Two gold stocks as an alternative to US tech sector

It’s not just US tech stocks shooting the lights out in 2020, and these gold plays could keep rising.

15th July 2020 09:36

by Rodney Hobson from interactive investor

It’s not just US tech stocks shooting the lights out in 2020, and these gold plays could keep rising.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Gold is indisputably on the rise again, with central banks and private investors buying the precious metal. For those who don’t want the disadvantages of holding gold bullion – the cost of storing and insuring holdings means gold is a drain on income – shares in goldmining companies is an alternative that avoids costs and produces an income in the form of dividends.

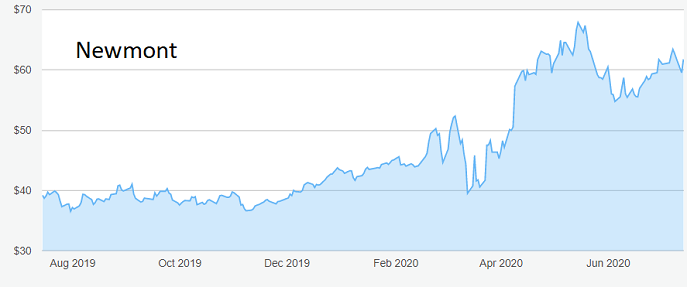

The world’s largest producer, and the only one in the S&P 500 index, is Newmont (NYSE:NEM). Last year it produced 6.3 million ounces plus a further 624 million ounces of biproducts. The company expects to continue producing 6.2-6.7 million ounces a year from mines in the United States, Australia, Peru, Ghana and Suriname. It also produces copper in Australia and United States.

Source: interactive investor. Past performance is not a guide to future performance.

Gold traded around $1,300 an ounce until May last year, when it started to take off. It now stands at around $1,800. In sterling terms, it has soared from £980 to above £1,400 in little over a year.

That is good for Newmont, which has driven down its production costs to about $800-900 an ounce, roughly half the price it can be sold at, and lower than the $966 average in 2019. Even if the price of gold slips back, which happened after the last surge to $1,800 an ounce in 2011, Newmont will be mining at a decent profit.

Investors should beware of seeing gold as a safe haven. It brings in no income and buyers are entirely reliant on new investors being willing to pay higher prices in future in order to make a profit. It is true that those who bought in 2000 have seen the value of their holding quadruple; those who bought in 2011 are only now back to where they started.

The current rise was initially sparked by low or even negative interest rates on government bonds, making alternative investments comparatively more attractive, as Cherry Reynard reported on this website last December.

- Gold investing: Is it too late to join the party?

- 10 speculative mining stocks for gold bugs

- Gold boom: $2,000 gold and two hot miners in demand

- Gold boom: prices and prospects by Petropavlovsk

Just as the gloss was fading, an extra boost has been provided by the coronavirus crisis that has made equities less appealing. Low interest rates look likely to last for quite some time yet, while economic uncertainties will hang over the global economy for an indefinite period.

The price of copper is more dependent on the state of the global economy, but it has held up well, recovering all the losses suffered during the Covid-19 crisis to reach a 12-month high of nearly $3 a pound.

Newmont’s next figures are due on 30 July. Analysts expect quarterly earnings per share of 33 US cents, a big increase on the same quarter last year. Sales should also be ahead, though at a less spectacular rate. If these projections are vindicated, the share price could well receive a substantial boost, as further improvement is likely over the rest of 2020, particularly in the profit level.

The shares dipped briefly below $40 at the bottom of the market in March but have since peaked at $68. They are still up 42% in 2020 so far, but have come off the boil in recent days, providing an opportunity to buy at around $62, where the yield is 1.1%.

- Stockwatch: ugly duckling gold miner becoming a swan

- US earnings season: what US company results for Q2 2020 might look like?

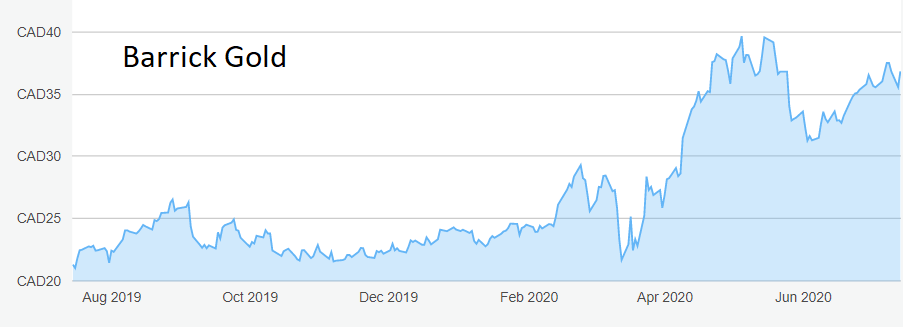

An alternative investment is Barrick Gold (TSE:ABX), which acquired Randgold, then the largest gold miner listed on the London Stock Exchange, last year. It has mines in North and South America, Australia and Africa.

Source: interactive investor. Past performance is not a guide to future performance.

Its share chart follows a similar pattern to that at Newmont as the same arguments apply, but at under 1% the yield is less attractive. The shares are up 53% in 2020 so far just under C$37.

Hobson’s choice: Buy Newmont up to $65. Barrick can be considered up to the recent peak of C$37.50, although that opportunity may not be around for long.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.