Trading update preview: still confident about Rolls-Royce?

Ahead of third-quarter results next month, City writer Graeme Evans reports on one analyst’s view of prospects at the jet engine superstar.

8th October 2024 13:35

by Graeme Evans from interactive investor

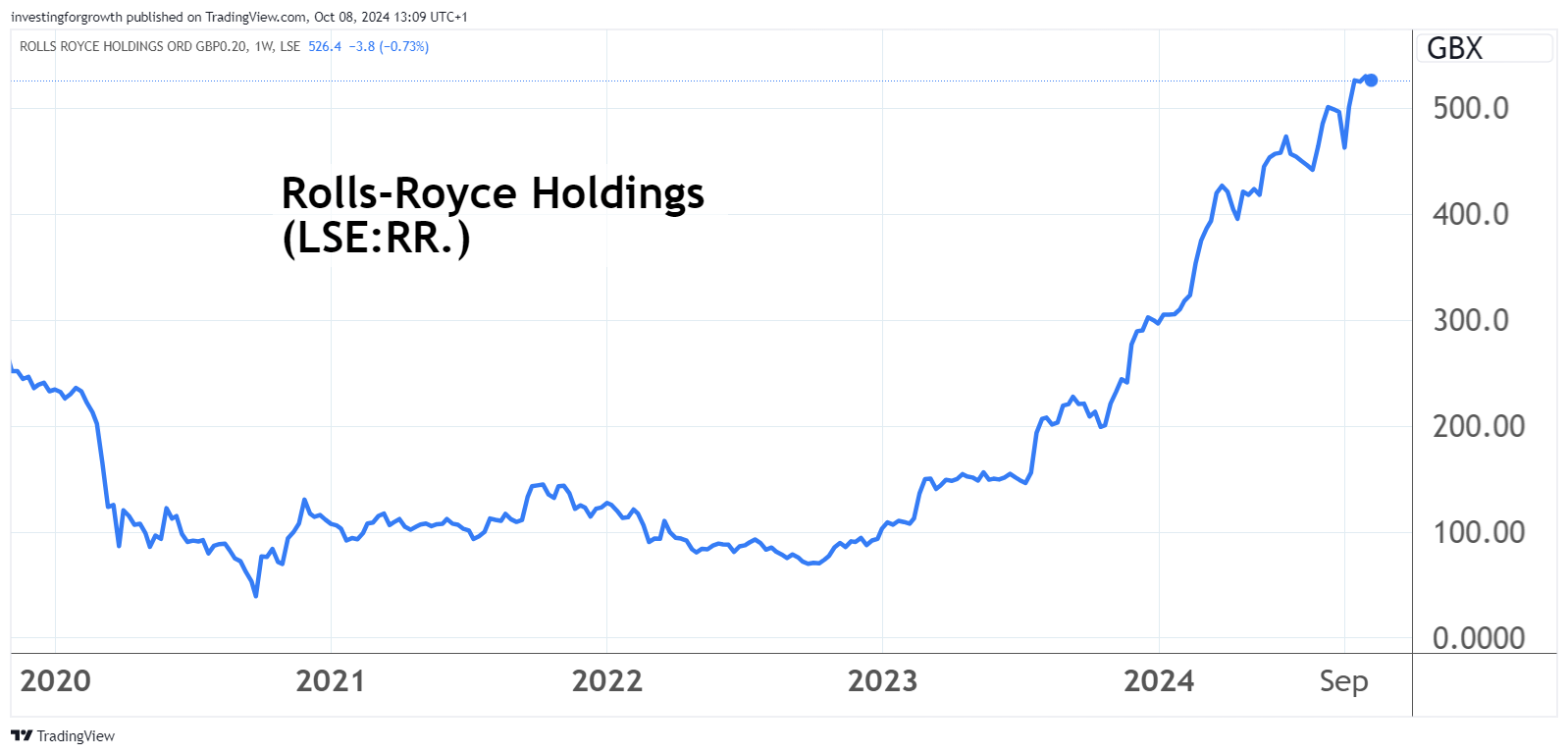

The case for Rolls-Royce Holdings (LSE:RR.) shares above 600p was today reiterated by a leading City firm, even though it doubts a forthcoming trading update will provide the catalyst.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

UBS continues to believe Rolls deserves to be trading 20% higher at 640p, having upgraded to this level after the company’s beat-and-raise set of half-year results on 1 August.

The Swiss firm has been ahead of one of the biggest FTSE 100 turnaround stories ever since switching to a Buy stance and 200p target when shares were at 153p in March 2023.

Source: TradingView. Past performance is not a guide to future performance.

The bank left its estimates unchanged today as it expects third-quarter figures on 7 November to show weak near-term engine flying hours offset by strong management commentary.

It said: “We expect continued confident language on the long-term turnaround and indications that new long-term guidance will be provided at full-year results, but with no new targets communicated at this stage.”

The bank’s tracking of large engine flying hours (EFHs) points to 100%-101% of pre-pandemic 2019 levels in July-August and about 102% in September. This compares with the company’s full-year guidance in the range of 100-110% of 2019’s level.

Continued strong demand for travel and the company’s young, growing wide-body fleet meant large EFHs rose by 22% on a year earlier to 101% of 2019 levels in half-year results.

- Rolls-Royce among UK stocks benefiting from big US rate cut

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: this business is heading for the exit

The recovery helped Rolls to upgrade its free cash flow guidance for 2024 to £2.1-2.2 billion from £1.7-1.9 billion seen previously. The new guidance, which helped shares top 500p for the first time, also included operating profits between £2.1 billion and £2.3 billion.

The progress has left Rolls in a position to declare a dividend payout equivalent to 30% of post-tax underlying profit when it presents February’s 2024 results. It then intends to target an ongoing pay-out ratio of 30-40% each year.

UBS noted at the time of the interim results that the revised 2024 guidance by Rolls was already equivalent to 75% of 2027 profit and 65% of free cash flow targets.

It said today that the scale of the transformation progress meant that near-term updates on engine flying hours were now less of a priority for investors.

The shares jumped 220% in 2023 and are up by another 75% so far in 2024 as chief executive Tufan Erginbilgic continues his “relentless focus” on commercial optimisation and cost efficiencies across the group.

- Stockwatch: results reinforce appeal of this momentum play

- 11 AIM companies that doubled in the third quarter

- Imperial Brands excels on miserable day for markets

He has done so in a challenging supply chain environment, with the company expecting these conditions to persist for a further 18-24 months.

Components supplier Senior (LSE:SNR) highlighted the tough backdrop earlier today when it said its aerospace division’s second-half performance is likely to be weaker than first.

It reported “temporary but significant headwinds”, having been told by a Tier 1 Airbus supplier that Senior’s delivery schedules will be impacted until the second quarter of next year.

Airbus is due to post third-quarter results on 30 October, with a delivery guidance downgrade now the base case scenario for analysts at UBS. The bank models 750 deliveries in 2024, against current guidance of about 770.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.