Trading tips: how to play the recovery and mitigate risk

This banking giant gives its view on the stock market, and where it thinks the opportunities are.

9th June 2020 14:44

by Graeme Evans from interactive investor

This banking giant gives its view on the stock market, and where it thinks the opportunities are.

Investors eyeing a “second wind” for resurgent global markets were given some encouragement this week when UBS sounded a more optimistic tone over the recovery.

The Swiss broker notes the absence of a ‘second wave’ of virus infections since the easing of Covid-19 restrictions across Europe, as well as continued support from the loosening of financial conditions following last week's intervention by the European Central Bank.

Mark Haefele, UBS Global Wealth Management's chief investment officer, says there is now more confidence in the bank's central outlook scenario for the S&P 500 to stand at 3,300 by next June (the US index currently trades at 3,232). Reaching its upside scenario of 3,500 will depend on the successful deployment of test-and-trace methods or a faster-than-expected, large-scale production of a vaccine.

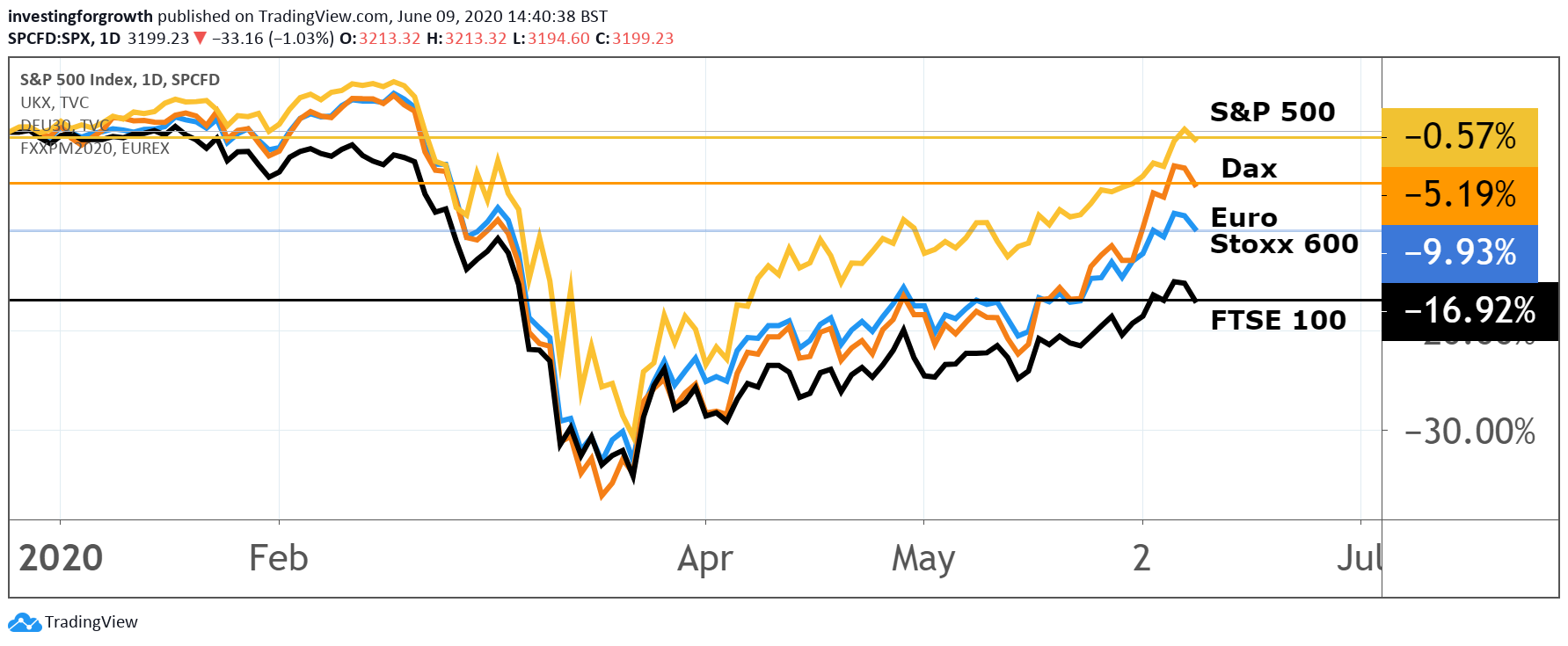

Source: TradingView. Past performance is not a guide to future performance.

But with broad equity indexes already around 40% above their recent lows, Haefele said it was important that investors now adopted a more selective approach. This is particularly the case with value stocks, which until recently were at a two-decade low relative to growth stocks.

Between 24 May and 4 June, UBS noted that MSCI Value stocks climbed 9.8% versus a gain of 5.2% for growth. This was further highlighted in last week's trading, when the rally for global markets was being driven by the year-to-date laggards.

European banks, for example, rose 17% last week, although the beleaguered sector remains more than 28% lower over 2020 as a whole. This rotation has been well received by long-suffering Lloyds Banking Group shareholders after the widely-held stock rebounded from the multi-year low of 28p seen in May to as high as 37p yesterday. It was down 4% to 35.4p today.

Financial stocks currently trade on a 2020 price/earnings (PE) multiple of 11.9x, falling to 8.9x the following year. This compares with the healthcare sector on 18.3 times for this year and IT on 27.1x in 2020 and 20.7x the year after.

- S&P 500 index recovers all losses from coronavirus sell-off

- Can the stock market really keep going up?

- Chart of the week: Lloyds Bank and the bond traders

- British American Tobacco issues Covid warning, but commits to dividend

Outperformers such as stocks in the pharmaceuticals and households goods sectors failed to make headway during last week's strong showing for European markets.

UBS's favoured segments within value now include the UK market, with the FTSE 100 index trading on a PE multiple of 17.9 times compared with 24.6x for the S&P 500. It notes that basic materials, energy and financial stocks make up 40% of the FTSE 100 index.

| Index valuations | ||||

|---|---|---|---|---|

| PE | Dividend yield (%) | |||

| Index | 2020 est | 2021 est | 2020 est | 2021 est |

Stoxx 600 | 19.2 | 14.5 | 3.3 | 3.8 |

S&P 500 | 24.6 | 19.0 | 1.9 | 2.0 |

FTSE 100 | 17.9 | 13.0 | 4.1 | 4.7 |

DAX | 18.7 | 12.9 | 3.1 | 3.5 |

Source: UBS

In terms of US value, UBS said energy stocks still appear to be pricing in oil prices below long-term normal expectations. In Asia, it also finds laggards in the value space, particularly in select names in the insurance and bank sectors and among conglomerates.

As economies reopen, UBS's Haefele said investors were also likely to seek out more economically sensitive companies that have underperformed through the crisis. He added that US mid-caps were well placed to begin to outperform large-caps, given that they are more exposed to physical rather than digital business.

- Stockwatch: could this new story underpin the market rally?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The FTSE 100 index and the S&P 500 have both risen by more than 11% in the past month, prompting some analysts to warn that markets are becoming detached from reality when the recessionary impact of the recent lockdowns has still to be felt.

Haefele says investors fearful of being in a market that has rallied so sharply can manage downside risk by diversifying globally across asset classes and regions, as well as consider alternative sources such as gold or Treasury Inflation Protected Securities.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.