Trusts for the energy transition

29th October 2021 14:25

What opportunities are there for investment trust investors amid the spike in energy prices?

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Over the course of the last 18 months, the world has been battling a crippling pandemic, but thanks to the remarkably fast development of vaccines, the recovery is very much under way.

However, a potential threat to this recovery is the alarming rise in energy costs, which is being experienced by a number of countries. We would argue that this highlights that there will still be investment opportunities in fossil fuels over the next few years, as well as in the technologies allowing them to be used more efficiently, and taking advantage is consistent with an ESG approach.

The origins of the crisis

After the initial impact of the pandemic, when the UK economy locked down, UK natural gas futures fell to their lowest levels in 20 years. However, the sharp recovery since Q3 2020 has brought with it a sudden and unpredicted rise. Gas futures are now trading at more than double the level they reached in the recovery from the 2007-08 financial crisis.

Fundamentally, the rationale behind the rise in a commodity price can be boiled down to supply and demand. Logically, as countries begin to re-emerge from lockdown and economies look to reopen, a rapid rise in energy demand could very much have been predicted. However, the scale and speed of the increase have taken the market by surprise. There are a number of reasons for this rapid surge.

First, a longer and colder winter across Europe and Asia last year led to a major rundown of supplies and tighter gas markets with far less spare capacity. Second, the summer brought with it far calmer weather than expected, which has prevented wind turbine networks from bearing the load. Third, extreme weather conditions across the US, contributed to by Hurricane Ida, have led to rising costs in production as a result of refinery closures. In the UK, a lack of gas storage facilities in comparison to other countries has resulted in the need to purchase higher quantities of wholesale gas, greatly increasing prices.

The reality is that while the energy challenges we face have been intensified by factors such as adverse weather conditions and unpredicted demand, it should be acknowledged that under-investment in critical infrastructures crucial for gas production and storage has had a meaningful impact. With the transition to net zero likely to take a number of decades, this under-investment is going to have to be addressed by the market one way or the other, whether through sky-high prices or by exploring for new fossil fuel sources, providing opportunities for investors either way.

How close are we to net zero?

