Two fallen star stocks good enough to stage a comeback

Both these small-cap shares were at record levels prior to the crash. Our analyst assesses prospects.

5th June 2020 15:48

by Richard Beddard from interactive investor

Both these small-cap shares were at record levels prior to the crash. Our companies analyst assesses prospects for a recovery from sharply lower levels.

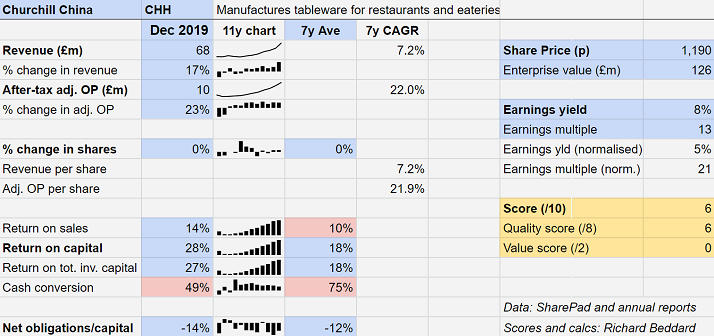

Churchill China's (LSE:CHH) annual report for the year to 31 December 2019 tells quite a story. But in many ways that story is overshadowed by what has happened since. Maybe it shouldn’t be.

Out-competed by cheap Chinese imports two decades ago, Churchill China chose to focus on tableware for the hospitality industry: pubs, restaurants, sporting and social venues, and caterers. The materials and processes developed over centuries in the potter’s long history gave it an advantage in the manufacture of hard-wearing plates, and the adoption of robotics and other manufacturing innovations improved efficiency.

By adding colour and texture to the products, but little complexity to the manufacturing process, Churchill China found it could charge more for tableware that didn't cost much more to make.

Soon, it was not only winning in the UK, where it is the leading supplier to the hospitality trade, but in Europe, the home of bigger and very efficient German manufacturers. Just over half of Churchill China’s tableware revenue comes from standard white tableware, although the rapidly growing popularity of ‘value-added’ patterned and textured products explain why the company has flourished over the last decade.

In 2019, Churchill China accelerated investment to meet high demand, which depressed cash flow, underlining its commitment to the hospitality industry, a commitment emphasised by the acquisition of a competitor, Dudson, out of administration, and an important supplier of vital clays and glazes, Furlong Mills, which Churchill China already part-owned.

Endeavour written into the profit and loss account

Endeavour is written into Churchill China’s profit and loss account. The company has improved revenue and return on capital every year since 2012, and the result was a profit of nearly £10 million in 2019, compared to just over £2 million in 2012.

Sustained investment leads to sustained growth

Everything was going so well until the pandemic closed the hospitality industry down in March. The company has not updated investors since the early stages, when it had suspended manufacturing to save on energy and staff costs and was fulfilling orders from stock.

The annual report, signed-off on 7 April, contains little more detail. Churchill China will not propose a dividend at the upcoming AGM, and the combination of the shutdown and government funding of salaries means it is spending less than £1 million a month (it had net cash of nearly £13 million at the year-end and an undrawn bank facility).

Return to retail?

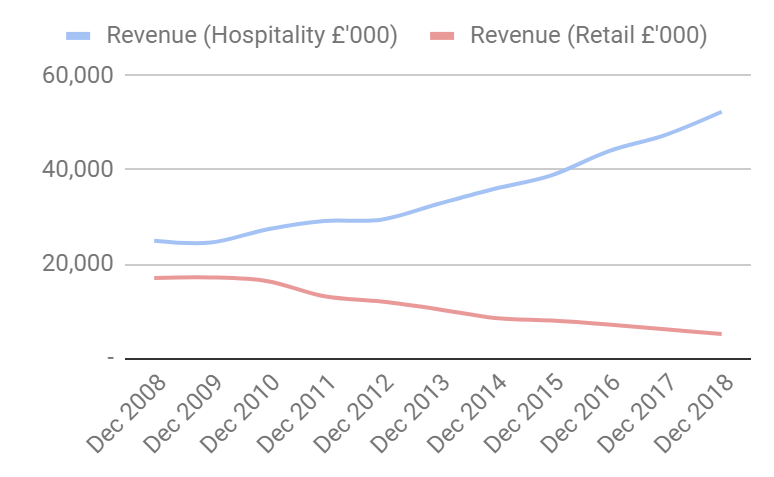

Longer-term, Churchill China says it has “considerable ability” to adjust its strategy to “other sectors”. With more people eating in, retail sales of tableware may be more buoyant, but devoting more resources to retail would be a turn-up for the books:

Churchill China has consistently built competitive advantage in the hospitality industry, allowing retail sales to dwindle. Source: Annual reports.

The company’s retail sales have shrunk so much that it dropped them from its segmental report in 2019, preferring to distinguish between ceramics (93% of total revenue) and materials, following the acquisition of Furlong Mills.

Much of what remains of retail is outsourced to China and, if the company switches production back to the UK, it will likely be a tactic to keep the factory operating at a reasonably efficient level until hospitality sales recover.

A more permanent reallocation of resources to retail is unlikely. Retail and hospitality customers are very different. Tableware is not a routine purchase for individuals or families, but restaurants and their distributors need a reliable supply of long-lived designs, so Churchill China is a service-oriented business.

