Top 10 most-popular investment trusts: January 2022

Some investors have grabbed an investment trust discount in the January sales.

1st February 2022 14:01

by Kyle Caldwell from interactive investor

Some investors grabbed an investment trust discount in the January sales.

It has been a rocky start to the year for markets and a particularly painful one for investors, who hold growth-focused funds or investment trusts, on the back of the market rotation to value shares at the expense of growth companies, including tech firms.

In the case of investment trusts, sharp share price falls in recent weeks have led discounts to widen for many growth-focused strategies, opening up potential opportunities to grab a discount in the January sales.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

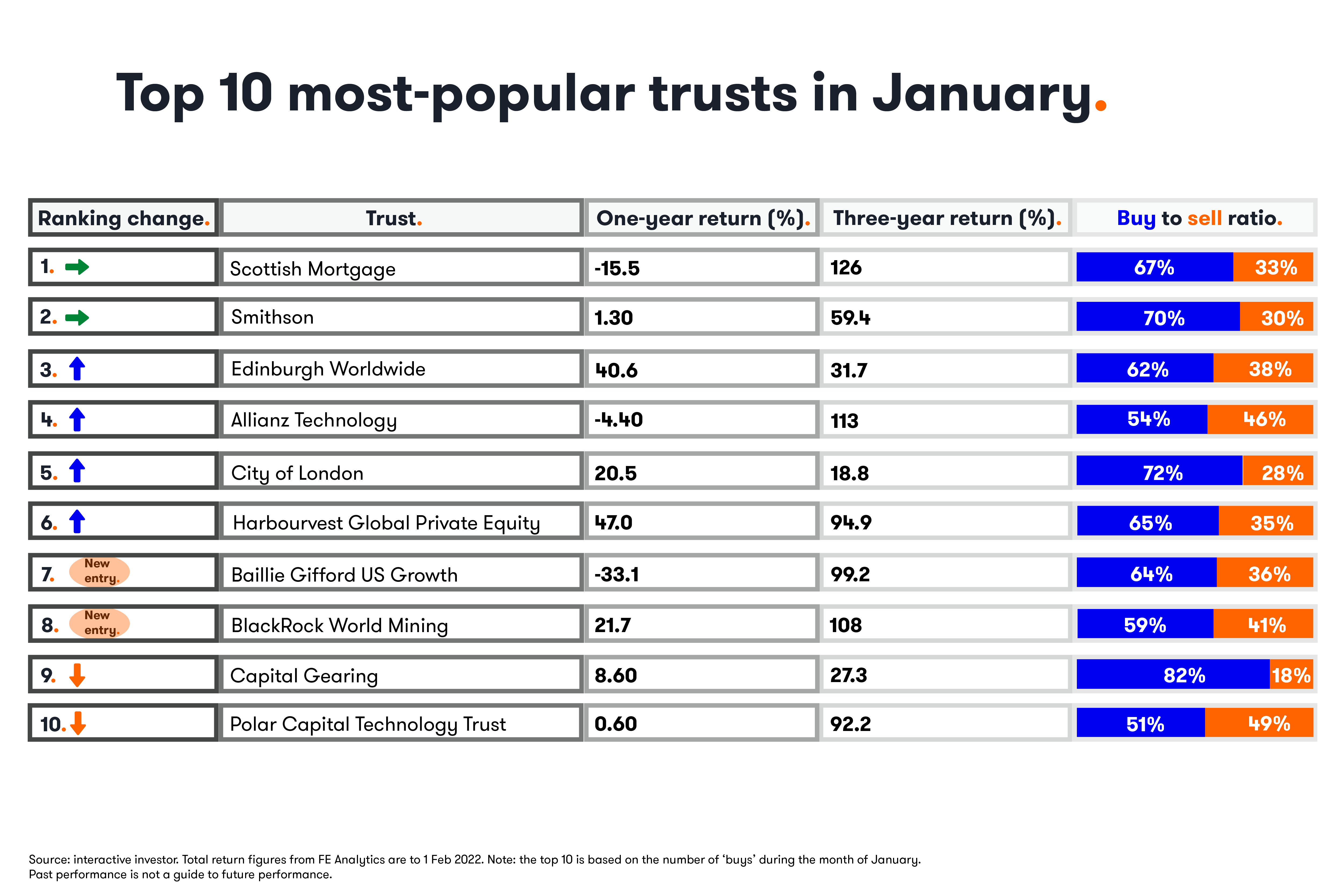

Some of interactive investor’s customers have been bargain-hunting, with two Baillie Gifford growth-focused trusts climbing up our top 10 table in January. The rankings are based on the number of buys in January.

