The top-performing funds so far this year

Do you own one of the top funds? Saltydog Investor runs the numbers as we approach the halfway mark of 2024

25th June 2024 11:11

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As we approach the midpoint of the year, we look back to see which funds have been the star performers so far in 2024.

Here are our top 10.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top Investment Funds

| Name | Investment Association sector | YTD return 20/06/2023 |

| Janus Henderson Global Technology Leaders | Technology and Technology Innovation | 29.9% |

| L&G Global Technology Index | Technology and Technology Innovation | 27.9% |

| Liontrust Global Technology | Technology and Technology Innovation | 25.5% |

| WS Blue Whale Growth | Global | 22.6% |

| Jupiter India | India/Indian Subcontinent | 22.4% |

| Pictet Digital | Technology and Technology Innovation | 22.1% |

| T. Rowe Price Global Technology Equity | Technology and Technology Innovation | 22.0% |

| L&G Global 100 Index | Global | 21.4% |

| Marlborough Far East Growth | Asia Pacific Excluding Japan | 21.1% |

| UBS US Growth | North America | 20.6% |

| Data source: Morningstar |

Past performance is not a guide to future performance.

Five of them, including the top three, are from the Technology and Technology Innovation sector.

The sector as a whole had a shaky start to the year, falling by 2.5% in the first week, but then recovered and ended up being the best performing sector in January, with a one-month return of 3.2%. In February it was eclipsed by the China/Greater China sector, which went up by 9.5%, but still came in second, having gained a further 5.7% in four weeks. All sectors rose in March and, although many sectors did better, Technology & Technology Innovation made 1.8%. By the end of the first quarter, it had risen by just over 11%.

- Europe’s answer to the Magnificent Seven – at cheaper prices

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

April was not so clever. The sector went down by 3.7% but since then it has recovered. It rose by 2.6% in May, and so far this month it has gone up by 5.4%. Since the beginning of the year the sector has made a total return of 15.6%.