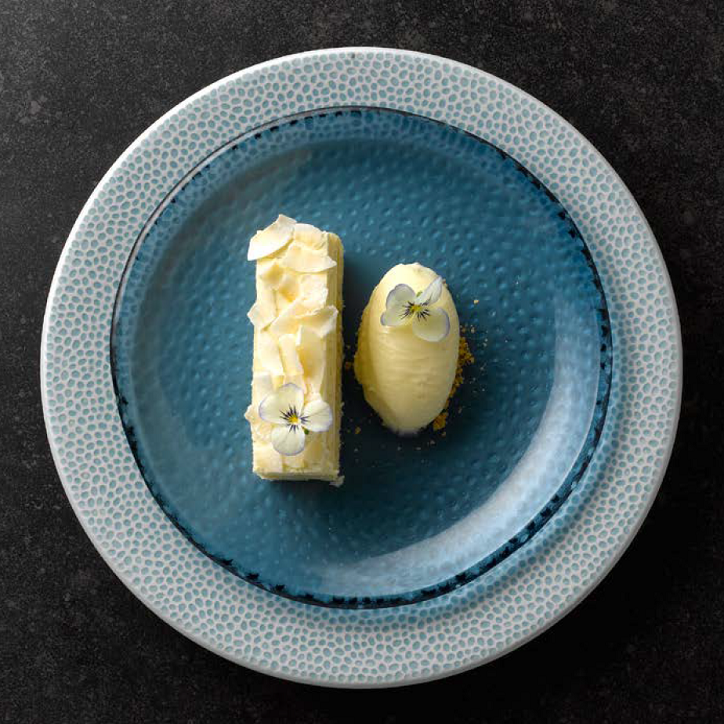

The product is different too. Durability is less important in the home because the product is used less frequently, and the patterns on restaurant tableware are simple and abstract, framing the food, as opposed to the more decorative patterns often found on tableware, which are there to be looked at as much as eaten off.

“Framing the Food”, source: Churchill China Annual Report

In the current environment, therefore, Churchill China’s considerable strengths are weaknesses. If people aren’t eating out and the futures of restaurants are in jeopardy, the restaurants will not be ordering more plates.

These days, Churchill China earns 62% of revenue from tableware abroad, so it may also channel its efforts into its much larger markets in Europe and North America, some of which may be less affected by Covid-19.

An investment in Churchill China today is a conflicted one. It is an excellent business, but its market has dried up in a way I never imagined that makes scoring it particularly difficult. I cannot fault Churchill China as a business, but its fortunes depend on the outcomes of a pandemic I do not understand. My torment is reflected in how I score it:

Does the business make good money? [2]

+ Yes. Return on Capital was 28% in 2019. It has improved dramatically over the last decade+ Cash conversion averages 60%. It has been dampened by investment in capacity and automation, and payments into the company’s pension scheme.

What could stop it growing profitably? [0]

- Until Covid-19 dies out, is eradicated, or we learn to live with it, profitability will be reduced. 2020 may be bleak. After that, who knows?

? Brexit: Churchill China earns 36% of revenue in Europe and imports some raw materials too.

How does its strategy address the risks? [2]

? The longer the impact of Covid-19, the less addressable the risks

+ A cash surplus, government help, and assets to sell off will keep the company going in the short-term

+ Investment in proprietary materials and processes means it should emerge stronger, as the hospitality trade recovers

+ A new logistics hub in Rotterdam will serve Europe.

Will we all benefit? [2]

+ Family-owned business that invests for the long-term+ Staff development is part of core strategy+ Directors are very experienced, salaries are within current norms.

Are the shares cheap? [0]

? A share price of £11.90 values the enterprise at £126 million, about 13 times adjusted profit in 2019. If the shares were available at this valuation a year ago, I would have loaded my portfolios up to the gills. But 2019 was the kind of year we might not see again for a while.

A score of 6/10 means Churchill China is probably a good long-term investment, but it is muted by a high level of uncertainty.

Hollywood Bowl: Playing a good game

Churchill China was one of three companies identified last week that confound me: a business I admire that is particularly exposed to the pandemic. Another is the tenpin bowling chain Hollywood Bowl (LSE:BOWL). While the trajectory and future impact of the pandemic is no clearer to me now than then, Hollywood Bowl has published half-year results for the period to March 2020, in which it spelled out in impressive detail actions it has taken to stay afloat and prepare for reopening.

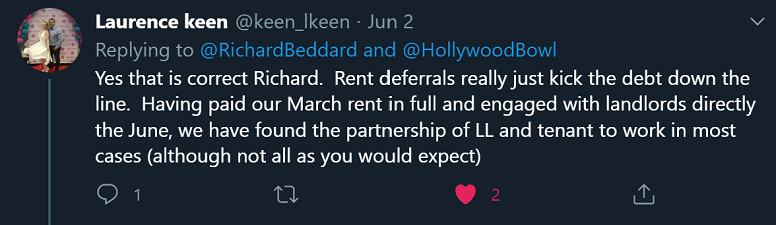

Perhaps most impressive was news that landlords are forgoing rent, a fact confirmed by chief financial officer Laurence Keen on Twitter:

In some cases, Hollywood Bowl has agreed to lease extensions, but I think these negotiations demonstrate one of the firm’s competitive advantages - its reputation as a ‘good tenant’, which helps it secure high footfall prime locations co-located with other leisure activities like cinemas and restaurants.

Obviously, this ecosystem needs to return to health if Hollywood Bowl is to be the highly profitable business it was, but it is reassuring to see the components of the ecosystem pulling together to bring that about.

Richard owns shares in Churchill China and Hollywood Bowl.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.