- Fund managers rotate out of tech and into banks ahead of rate rises

- Bargain Hunter: out-of-form Baillie Gifford trusts slip to discounts

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Moving seven places up the table was Edinburgh Worldwide (LSE:EWI). The trust, which is managed by Douglas Brodie and invests in global smaller companies, has seen its performance go from hero to zero since the start of 2021. In 2020, the trust was one of the best-performing trusts of the year, with a share price total return of 87.7%. However, its one-year return is now showing a very sizeable loss of -40.6%.

Edinburgh Worldwide seeks to identify tomorrow’s winners by backing small entrepreneurial companies, typically with a market capitalisation of less than $5 billion when it first makes an investment. The trust’s style has fallen out of favour, due to investors moving away from high-growth businesses that have performed well during the pandemic.

However, its approach has over long time periods has paid off, even having given back some of its performance over the past year. Five-year returns show a gain of 120%.

As a result of its short-term performance woes, the trust has moved to trade on a sizeable discount. Figures from Winterflood, the analyst, show Edinburgh Worldwide can currently be picked up on a discount of 6.3%. Its 12-month average discount figure is 0.2%. Given that the trust has advanced up the leaderboard into third place, it appears that some investors have been viewing the discount as a potential opportunity. Its percentage buy/sell ratio in January was 62% vs 38%.

Also climbing up the table in January was Baillie Gifford US Growth (LSE:USA). It is a new entry into the top 10 in seventh place. It last appeared in the top in June 2021. In common with Edinburgh Worldwide, its performance has notably come off the boil. Over one year, the trust has lost 33.1%. In 2020, Baillie Gifford US Growth returned an eye-stretching 128.6%. The trust, which was launched in March 2018, has returned 99.2% over three years. It invests in innovative businesses in the hope that they will become exceptional growth companies over time.

Its performance over the three-year time period and since its launch, coupled with a 9.9% discount, has proved an attraction for some investors. Over the past year, Baillie Gifford US Growth has typically traded on a premium of 1.9%. Its buy/sell ratio is 64% vs 36%.

The other Baillie Gifford trust in the top 10, which has also fallen out of form but continued to prove popular with interactive investor customers, is Scottish Mortgage (LSE:SMT). The trust, which has lost 15.5% over one year and is down 13% since the start of 2022, backs disruptive companies that have a technological edge over competitors. It also has a sizeable position, just under 20% of its assets, in unlisted companies. Many of these companies are at an early stage of development. Therefore, when there’s a heavy sell-off in tech companies, which has been playing out of late, Scottish Mortgage is negatively impacted.

Investment trust analysts have continued to back it. Analysts at Numis and Stifel said they expect the innovative companies Scottish Mortgage invests in to continue growing value for long-term shareholders. Three- and five-year returns are 126% and 226%.

Customers of interactive investor also remain positive, with Scottish Mortgage remaining the most-popular trust in January. It has consistently occupied the top spot since June 2019. The percentage buy/sell ratio in January was 67% vs 33%. The trust is currently trading on a discount of 1.7%, slightly higher than its 12-month average discount figure of 1%. At various points in January the discount was higher than its current level, and some investors snapped up the trust.

- Scottish Mortgage sell-off: how should investors respond?

- Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

- A guide on how investors can protect against inflation

In other signs of bargain-hunting taking place, two technology-focused trusts retained their places in the top 10. Both Allianz Technology Trust (LSE:ATT) and Polar Capital Technology (LSE:PCT) saw their share prices come under the cosh in January, posting losses of 18.9% and 15.2%. Allianz Technology moved up one place in the table to fourth. Polar Capital Technology, however, slid six places to 10th. Allianz Technology and Polar Capital Technology are currently trading on respective discounts of 8% and 10.1%.

As well as sizing up opportunities in growth or tech-focused strategies, some investors have been looking at adding some inflation protection into their portfolios. This may have helped fuel demand for BlackRock World Mining Trust (LSE:BRWM), a new entry in the top 10 in eighth place. The trust has 16% of its assets in gold, which is considered one of the few ways to protect against high levels of inflation. High demand for BlackRock World Mining’s shares is reflected by its 5% premium. Its average premium figure for the past year is 0.6%.

Retaining second place was Smithson Investment Trust (LSE:SSON). Since its launch in October 2018, it has been highly popular with investors. Managed by Simon Barnard, it applies the successful investment philosophy of Terry Smith’s £26.1 billion open-ended Fundsmith Equity fund, but instead focuses on global smaller companies deemed too small for the original Fundsmith fund.

The final three trusts in the top 10 were City of London (LSE:CTY), HarbourVest Global Private Equity (LSE:HVPE), and Capital Gearing (LSE:CGT). City of London, which invests in UK dividend-paying shares, moved up one position to fifth. Harbourvest Global Private Equity, a private equity-focused fund-of-funds, slid from third to sixth place, while Capital Gearing, which adopts a wealth preservation approach, dropped two places to ninth.

The two trusts that exited the top 10 were Monks (LSE:MNKS) and Personal Assets (LSE:PNL).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.