Top 10 most-popular investment funds: November 2021

1st December 2021 11:12

by Nina Kelly from interactive investor

A new entry, a consistent performer zooms up the table, and new holdings detailed.

As the Omnicron variant spooked investors in the last days of November and markets took a dive under renewed Covid fears, there was little sign of panic among fund investors, according to our monthly ranking of the most-bought funds on the interactive investor platform.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

Terry Smith’s Fundsmith Equity remained the most popular choice among our customers. In October, Smith disclosed that he had bought shares in tech giant Amazon (NASDAQ:AMZN) for his flagship fund, but the investment was not large enough to make it a top 10 holding in the portfolio. The star fund manager spoke to interactive investor about the US mega-cap firm earlier this year. Smith also revealed he has begun buying another new investment for Fundsmith Equity, but that this won’t be revealed until “we have accumulated our desired weighting”.

Passive funds still comprise half the table – the same balance as last month – with Vanguard LifeStrategy 80% Equity in second place. In addition, investors are still putting their faith in global funds, as defined by the Investment Association (IA), which also make up half the top 10. The Vanguard fund is one of six funds that interactive investor handpicked for its Quick-Start funds range. Find out more here.

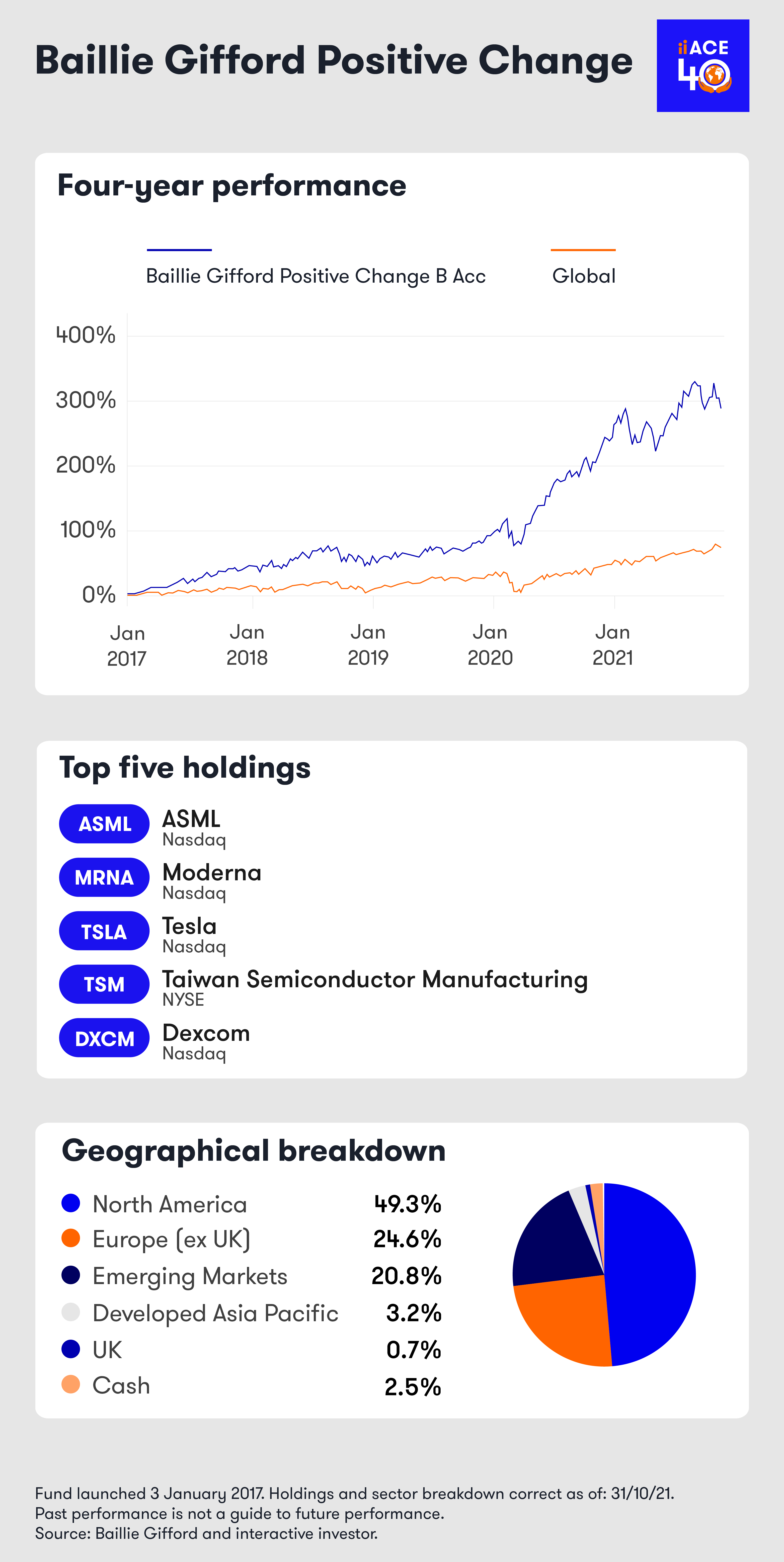

Baillie Gifford Positive Change, which appears on interactive investor’s ACE 40 rated list of ethical investments, held on to its third-place position. For a more detailed look at Baillie Gifford Positive Change, examine our mini factsheet below.

