Trio of investment trusts set to reward contrarians post-pandemic

When the world regains a semblance of normality, these trusts are likely to reward contrarian investors,…

11th May 2020 11:37

by David Liddell from interactive investor

When the world regains a semblance of normality, these trusts are likely to reward contrarian investors, argues David Liddell.

As I write, in the first week of April, the coronavirus-induced volatility in financial markets is exceptional. Since the start of the crisis, the FTSE 100 index has so far hit an intraday low of about 4900, in March, down 35% from the beginning of the year. It has since bounced back by 16%.

Markets have, in the main, been reacting to health statistics, as there is little clarity yet on how long the corporate shutdown will last. Amid this uncertainty, there is no consensus about how the global economy will look when the pandemic lockdown ends. It’s not an ideal situation for contrarian investors – what outcomes might surprise markets the most?

With governments pumping money into the global economy through unprecedented borrowing at the same time as corporate supply chains are breaking down, one answer to that question may be higher inflation and interest rates. In the crisis, government bond yields are being suppressed by the search for havens and by central bank buying. However, this may change when the increased government borrowing floods the bond markets with supply.

- Explore more investment trust content

Financial muscle

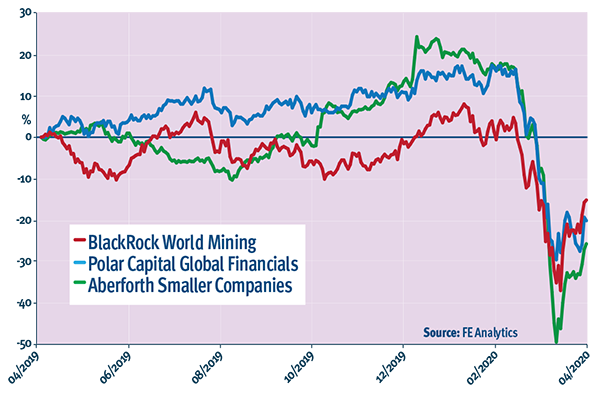

Which sectors might benefit from this background? These are highly unusual times, so perhaps history is no guide, but financials are usually a beneficiary of higher interest rates, at least while economies are on an upward trend. We think Polar Capital Global Financials Trust(PCFT) is worth a look. Its share price is currently 30% lower than its one-year high. The trust’s top five holdings are: JPMorgan, Mastercard, Bank of America, Chubb and Arch Capital. The geographic exposure is North America 44.8%, Asia-Pacific (ex-Japan) 18.1%, Europe 14.3% and rest of the world 22.8%.

We think high exposure to US banks makes sense.The ‘land of the free’ may be hardest hit over the short term by rising unemployment there, but it has the ability to bounce back quickly. Crucially, both from a regulatory and a capital position, US banks may be better able to maintain their dividends than European counterparts. The financial sector generally may find it easier to regroup once the crisis has abated, compared with some other sectors, as it has been easier for many of its employees to work from home.

The Centre for Economics and Business Research estimates that in the UK the shutdown may cause the finance and insurance sector to lose ‘only’ 18% of its output, compared with 50% for construction and 69% for manufacturing. Obviously, though, if the shutdown is a sustained one and brings about a full-blown recession, financials will probably not be the place to be.

Whether the statistics coming out of China on Covid-19 mortality are hugely understated or not – they almost certainly are – the authorities there seem to have the epidemic under control. With the Chinese government keen to reboot its economy, the stimulus measures being enacted should boost construction and manufacturing, which in turn should benefit the mining industry.

BlackRocK World Mining (BRWM) stands to gain. We like this trust for several reasons: its discount remains relatively high; its dividend yield, while under threat, would still be reasonable if it halved and should find support from the cash flow of underlying companies (assuming the lockdown doesn’t last too long); and valuations in the mining sector are not stretched. Rio Tinto, for example, is trading on an historic price/earnings ratio of around 8 times. The trust also has some protection from future turbulence through its 30% exposure to precious metals.

Encouraging construction activity is likely to be a priority for the UK government post-lockdown. No trust is ideal for construction exposure, but medium and small company trusts look promising.

Aberforth Smaller Companies (ASL), which has a number of construction industry suppliers among its top 10 holdings, looks like a decent bet. Its share price is 40% below its recent high, and it has a value bias and a good long-term record – although, like most value investors, recent performance has been nothing to write home about. The historic yield is 3.6% but, of course, dividends from underlying investments may be at risk.

Scope for further advances after lockdown

The author is founder of IpsoFacto Investor, which offers a free two-month trial of its advisory services. Visit ipsofactoinvestor.co.uk

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.