Trade or hold funds? This data reveals what works

Morningstar looks into the difference between returns for buy-and-hold fund investors and those who actively trade.

21st November 2023 12:19

by Morningstar from ii contributor

Selecting promising funds is the first step for successful investing – but the real test lies in timing transactions correctly, such as avoiding the pitfalls of buying at the peak or selling at the bottom.

Behavioural tendencies often lead investors to act irrationally with their money, following the crowd and piling assets into recently high-performing funds, only to later experience disappointment and sell at a loss.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Data group Morningstar’s recent Mind the Gap study measures investors’ timing by contrasting two types of returns to reveal the “behaviour gap”.

Total returns showcase a fund’s growth through a buy-and-hold strategy, while investor returns show the effect of flows by incorporating the amount of assets at the fund in different periods into the return calculation. When investor returns lag total returns, the average dollar in the fund has earned less than what a hypothetical investor would have earned by staying invested for the entire period (with some caveats).

How UK investors fared

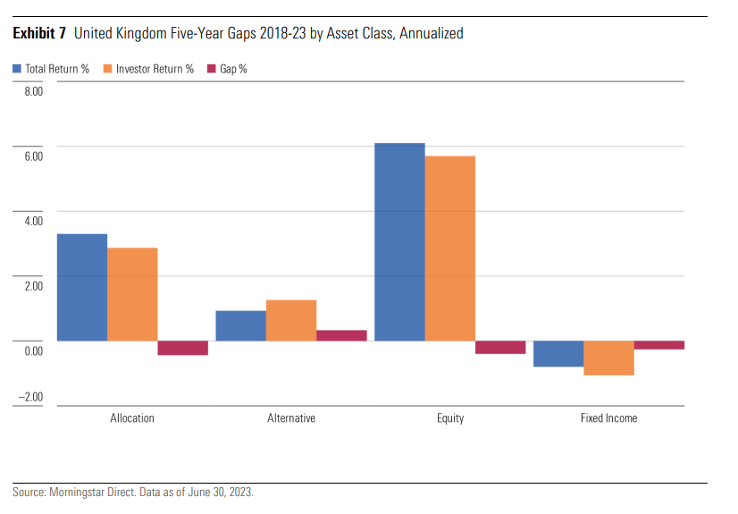

The study found that fund investors in the UK suffered smaller losses due to unfavourable timing compared with investors in other countries. In the UK, investors lost 0.32 percentage points of annualised returns due to their trade timings. Equity, bond, and multi-asset funds all saw mildly negative gaps in the UK, while alternatives sprang to a small positive gap, showing that investors added value by timing their entry and exits.

UK equity investors saw the clearest change in fortunes. Equities saw a return gap of negative 0.40 percentage points over the five-year period ending June 2023. Multi-asset funds saw a similar-size gap to equities, while in fixed income, the gap was 0.26 percentage points — all moderately low gaps compared with other markets in Morningstar’s study.

Within alternatives, there was a positive gap to the tune of 0.33 percentage points, with investors particularly in macro trading seeing more positive investor return outcomes than the uninspiring returns of many products.

One of the contributors was the fall from grace of the abrdn Global Absolute Return Strategies (GARS). The lacklustre performance profile started to see investors exit, but the bulk of outflows occurred at the start of the period, and most investors thus avoided the larger losses incurred in the most recent years. Assets under management in the UK-domiciled version of the fund stood at £17.1 billion at the start of the analysis period (30 June 2018) and five years on capitulated to £860 million. The firm has since announced it will be merging the fund’s remaining assets into another strategy.

Value and growth style differences

Within global equities, investment styles had different return gaps. While value stocks saw a torrid time over the analysis period, global value funds' investor returns were not too much behind total returns (an investor return gap of 0.28 percentage points). This indicates that, encouragingly, investors didn’t capitulate at the low point.

In contrast, within growth, the return gap was larger at 0.67 percentage points. Growth as a style had worked extremely well for most of the years since the 2008 global financial crisis and took a further leg-up during the depth of the Covid-19 crisis, especially in some of the more speculative areas. As often happens when investors have been watching a period of strong performance from the sidelines, they finally pull the trigger to buy, perhaps on a “fear of missing out”. Those who invested in the post-Covid run would have endured high paper losses as a result of the 2022 crash for growth stocks.

In a comparison between UK’s equity asset managers, Baillie Gifford is among the managers with an overall negative gap. It is also one of the houses running funds that typically has higher volatility than its peers. Counterintuitively, however, the company’s most volatile fund, Baillie Gifford Long-Term Global Growth, in fact had a positive gap, showing investors timed their entry and exit from this fund well: the fund had outflows in each of the last five calendar years.

Its investor base is biased toward institutions and pension funds, and the largest outflows came in the second half of the calendar-year 2020. As outflows continued in 2022, a much smaller proportion of assets went through the near-40% drawdown in 2022. In contrast, two Baillie Gifford funds, International and Baillie Gifford Global Alpha Growth, saw gaps deep in negative territory. Their performance profile was similar to the Long Term Global Growth fund, but the flows' profile was strikingly different: positive flows in 2020 were loaded towards the latter part of the year when performance started to turn, and large inflows continued in 2021 despite the sharp decline in these funds' values.

A similar story was seen in UK equities, where the most volatile area, small-cap stocks, had clearly negative flows, while in UL large caps, investor returns beat total returns.

In conclusion, the study underscores the importance of strategic timing, especially when dealing with less volatile investments, while cautioning against the challenges associated with high-risk categories. Opting for less volatile funds within each category is recommended, as they tend to offer more stable returns compared to their riskier counterparts. The study emphasises the need to stay focused on long-term goals and allocations, steering clear of the pitfalls of performance chasing and excessive concentration in high-risk funds.

Jonathan Miller is director of manager research, Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.