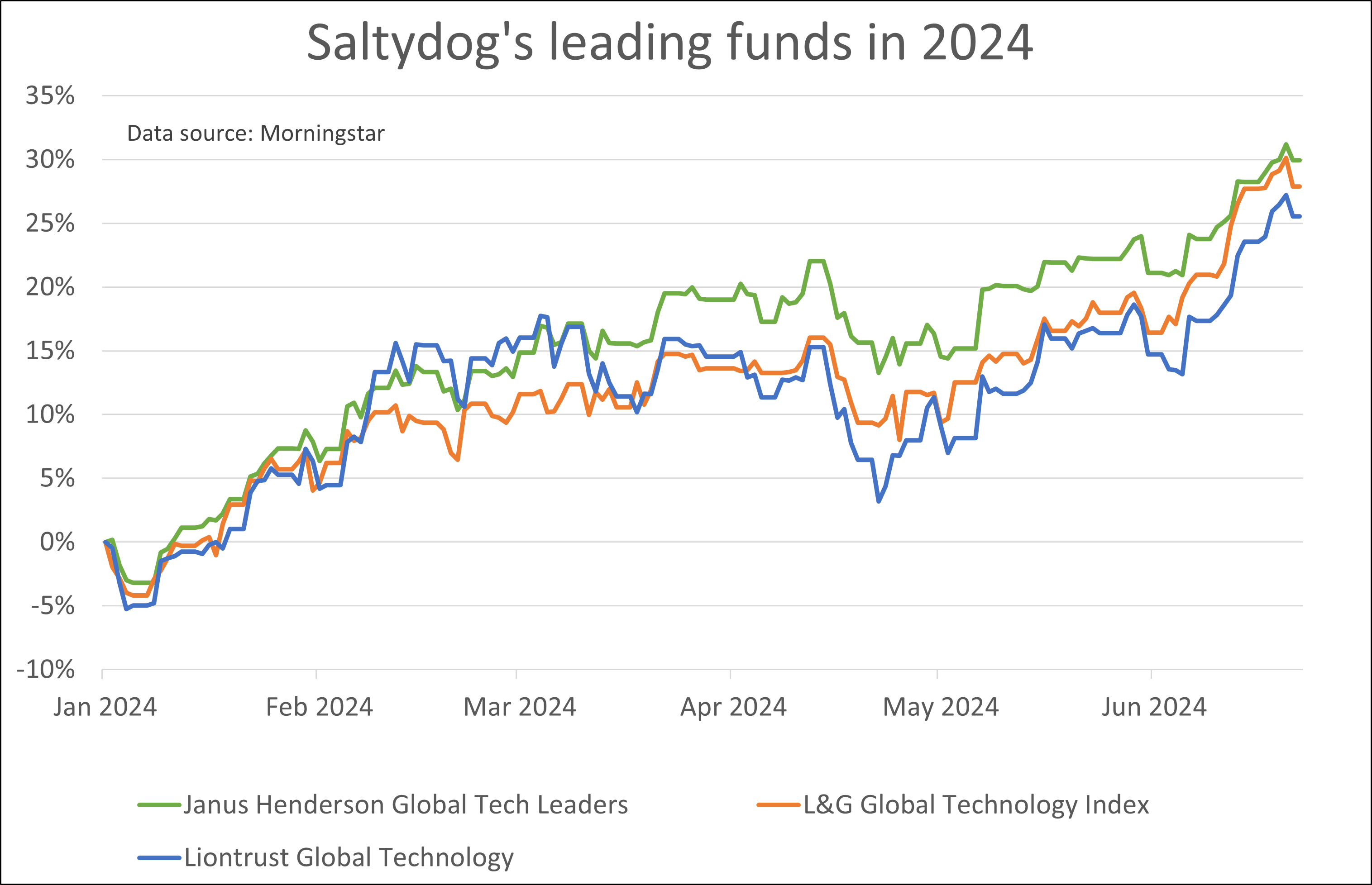

As you would expect, some funds have done significantly better than the sector average. If you look at the top three in the table, Liontrust Global Technology has risen by 25.5% in just under six months, while the L&G Global Technology Index has made 27.9%, and Janus Henderson Global Technology Leaders has beaten them all, up 29.9%.

Here is a graph showing how they have performed this year. They all fell in April but now appear to be back on track.

The Investment Association sector definition gives fund managers a fair deal of leeway. The main stipulation is that they have to “invest at least 80% of their assets in equities of technology and related sectors, including industries such as telecommunications, robotics and online retailers”. That could range from startups to large multinationals, which could be based anywhere in the world.

However, when you actually look at the companies that most of the funds are investing in, there are a handful that tend to feature most of the time.

If you look at the top ten holdings in the three funds that we have already highlighted, they all include the microchip producers Nvidia and Advanced Micro Devices. Meta, which owns Facebook, Instagram, and WhatsApp, among other products and services, also appears in the top ten holdings of all three companies.

Two out of the three funds also have Microsoft, Alphabet, and the Taiwan Semiconductor Manufacturing Company in their top ten. Other companies that feature include Amazon, Apple and Tesla.

The one thing that all these companies have in common is that they are directly involved in the artificial intelligence revolution that has taken the world by storm. They are either producing the components required to make it possible or are leading the way in making it useful.

- Baillie Gifford trust reveals get-out clause if it can’t beat its index

- Nick Train: stick or twist with the struggling star manager?

It seems inevitable that the use of artificial intelligence will continue to increase at an astonishing rate. More and more businesses will use it to enhance their operations, customer engagement, and overall business strategies. That means that the outlook for these technology companies looks good. However, that does not necessarily mean that they will keep on going up in value. How much of the future growth is already built into the share price?

This year Nvidia has already gone up by over 160% and now has a market capitalisation of over $3 trillion (£2.4 billion). It has a price-to-earnings (p/e) ratio of over 70 (compared with the FSE 100 average of around 15). Could it really go up by a similar amount in the second half of the year?

That would give it a market cap of over $8 trillion. When you think that the nominal GDP for the whole of the UK was around $3 trillion last year, then it sounds implausible, but there is no knowing what can happen with technology stocks. Many people have been saying that they are overvalued for years, and yet they keep on going up.

Because these technology companies are also some of the biggest and most well-known companies in the world, it is quite likely that they would also feature in funds from other sectors. Funds like WS Blue Whale Growth, from the Global sector, are a bit like a technology fund in disguise. Its largest holding is Nvidia, and it second largest holding is Microsoft. LAM Research and Meta also feature in its top ten. It is a similar story for the L&G Global 100 Index and the UBS US Growth funds, which are in the North America sector. These three funds all feature in our current top ten.

In ninth place is the Marlborough Far East Growth fund, from the Asia Pacific excluding Japan sector. It is also heavily weighted towards technology stocks, but not the big US ones. Its largest holding is the Taiwan Semiconductor Manufacturing Company, followed by Samsung Electronics, and then SK Hynix, a South Korean company that makes memory chips.

- Bond Watch: did the Bank of England signal an August rate cut?

- Top UK funds and shares the pros are backing as the market rebounds

We do not currently hold any funds from the Technology & Technology Innovation sector in our demonstration portfolios, although we were invested in the Pictet Digital fund earlier in the year. However, both portfolios have been holding the UBS US Growth fund since last June.

Finally, fifth in the table is Jupiter India. This is the only fund in the top ten that is not really directly benefitting from growth in the technology stocks. It is a fund that we have also been holding for all of this year, and I have written about it on several occasions. It has benefitted as a result of the growing Indian economy. It had a brief setback at the beginning of the month, when the results of the Indian general election were announced, but it has subsequently recovered.

Overall, it looks like we are going to have a pretty good first half of the year, with around 90% of the funds that we monitor making gains. We hope it will continue for the rest of 2024.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.