Trifast: Great company but should you buy the shares?

Despite big advantages over rivals, the investment case is not clear cut, argues our companies analyst.

2nd August 2019 16:50

by Richard Beddard from interactive investor

Despite big advantages over rivals, the investment case is not clear cut, argues our companies analyst.

The most admirable thing about Trifast (LSE:TRI) is the company's culture. It comes across in the annual reports as a confident and self-reliant business. More than half of Trifast's 1,300 employees have stayed for 10 years or more, even though those years have been eventful.

A people business

Trifast supplies fasteners - nuts, bolts, rivets and screws - increasingly to the most important manufacturers in the automotive and white goods supply chains, although its heritage is electronics. It is a fragmented industry, but your car dashboard or washing machine may be held together with Trifast fasteners.

Even nuts and bolts can be highly specialised, which means manufacturers value fastener expertise when they design new products. It is a people business according to chief executive Mark Belton, quoted initially in "Fastener + Fixing Magazine" (surely an "Have I Got News For You" staple) and reprinted in the annual report:

"People buy off people. People want to help; they want to know about the part; they want to talk to an engineer about its capabilities and understand the product."

The collapse in demand for diesel cars took the edge off Trifast's growth in the year to March 2019 and is weighing on its prospects for 2020, particularly in the UK. But the UK only earns Trifast 36% of revenue these days.

Thanks to a better performance in Europe, Asia, and the USA, and the acquisition of Precision Technology Supplies on the last day of the previous financial year, revenue and profit grew modestly and return on capital is at a record 17% suggesting perhaps there is more to making and selling nuts and bolts than meets the untrained eye.

New kid adopted by family

Trifast refers to itself as a family of businesses and the new kid, PTS, is a stripling costing less than Trifast's annual operating profit and headquartered just down the road in Sussex.

PTS distributes stainless steel industrial fastenings and parts to manufacturers and distributors in a variety of industries largely outside Trifast's biggest sectors, including medical instruments and robotics.

Trifast says customers are increasingly using stainless steel but given the edgy state of the auto industry it will perhaps be a welcome diversification too.

Without PTS' £7.1 million contribution to revenue and £1.2 million contribution to pre-tax profit in the year to March 2019, Trifast would barely have grown at all. With this contribution, revenue increased 6% and profit increased 8%.

Reasons to be cheerful

The company's global footprint and focus on the biggest multinational companies has put it at an advantage compared to local rivals as customers seek buy components of a uniform standard and design from a reduced number of suppliers.

Trifast collaborates with multinationals to source or design fasteners for them. Over half its inventory is customer specific and once a fastener is designed into a product, it will be required for years.

While dieselgate has highlighted the pace of change in the auto industry, Trifast fasteners are mostly used to hold together bits of a car that will still exist even if it does not have an internal combustion engine, like the chassis, dashboard, seats and lights.

Electric vehicle battery assemblies and housings, it says, are fastener-rich, and it has secured orders for 2020.

Sales of more complex own-branded products like the EPV self-extruding screw developed and patented in 2019, are increasing too. They earn higher and, hopefully, more stable profit margins as they are less easily substituted.

Reasons to frown

But despite the graft of the people at Trifast, we live in interesting times. In an eerie echo of the financial crisis, when Trifast stocked up on nuts and bolts in advance of incoming EU anti-dumping duties only for the financial crisis to sweep away demand, stocks are once again high because of a geopolitical development (Brexit). The last thing Trifast wants to do, it says, is to stop a customers’ production line.

But production lines are slowing of their own accord. At its Annual General Meeting in July, Trifast reported lengthening lead times as customers defer orders due to the automotive slowdown and general economic uncertainty.

If recession were to strike, Trifast would probably be in a better position than it was more than 10 years ago, but I do wonder how much better...

This is how I rate Trifast, each section is scored out of two:

Does Trifast make good money?

