A ‘Trump’ card for US small caps?

A look at Trump presidency's potential impact, from policy implications to market dynamics, with a focus on the unique positioning of small-cap stocks.

26th November 2024 09:21

The 2024 US presidential election has ushered in a new era of policy expectations and market dynamics, with Donald Trump's return to the White House potentially reshaping the investment landscape for US small-cap stocks.

As investors digest the implications of this electoral outcome, history has shown that bets on US small caps following US presidential elections often pay off, especially if the backdrop boasts: a growing economy (check), interest rate cuts (check), and favourable policies (check), which are key factors worth considering.

And while this time could be different, especially if the US Federal Reserve (Fed) can't deliver as many rate cuts as expected because of inflation pressures, we explore why the prospects for small caps may warrant consideration [1].

Economic growth and market-friendly policies

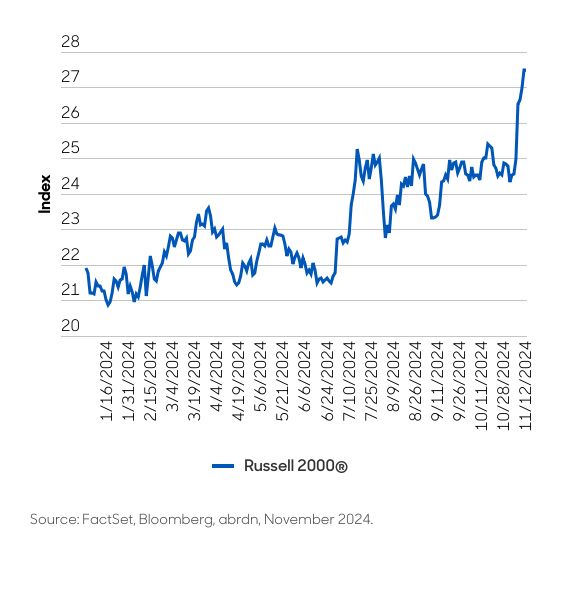

Trump’s presidency is expected to drive significant gains in small cap stocks. The Russell 2000 Index, which tracks US small cap companies, has already seen substantial gains (Chart 1). This reflects what we believe is investor optimism about Trump’s pro-business agenda [2] [3].

Chart 1. Russell 2000’s post-election surge

‘America first’ a key advantage?

US small-cap stocks are traditionally more focused on the domestic market, with less exposure to international trade and currency fluctuations compared to their large-cap counterparts.

This characteristic could prove particularly advantageous in the current environment, where Trump's America-first policies and potential trade restrictions might create headwinds for US companies with significant international exposure [4].

The proposed increase in tariffs, particularly on Chinese imports, could benefit domestic-focused small caps in several ways:

Tax policy implications

The prospect of corporate tax cuts under a second Trump administration could disproportionately benefit small-cap companies. Unlike large multinationals that often have complex international tax structures, small caps typically pay closer to the full US corporate tax rate. Any reduction in corporate tax rates would therefore have a more direct and significant impact on their bottom lines.

Regulatory environment

The expected relaxation of regulatory requirements under a Trump administration could particularly benefit small-cap companies, which often face disproportionate compliance costs relative to their size. Firstly, a reduced regulatory burden would lead to lower compliance costs. Small-cap companies typically have fewer resources to dedicate to regulatory compliance, so any reduction in these requirements would free up capital that could be reinvested into growth initiatives, such as research and development or expanding operations.

Secondly, faster product approval processes would be another significant benefit. Lengthy and complex approval procedures can delay the time it takes for small-cap companies to bring new products to market. Streamlining these processes would enable these companies to launch products more quickly, gaining a competitive edge and accelerating revenue generation.

Additionally, easier access to capital markets would be a crucial advantage. Regulatory requirements can often create barriers for small cap companies seeking to raise funds through public offerings or other means. By easing these regulations, small caps would find it simpler to access the capital they need to grow and scale their businesses.

Finally, a more flexible operating environment would allow small-cap companies to adapt more readily to market changes and opportunities. Reduced regulatory constraints would provide these companies with the agility to innovate and respond to customer needs more effectively, enhancing their overall competitiveness and potential for success.