Baillie Gifford American fared less well, tumbling from sixth to ninth place. The growth fund was revealed as the top performer in a piece of interactive investor research conducted last month naming the top 20 best-performing funds of the past decade. The research was undertaken to mark 10 years since the launch of the Junior ISA. Baillie Gifford American would have turned an initial investment of £3,600 into an impressive £36,284 – enough to put a smile on most teenagers’ faces.

Rising four places to fourth in the top 10 was tracker fund L&G Global Technology Index. This fund also made the list of the 20 best-performing funds since the Junior ISA launched a decade ago. Parents who bought this fund and held it in the tax wrapper since its introduction 10 years ago, would have turned an initial investment of £3,600 into £27,436. L&G Global Technology Index was also one of seven funds highlighted by Saltydog Investor to be the most consistent over three years. The Saltydog article and methodology can be found here. L&G Global Technology Index’s one-year (39.7%) and three-year performance (148.3%) figures are the best in our top 10 table (see below), while its five-year figure is 248.5%.

- Check out our award-winning stocks and shares ISA

- How fund investors can protect and profit from higher interest rates

Three index-tracking funds occupy mid-table positions, namely Vanguard LifeStrategy 60% Equity (fifth), Vanguard US Equity Index (sixth), and Vanguard LifeStrategy 100% Equity (seventh). The US equity fund has risen three places since last month. As at 31 October, this passive fund offered investors exposure to 4,073 stocks at the large, mid, small and micro-cap level in the US.

Rathbone Global Opportunities moved up two places to eighth, and the £1 billion LF Blue Whale Growth fund was the new entry at number 10. Rathbone Global Opportunities is managed by James Thomson, who takes a contrarian approach. He invests in under-the-radar and out-of-favour growth companies. He favours businesses that have the ability to control their own destiny, avoiding firms sensitive to external macro factors, such as commodity prices.

LF Blue Whale Growth has a concentrated portfolio with 29 holdings. Last month, it added two new companies to its top 10; healthcare firm Sartorius (XETRA:SRT) and Dutch chip firm ASML (NASDAQ:ASML). Sartorius, according to Blue Whale’s manager Stephen Yiu, is “one of the only publicly available pure-play investment opportunities in the growing bioprocessing industry”. Blue Whale adds that “the bioprocessing industry is attractive because the business model and regulatory approval requirements mean that 75% of Sartorius’ revenue is repeatable consumables revenue that is locked-in for the lifetime of the biologic – a type of medicine that is made not from chemicals but from organic matter”.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Subscribe to the ii YouTube channel for interviews with popular investors

Of ASML,Blue Whale explains that it is the dominant manufacturer of machines used to make semiconductors. These semiconductor chips are used in Apple iPhones and data centres, for example, but will “go on to define the next stage of technological innovation from self-driving cars to augmented reality devices and super-connected cities”. Blue Whale claims that the company is well positioned to benefit from the “almost 25% expected yearly growth in demand for smart and connected devices going into the next decade”.

The fund that exited the top 10 in November was TB Guinness Global Energy.

Top 10 most-popular investment funds: November 2021

| Rank | Fund | IA sector | Ranking change since previous month | 1-year return to 1 Dec (%) | 3-year return to 1 Dec (%) |

| 1 | Fundsmith Equity | Global | No change | 20.6 | 64.5 |

| 2 | Vanguard LifeStrategy 80% Equity | Mixed investment 40%-85% shares | No change | 14.1 | 36.1 |

| 3 | Baillie Gifford Positive Change | Global | No change | 20.1 | 148.1 |

| 4 | L&G Global Technology Index | Technology & Telecommunications | Up four places | 39.7 | 148.3 |

| 5 | Vanguard LifeStrategy 60% Equity | Mixed investment 40%-85% shares | Down one | 11.1 | 31.1 |

| 6 | Vanguard US Equity Index | North America | Up three places | 27.2 | 65.7 |

| 7 | Vanguard LifeStrategy 100% Equity | Global | No change | 19.5 | 41.5 |

| 8 | Rathbone Global Opportunities | Global | Up two places | 23.4 | 86.4 |

| 9 | Baillie Gifford American | North America | Down three places | 14.5 | 180.8 |

| 10 | LF Blue Whale Growth | Global | New entry | 25.7 | 84.3 |

Source: interactive investor. Note: the top 10 is based on the number of “buys” during the month of November.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.