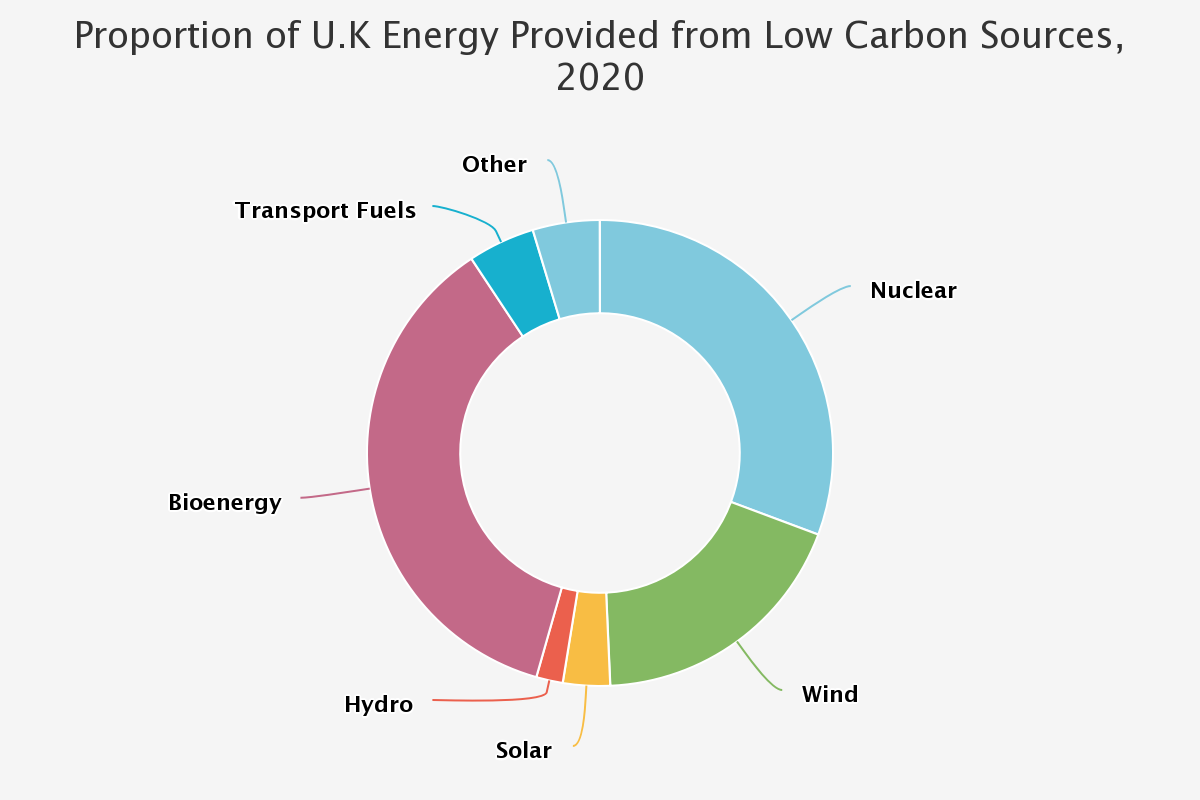

In 2020, the UK obtained 21.5% of its primary energy from low-carbon sources (according to the Department for Business, Energy & Industrial Strategy), which is more than double the 2010 figure of 10.1%. While this is promising and points towards improved technologies across the low-carbon landscape, it is nevertheless clear that fossil fuels remain critical to current usage. Furthermore, of the low-carbon sources of energy, in 2020 18% came from wind in what was the UK’s windiest year in five years. Already reliability issues have come to the surface thanks to 2021 being a much quieter year for wind, meaning other energy sources have been required.

A more recent snapshot of the situation – based on data from the National Grid analysing the forms of energy used to generate electricity in the UK on 12 October 2021 – shows a fossil fuel contribution of 59.5%. However, across a 48-hour period this figure dropped to 51.5%, and over the course of the last year it was around 45% (according to the National Grid). On the flip side, at no point over the last year did the contributions from renewable energy exceed 35%, which highlights the importance of a managed phase-out of oil and gas.

According to OGUK (the trade body for the offshore oil & gas industry), the UK has fallen from energy self-sufficiency in 2004 to a position today where it can meet only half its natural gas needs from domestic production. More worryingly, OGUK forecasts that without further sources coming on stream, domestic production will fall by 75% by 2030. Drilling for gas is objectionable for environmental reasons, but renewables are not yet ready to take up the slack (as we discuss below), and with a long lead time for nuclear power stations, gas is likely to remain a key source of energy in the short term.

UK LOW-CARBON ENERGY SOURCES

Source: The Department for Business, Energy & Industrial Strategy

All good things come to those who wait

None of this is to deny that the direction of travel is clear. In fact, the world has made major strides in ramping up renewable energy generation capacity in recent years. Based on analysis from the 2021 BP Statistical Review of World Energy, over the last five years renewable generation has accounted for around 60% of growth across global power generation, with wind and solar power capacity more than doubling. With forecasts for ESG assets under management to hit $53 trillion by 2025 (Source: Bloomberg Intelligence), demand for investment in less carbon-intensive sources of energy is going to expand dramatically, incentivising further growth. “Green” and “energy-transition” trusts have a clear runway of growth ahead of them, but there is a danger of putting too much faith in our politicians’ hype, and of the UK trying to run before it can walk. In the short to medium term, there is still an important place for fossil fuels in the UK’s energy mix, and if public consent for net-zero is to be maintained, it is essential that people can heat their homes and keep the lights on without breaking the bank in the meantime.

How should you invest in the transition?

One way to invest in both sides of the transition is BlackRock Energy and Resources Income (LSE:BERI). Until June 2020, BERI looked to pay a dividend coupled with long-term capital growth via investments in mining and traditional energy companies. However, in that month a third area of focus was added to the portfolio that relates to companies actively working towards the transition to a low-carbon economy.

