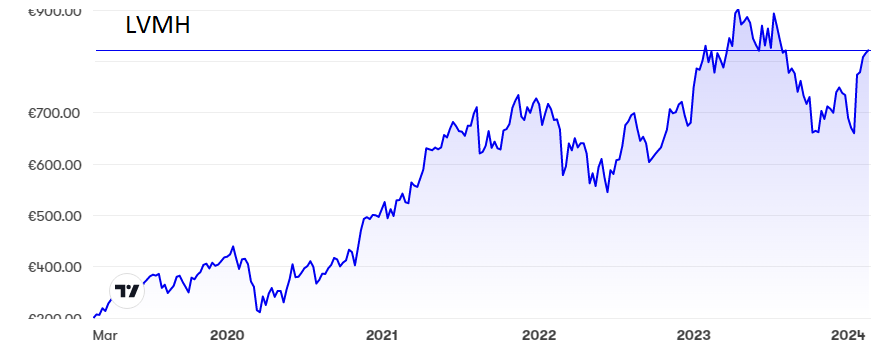

The shares tripled over four years to a peak of €900 last April. Despite a subsequent dip to €670 they are now back on the rise at €820, which could prove to be a temporary ceiling.

The price/earnings (PE) ratio fully reflects the strength of the business at 26.9, while the yield is unexciting at 1.5%.

Source: interactive investor. Past performance is not a guide to future performance.

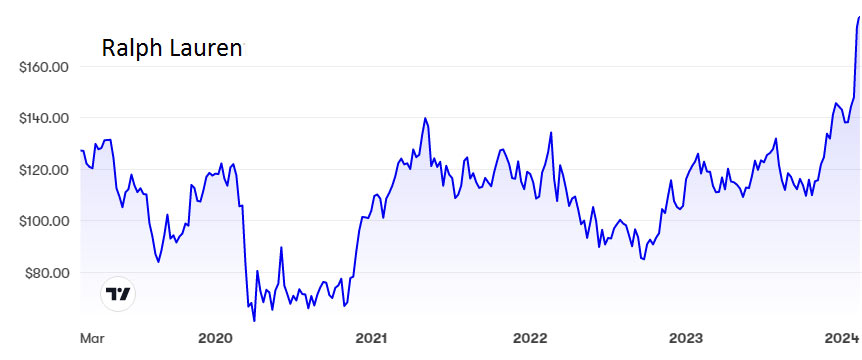

Meanwhile, luxury clothing retailer Ralph Lauren Corp Class A (NYSE:RL) beat analysts’ expectations in the September-December period, the New York company’s third quarter. When a pair of lady’s shoes can knock you back £449, you realise there is money to be made at the top end of the clothing market. Sweaters at £189 each look a snip by comparison.

Revenue rose 6% to just shy of $2 billion (£1.6 billion), easily beating Wall Street forecasts, with Europe and Asia leading the way upward. Same store sales were 9% ahead, twice as good as the market was expecting. No wonder the shares initially jumped 17% on the figures.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- ii view: Airbus details special dividend following record orders

- A decade of spectacular growth for Europe’s 10 biggest companies

That added to a strong run since October, when the shares stood at $110. They are now at a new peak of $183, although the PE is less demanding than for LVMH at an admittedly still toppy 20.4. The yield is also a little better at 1.7%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I last wrote about LVMH shares in November 2022 and suggested holding on at the then price around €700. Anyone who did so has been ahead for most of the time and enjoyed a solid if unspectacular dividend. The shares are still worth holding on to and, once again, investors could look for any weakness as an opportunity to buy. LVMH will not make you rich quickly but is unlikely to disappoint.

- Everyone says don’t try to time the market, but maybe they’re wrong

- Walmart achieves new record after bumper results

- eyeQ: 10 actionable trading signals for week beginning 19 Feb 2024

I gave Ralph Lauren a grudging buy rating 15 months ago. Those who were more enthusiastic than I was are now sitting on a sizable profit. Hold on while the good times roll. As with LVMH, any weakness would be a sign to buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.