Interest rates and economic stimulus

The Fed’s anticipated rate cuts are another factor that could boost small cap stocks. Lower interest rates reduce borrowing costs, which is particularly beneficial for smaller companies with higher debt burdens. Additionally, Trump’s policies are expected to stimulate economic growth, further enhancing the prospects for small caps [3].

Because of the limited size of these small-cap companies, they often have more room to grow. They can be more flexible than large caps, adapting to changing market conditions. Less analyst coverage in this space allows for a better chance for active managers to find undervalued, overlooked hidden gems [5]. This leads to greater opportunities to generate alpha than can be found among the well-researched larger cap US stocks.

Market dynamics and investor sentiment

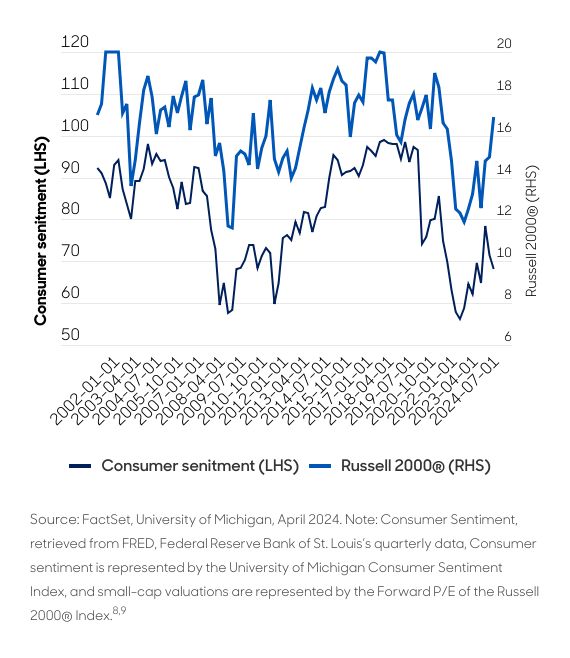

Investor sentiment has been buoyed by the resolution of political uncertainty and the expectation of a growth-focused economic agenda (Chart 2).

Chart 2. Small caps closely follow US consumer sentiment

The S&P 500 and other major indexes have also rallied, reflecting optimism about the new administration’s policies [6] [7]. With that, we believe small-cap stocks are poised to benefit from this positive market environment.

Final thoughts...

The combination of policy tailwinds and domestic focus makes US small caps an intriguing opportunity in the post-election environment. While risks exist, the potential benefits of tax reform, regulatory relief, and trade policy changes could create a favourable environment for select small-cap companies.

Christopher Colarik is small-cap portfolio manager at abrdn.

Tom Harvey is senior equity specialist at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

1 "US Yields Surge as Trump Victory Accelerates Bond Sell-Off." US News, November 2024. https://money.usnews.com/investing/news/articles/2024-11-06/yields-soar-as-likely-trump-win-stirs-bond-vigilantes.

2 The Russell 2000® Index is an unmanaged index considered representative of small‐cap stocks. The Russell 2000 Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co.

3 "Small cap ETFs set to explode under Trump presidency." NASDAQ, November 2024. https://www.nasdaq.com/articles/small-cap-etfs-set-explode-under-trump-presidency.

4 "4 Things Investors Should Be Doing to Prepare for Trump’s Second Term." Barron's, November 2024. https://www.msn.com/en-us/money/savingandinvesting/4-things-investors-should-be-doing-to-prepare-for-trump-s-second-term/ar-AA1tDimY?ocid.

5 "Identifying Hidden Gems." Small cap stocks: How to Invest in the Hidden Gems of the Market. FasterCapital, June 2024. https://fastercapital.com/content/Small-cap-stocks--How-to-Invest-in-the-Hidden-Gems-of-the-Market.html.

6 The S&P 500® Index is an unmanaged index considered representative of the US stock market.

7 "How Trump’s election is forecast to affect US stocks." Goldman Sachs, November 2024. https://www.goldmansachs.com/insights/articles/how-trumps-election-is-forecast-to-affect-us-stocks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.