Top share picks for 2019: Year of the banks, Tesco, Shell and Vodafone

5th December 2018 12:31

by Graeme Evans from interactive investor

High yielding cyclical stocks trade at a 20% discount to defensive plays, but Graeme Evans hears from one expert that the economic cycle has further to run.

Equity markets have been battening down the hatches, with cyclical stocks trading at a significant discount and price earnings (PE) multiples de-rating in a way that points to major falls in earnings per share (EPS).

But are these valuations correct, if as many believe, there's actually still further to go in the economic cycle and we're just experiencing a deceleration?

Analysts at UBS are convinced the economic outlook remains positive, potentially opening up opportunities for cyclical stocks that are currently trading at a chunky 20% discount to their defensive equivalents.

This compares with the long-term average of 8%, even though cyclicals are currently offering dividend yields broadly in line with defensive stocks.

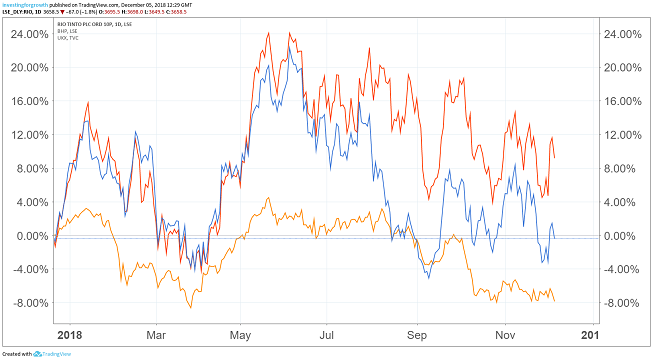

Late cycle plays such as mining should be major beneficiaries if the economic cycle continues, which is why UBS has just added BHP and Rio Tinto to its European Equity Strategy top stocks list.

There's room for the FTSE 100 pair's share prices to rally by as much as 30%, with UBS’s mining upgrade based on expectations of strong cash flow and dividends, the positive commodity price outlook, and potential upside from China stimulus, particularly if there's a de-escalation of trade wars.

Source: TradingView (Rio Tinto, blue; BHP, red; FTSE 100, yellow) (*) Past performance is not a guide to future performance

Some UK-listed stocks already in the UBS top stocks list include Tesco, Lloyds Banking Group, Cobham, British American Tobacco, Royal Dutch Shell, Informa and Vodafone.

UBS's list offers higher EPS growth than the market at a lower PE and higher dividend yield. This leads to a PEG ratio that is about one percentage point lower than the market.

The bank said:

"While there are risks around rising wages and input costs, there is also potential upside from companies' ability to re-gear and boost return on equity through share buybacks and M&A."

Vehicle marketplace Auto Trader is a new entry to the list and features as a key UK domestic stock. While its shares have been stop-start in 2018 due to fears about the health of the car market, they are still 29% higher for the past year.

Among the sectors seen as offering most value, UBS thinks 2019 may finally be the year for banks. They have underperformed in 2018, reflecting political risks, growth disappointment and delays in expectations of rate hikes.

In fact, the sector now trades with a lower relative valuation than the 2011/12 trough and is approaching the all-time lows of 2016. As we wrote last week following the Bank of England stress tests, UBS is positive on Lloyds, Barclays and RBS, with price targets of 80p, 240p and 300p respectively.

Whereas pharmaceuticals are traditionally seen as being defensive in nature, that's not been the case in recent years as UBS said the sector has been trading more closely with cyclical sectors since 2016.

UBS said pharma continues to trade at very attractive valuations relative to other defensives and was broadly in line with the average cyclical sector.

The bank is also overweight on telecoms ahead of an expected and "long overdue" bounce back.

UBS wrote:

"The sector is printing positive earnings growth again since the start of 2017 and earnings momentum is showing signs of improvement."

The telecom top picks include Vodafone, on which UBS predicts a potential 37% upside for the share price.

One of the sectors being downgraded by UBS - from 'neutral' to 'underweight' - is real estate. EPS momentum has been the key source of outperformance this year, but that now appears to be fading due to UK property prices and as European spreads between corporate bond and residential yields have shrunk to the lowest level since 2013.

*Horizontal lines on charts represent levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.