With this broadening of its investment focus, the trust is positioned strongly for the current market trajectory. The decision to appoint Mark Hume as a co-manager of the trust has also intensified the shift of the trust to a more balanced energy portfolio. As at the end of August, the portfolio was underweight its neutral allocation of 30% in energy transition, with only 26% invested there, perhaps indicating that the managers see near-term opportunities in the forgotten traditional energy sources.

Thematic exposures that are deemed to be positive for BERI include electrification, energy efficiency, clean power and clean transportation. The managers believe that the energy transition will take many years, and that over the course of this period there will be investment opportunities; however, they can also invest in companies which they see as crucial for today’s global energy needs. The trust’s top 10 holdings include traditional oil majors such as Chevron (NYSE:CVX) and ConocoPhillips (NYSE:COP), in addition to large-cap mining holdings such as Rio Tinto (LSE:RIO) and BHP (LSE:BHP). However, from a cleaner energy perspective, holdings such as Vestas Wind Systems (XETRA:VWSB) demonstrate the balanced nature of the portfolio, which currently has a 4% dividend yield and trades at a 4.7% discount (as at 21/10/2021). We hope to publish an updated note soon.

Impax Environmental Markets (LSE:IEM)sits more on the clean energy side of the aisle. However, its flexible mandate means it can invest in mid- and small-cap companies that management expect to profit from the transition to a more sustainable economy. This has been used to invest in companies, such as Ashtead (LSE:AHT), which help to reduce emissions via their equipment leasing (see our latest note).

Having been launched in 2002 with a focus on ESG-conscious and sustainable investors, IEM has looked to identify growth companies within this area for nearly two decades. Management looks for companies across the globe that work to mitigate the effects of climate change. Areas of investment for IEM typically fall within four broad areas: new energy; water; water waste recovery; and sustainable food, agriculture and forestry. Diverse holdings within the sector have helped the trust to avoid the significant downturn in renewable energy stocks that has been seen across the last few months. IEM makes use of an ESG scoring system to screen stocks; accordingly, any which do not meet the trust’s required ESG score will not be invested in. The valuation-led approach in terms of aiming to generate consistent alpha is an approach that has helped IEM to perform well throughout a strong stock market growth cycle.

For investors looking to identify the potential growth companies of the energy transition, and who wish for exposure across the value chain, IEM most certainly remains a differentiated proposition to most global funds and trusts. It is expensive, though, trading on a premium of 5.4%.

Jupiter Green (LSE:JGC)aims to achieve long-term capital growth and income through investments across a diverse portfolio of companies that provide environmental solutions, and the trust mainly invests across small- and mid-cap companies that provide these solutions. Investments are underpinned by seven sustainability themes: the circular economy, clean energy, water, mobility, energy efficiency, sustainable agriculture, and environmental services.

Many of these themes are related to the efficiency of energy use, which aligns with the reality that a reduction in energy usage (or at least a reduction in the growth rate of energy used) will be necessary during the energy transition because renewable capacity is not yet close to providing for all our needs. JGC is currently trading on an 11.1% discount and could appeal to investors looking to take advantage of the sell-off in clean energy and environmental themes which we have seen in recent months.

Conclusion

As the world re-emerges from Covid-19 shutdowns, shortages of certain products and resources may have been inevitable. However, the huge spikes in energy prices – in particular for gas, as far as the UK is concerned – have highlighted how dependent we are on fossil fuels in the short to medium term.

We believe that a lack of investment and focus on resources that are crucial to our daily needs has created a troubling situation that is certainly not likely to be fixed overnight. As a result, this is a timely reminder to investors that they should be alive to the investment opportunities both in fossil fuels and in technologies allowing them to be used and extracted more efficiently, as well as in the energy sources of tomorrow. The transition is occurring, but it is likely to be slower than our politicians would like or promise.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.