Average Return on Capital is 13%, below the 17% achieved in 2019. Profits were very depressed during the financial crisis, though, when the company made a loss in strict accounting terms.

Though cash conversion is reasonably strong, there is an increasing amount of judgement in the adjusted figures put out by the company, which do not include share-based payments and the cost of Project Atlas, a £15 million four-year project to put the Trifast family on the same software platform.

Trifast is indulging in the time-honoured method of adding "one-off" costs back to profit to give investors a better understanding of underlying performance.

Sometimes this is legitimate, and sometimes it is not. Usually it is very hard to decide!

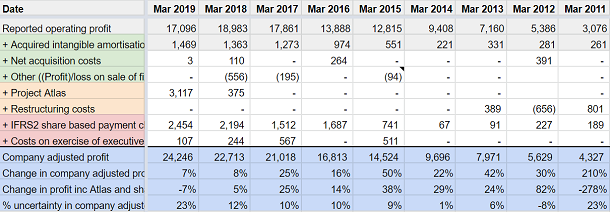

To explain my qualms about share based payments and Project Atlas I must expose you to the guts of my spreadsheet. Do not worry about the fearsome terminology if it is unfamiliar.

Look at the colour coding. The top line is reported operating profit, as estimated according to accounting regulations.

The next three items are green, because I am happy for the company to count them as one-off costs and add them back to operating profit. The following two lines are orange, I am not sure about adding them back to profit.

The final two lines are red. They are costs related to share based payments. I really do not think companies should add what is effectively an employee cost back to profit.

The company adjusted profit figure adds all of these costs back to profit to make £24.246 million compared to £18.568 million of reported operating profit plus admissible (green) adjustments.

The biggest costs the company would like us to ignore in judging its performance are Project Atlas (orange) and share based payments (red) and the difference between the figures including and excluding these costs is 23%, enough to turn an increase in profit of 7% into a decrease of 7% (almost entirely due to Project Atlas as share based payments were high the previous year too).

On Project Atlas, I am giving the company the benefit of the doubt. It is spending money on advice and a project team to implement the process and IT changes.

It believes the project will result in a return on investment of more than 25% once it is fully up and running.

The return on capital figures used in my calculations elsewhere in this article therefore treat the green and orange items as exceptional and add them back to profit, but include the cost of share based payments.

Score: 1

What could prevent it from growing profitably?

Trifast still serves cyclical markets, and it may have swapped a dependency on the electronics market for a dependency on the auto market, which brought in 33% of revenue in 2019. The company continues to change, but will it be enough?

While funding and managing Project Atlas and Brexit contingency planning, Trifast has a lot on its hands. As always, it says it is searching for more acquisitions. Perhaps it should lay off them for a while.

Score: 1

How will it overcome these challenges?

Trifast has targeted large multinational equipment manufacturers, particularly auto manufacturers, it is also manufacturing more complex own-branded fasteners (it manufactures about a third of the fasteners it supplies, typically the more specialised ones).

These innovations have enabled it to lift margins to 9% from 5-6% before the financial crisis, which should make it somewhat more resilient. So should its reduced dependency on the UK economy.

Score: 1

Will we all benefit?

The company has a deep commitment to employees and customers.

The annual report explains the business and the numbers well. Trifast says its door is open to visiting shareholders, which makes me wonder why I have not knocked on it.

The giant share based payment charge relates not just to the board, but to senior managers who have an incentive scheme of their own, and other staff through a Save as You Earn Scheme.

The company has its own minimum wage, which is higher than the national minimum wage.

At their maximums, board incentives seem overly generous, but they would at least require Trifast to perform well.

Score: 2

Are the shares cheap?

No. At 195p the enterprise is valued at just over £285m, or about 15 times adjusted profit. The earnings yield is 7%.

Score: 0.6.

Much as I like Trifast's people first, customer first culture and proactive strategy, I am nervous that it cannot fully address the risks of a big cyclical decline in demand, especially since it is so long since we had a big one!

Total: 5.6/10

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.