Top 10 most-bought investment funds: January 2022

1st February 2022 14:55

by Nina Kelly from interactive investor

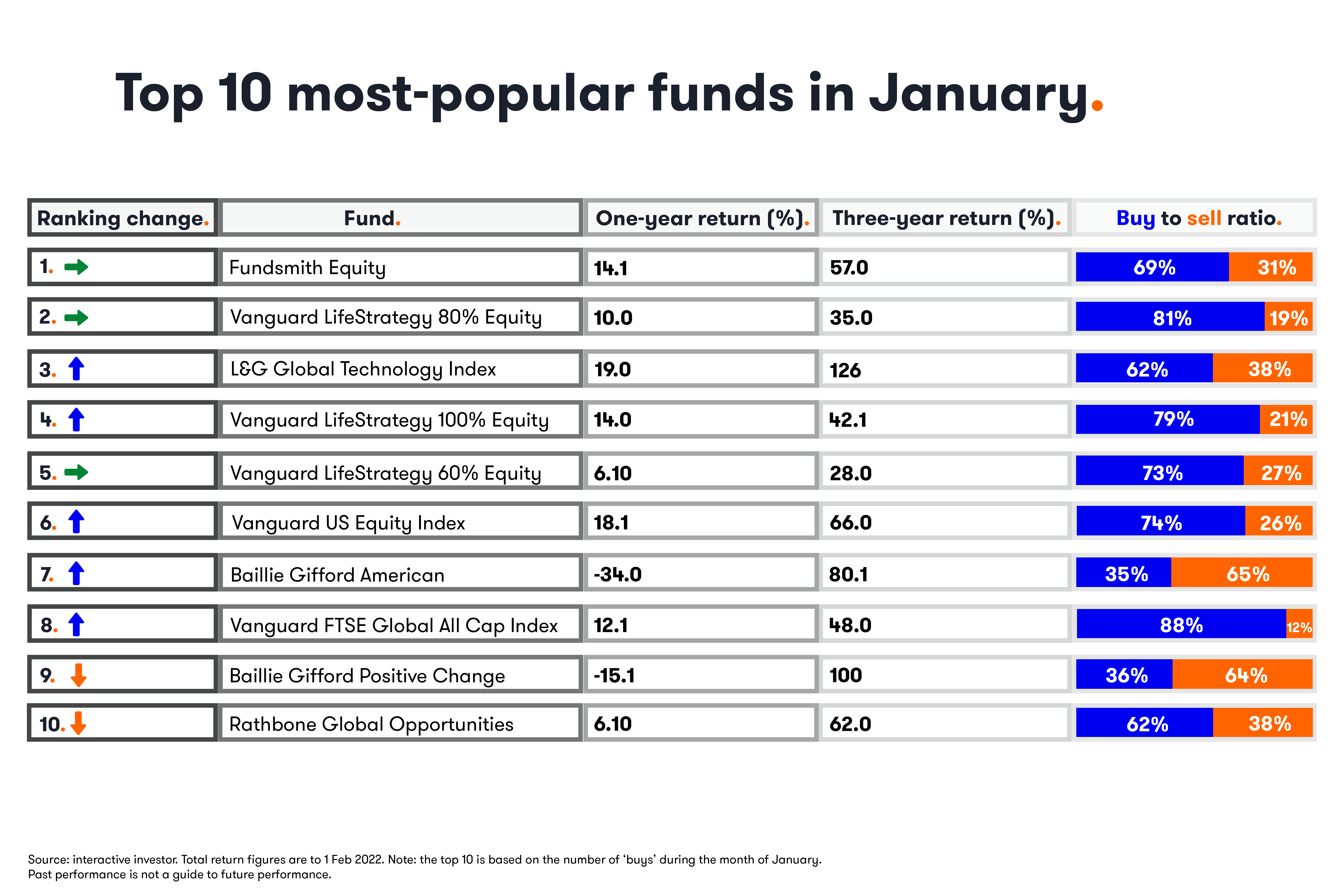

A Baillie Gifford favourite plunges, Vanguard risers, and passive trumps active as inflation bites.

Many have been selling off the stay-at-home tech stocks that served them well during pandemic lockdowns in anticipation of interest rate rises. It’s expected that the Bank of England will increase the base rate this week from 0.25% to 0.5% in an attempt to temper inflation, which at 5.4% is a 30-year high for the UK. The US central bank, the Federal Reserve, is expected to follow suit in March. When central banks hike rates, investors often ‘ditch and switch’ tech shares and other growth stocks, which are hit hard when rates rise, for value sectors that benefit from the uplift, including financials.

