Two places where Einstein would invest right now

A Finimize analyst considers two genius-level long plays.

19th January 2024 12:58

by Theodora Lee Joseph from Finimize

- Big ideas can get you pretty far – in life and investing. And throughout human history, these have been two of the biggest: defying death and defying gravity.

- The space value chain begins with launches so if you want some immediate lift-off, investing in companies involved in satellite manufacturing, launches, and services might be the way to go.

- The longevity economy covers a bunch of areas, like biotech, regenerative medicine, anti-aging treatments, genomics, personalised medicine, age tech, nutrition, wellness, and even some new financial systems like longevity insurance.

Big ideas can get you pretty far – that’s true in life and investing. And there have never been bigger ideas than defying death and defying gravity. So it’s worth a little exploration into these two genius-level long plays: the space economy and the longevity economy. Let’s, ahem, launch right into it…

The space economy.

The space race used to be a showdown between the governments of just two countries. But the space industry is a lot bigger than that now, and the private sector is in on the low-gravity action too. There are over 10,000 companies and around 5,000 investors currently playing a role in the “space economy”, which is basically all the money-making stuff “out there”, like satellites, space science, and even astro tourism.

Of course, the big moneymaker in the space economy is satellites, which make up more than 70% of the whole deal. That includes making them and launching them, plus all the gear that’s needed on the ground. Essentially, you can simplify the satellite industry into four main activities: manufacturing, launching, in-orbit maintenance, and service provision – think: Earth observation or high-speed broadband.

What’s the opportunity here?

Analysts at Citi are predicting that the space industry will reach a whopping $1 trillion in yearly revenue by 2040. They expect launch costs to drop a massive 95%, opening the door for more tech services in space. Thanks to advancements, especially from private companies, satellites are getting smaller and lighter, and space exploration is becoming way more affordable for more players.

The future of space holds some pretty sci-fi possibilities, like mining in space or even building stuff up there. Picture this – pharmaceutical companies setting up labs on space stations to study cell growth, or semiconductor companies making computer chips in zero-gravity factories. The catch, though, is that we’ll need to keep slashing the costs of launching satellites, spacecraft, and rockets to make these futuristic dreams a reality.

Right now, even with all the buzz about space tourism, things like space-based solar power, mining on the Moon or on asteroids, intercity rocket travel, and microgravity research and construction are still kind of up in the air, more in the “what if” realm than the planning stage.

The longevity economy.

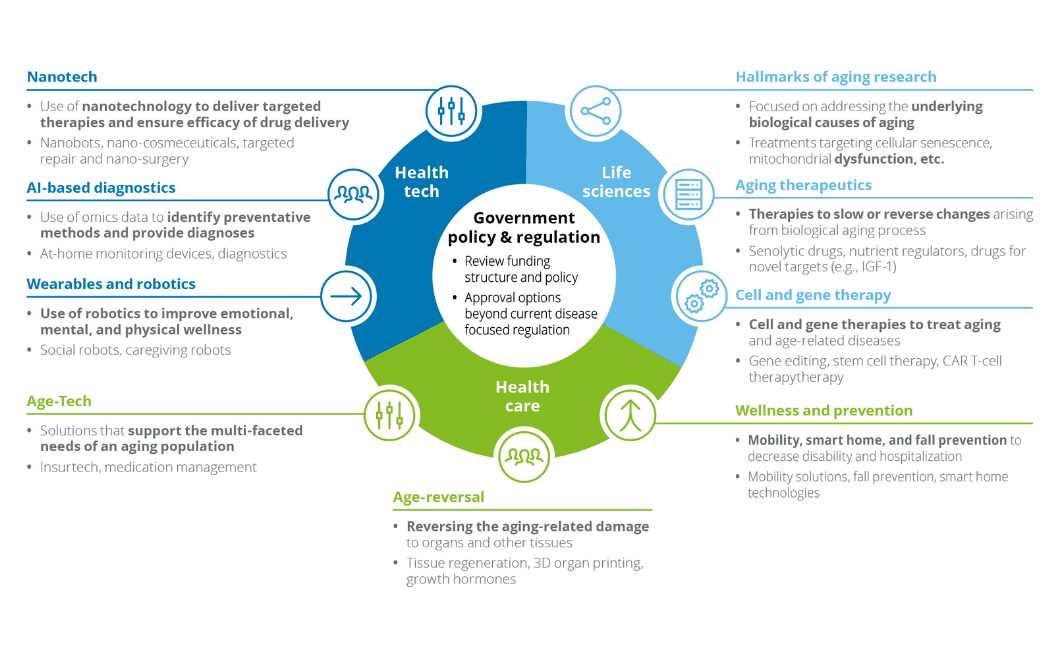

It’s about time. Actual time. The longevity economy is built around helping people live longer – and helping to make the years better. The idea is to slow the harmful effects of aging and even reverse the clock, so people can live longer, more happily, and in better health. This whole scene covers a bunch of areas, like biotech, regenerative medicine, anti-ageing treatments, genomics, personalised pharma, age tech, nutrition, wellness, and even finance, with things like longevity insurance.

And there are good reasons why this economy is booming right now. Stanford University’s Center on Longevity says that by 2050, a century-long lifespan will be the norm for newborns. And, get this, by 2030, there’ll be over a billion people worldwide who are 60 or older. This demographic shift presents a massive opportunity for businesses to adapt and thrive – even as world growth slows.

The longevity economy and its parts. Source: Deloitte.

What’s the opportunity here?

It’s pretty far-reaching actually, stretching like a Tai Chi class across industries and sectors. With people living longer and healthier lives, new markets, technologies, and services are already emerging to cater to the needs and preferences of an older demographic. Here are a few of those areas:

Healthcare and biotech. There’s rising demand for medical treatments, pharmaceuticals, and therapies to target age-related diseases and conditions. That brings opportunities for breakthroughs in regenerative medicine, personalised medicine, and the development of anti-ageing interventions.

Wellness and lifestyle. There’s a growing market for fitness programmes, nutritional supplements, wellness retreats, and technologies designed to support healthy, older lifestyles.

Financial services. Longer retirements come with bigger price tags, so that means more demand for financial planning services, retirement solutions, and long-term care insurance.

Age tech. As with everything, there’s a role here for technology. Gadgets that allow individuals to age in place – like smart home solutions, mobility aids, and safety devices – will see strong demand.

Long-term care and assisted living. With more people living longer, there will be an increased need for innovative and personalised care solutions, including senior living communities, home healthcare services, and technologies that assist with daily life.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.