Funds from the Baillie Gifford stable invest in growth companies, perhaps explaining why ii ACE 40 ethical fund Baillie Gifford Positive Change has slumped five places to ninth since last month. It is quite a fall considering that Positive Change reached second place in our top 10 table in August 2021. Positive Change portfolio holdings at the time of writing include chipmakers ASML (EURONEXT:ASML) and Taiwan Semiconductor Manufacturing Co (NYSE:TSM), and electric car pioneer Tesla (NASDAQ:TSLA).

- 12 funds for the £10,000 income challenge in 2022

- Watch our latest fund manager interviews by subscribing for free to the ii YouTube channel

Fellow growth investor Baillie Gifford American has also fallen out of form, although itrose two places to seventh in our table in January. The performance of both actively managed funds has come off the boil since their stellar returns of 2020, but as already noted, the rotation into value shares has had an impact. However, Baillie Gifford invests for the long term and the negative one-year performance figures cited in the table below may simply be short-term pain investors have to grin and bear it.

In addition, the themes of the Positive Change fund, for example, including the Environment and Resource Needs, and Healthcare, are likely to become increasingly important given the ageing populations in the West and climate change.

Fundsmith Equityis seemingly cemented in the number one spot. Terry Smith’s flagship £29 billion fund underperformed against its benchmark in 2021, but only marginally. The star fund manager explained why in a note to shareholders, which was the subject of a discussion in the latest Funds Fan podcast episode. However, Smith pointed out that over the long term, since launch in November 2010, Fundsmith Equity is still the best performer in the Investment Association’s (IA) global fund sector, with a return 357 percentage points above the sector average, which has delivered 213.9% over the same period. One of interactive investor’s specialist writers recently suggested six alternatives to Fundsmith Equity and the piece was one of the month’s most popular articles.

- Our outlook for 2022: key topics and investment ideas for the year ahead

- Fund ideas for 2022: technology, healthcare and commodities

interactive investor’s most recently published quarterly Private Investor Index, which charts how our investors are faring, revealed that Fundsmith Equity has a universal appeal among all age ranges, while variants of the Vanguard LifeStrategy range featured in the top 10 most-held investments by value across the board – bar those 65+ (on average).

ii customers continue to favour the diversification benefits of low-cost, multi-asset tracker funds such as Vanguard LifeStrategy's 100% Equity option, which has risen four places to fourth, and sister funds 80% Equity and 60% Equity, which retain second and fifth place, respectively. The 60% and 80% options are part of ii’s Quick-start funds range aimed at beginners. I recently wrote a piece exploring satellite options for beginner investors interested in adding some ‘spice’ to their portfolio, while if you are lucky enough to get a bonus, interactive investor’s Moira O’Neill suggests a multi-asset fund such as the 60% Equity option could be a suitable potential home for employees who will take home a bonus of around £10,000.

The other Vanguard funds in the top 10 table are US Equity Index(up one place to sixth) and the Vanguard FTSE Global All Cap Index (up two places to eighth). The US Equity fund was one of the most-bought ii Super 60 rated funds in 2021, along with Super 60 peer Fundsmith Equity.

- Examine more articles on investment funds and trusts

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Against a backdrop of rising inflation and Russia-Ukraine tension, global strategies took precedence at the start of the year and the L&G Global Technology Index, (third place)and Rathbone Global Opportunities (10th)remain popular. Saltydog Investor Douglas Chadwick recently sold the L&G fund and several others and explains why here. Meanwhile, in their December 2021 quarterly update to investors, Rathbones Global Opportunities’ co-managers James Thomson and Sammy Dow explained that in the fourth quarter, the fund returned 5.9% versus a 4.7% average increase in the IA Global sector.

Reflecting on 2021, the pair said: “The waves of Covid-19, the supply chain disruptions, the booming employment picture, the $2.7 trillion of US and European excess savings, the inflation spike and spectre of rising rates are blending and bumping up against each other. The business cycle and the Covid cycle are intertwined and putting the outlook into a constant state of flux. Policymakers and investors face a challenging environment: heightened uncertainty and volatility that obscures signal from noise.” They revealed the top contributors for the year as gaming, data centre and AI chip-maker NVIDIA (NASDAQ:NVDA); financial software developer Intuit (NASDAQ:INTU); pharmaceutical and lab equipment supplier Sartorius (XETRA:SRT), internet search and advertising giant Alphabet (NASDAQ:GOOGL); and computer chip printer designer ASML (EURONEXT:ASML).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.