Tips for value investors and four trusts to play the theme

27th September 2018 10:45

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

While there are some signs that we may be finally seeing the froth come off the growth-led market, we think investors need to be highly selective in choosing value strategies.

Artificial Alpha

Thomas McMahon, senior analyst at Kepler Trust Intelligence.

Investors have become increasingly dependent on growth and momentum strategies to generate returns over recent years, with value investing falling out of favour.

One option for those investors looking to diversify away from growth and momentum strategies is a smart beta product. These have grown hugely in recent years, in some measure piggy-backing on the growth of passives, although in our view it is questionable whether they should really be considered 'passive' strategies. There is now $15 billion invested in the iShares S&P500 Value ETF, for example, as investors view it as an alternative to active management in a market that is believed to be efficient and hard to beat.

While there are some signs that we may be finally seeing the froth come off the growth-led market, we think investors need to be highly selective in choosing value strategies.

This is backed up by recent academic research, which points to the fact that simply buying what is cheap on a price/earnings (P/E) or price/book (P/B) basis is likely to be a losing strategy. In our view, investors therefore need to find an active manager with a sophisticated approach to identifying value opportunities if they want to beat the market over anything other than the very short term.

Investors who were hoping to use passives to gain access to value may not benefit when the market rotation does happen. The research also represents a warning against buying simplistic active strategies or buying value funds indiscriminately.

Recent academic research finds passive "ratio-based" investing is unlikely to work

Buying stocks which are cheap on a P/E or P/B basis without qualitative analysis of their prospects does not generate alpha, according to a recent paper by U-Wen Kok, Jason Ribando and Richard Sloan (KRS). Value investors aim to make money by buying companies when they are undervalued. However, companies can also be cheap because they are poor businesses and the market expects their earnings to worsen, in which case an investment would be a poor one. KRS's research shows that simple rules-based strategies for investing in "value" do not work because they do not discriminate between stocks which are undervalued and stocks which are deservedly cheap.

KRS examined the returns to investing in the cheapest stocks on a price-to-book ratio over various time periods, using US stocks. Price to book is one metric used solely or in part to define the value indices created by S&P, Russell, MSCI and CRSP. KRS looked at using a simple rules-based strategy to invest in only the cheapest companies without any further analysis. They broke down the data further to look at how the ratio worked in large and small capitalization companies, and over different time periods.

The results showed that buying cheap stocks on a P/B basis has not added alpha for many years, and in fact, when it was a successful alpha-generating strategy this was only due to shorting expensive small cap stocks, something which is expensive to do when even possible.

It is important to note that there is no value premium in large caps on this result – i.e. buying cheap large cap stocks using simple ratios has never been a winning investment strategy. And in fact, the positive result from applying a value strategy in small caps is not even a permanent phenomenon, only evident in the data between 1963 and 2002. Since that year, it appears the strategy has no longer added alpha in small or large caps.

This does not mean that value investing does not work, of course, but rather that a more sophisticated approach is needed. The implication is that only an active manager can make money from value investing. KRS's research in fact echoes the teachings of the fathers of value investing Ben Graham and David Dodd. Graham in particular inspired many modern practitioners, and he explicitly warned against a purely quant-based approach, insisting that diligent fundamental research is essential for successful value investing.

The reasons why passive value strategies don't work

According to KRS, the poor returns to ratio-based investing is relatively simply explained. There are two ways that valuation multiples such as price to book and price to earnings can mean revert. The first is that the price can rise and the second that earnings can fall. In the former case, the share price failed to reflect the earnings potential of the company, and the value investor's investment was successful as the price rose to incorporate this information. In the latter case, the low price for the stock would have been proven to have been justified by poor earnings growth, and an investment would be a losing one versus simply buying the market.

KRS again looked at stocks in the Russell 3000 all-cap index and broke them down into quintiles on price to book, price to historical earnings and price to future earnings. They then decomposed the change in the relevant metric into the change in the fundamental (i.e. a decrease in earnings or book value) and the change in the price.

In all cases it was the change in fundamental which dominated. Stocks which looked expensive on a price to book market showed high levels of asset write-downs and the evidence is clear that they are on average companies with over-valued assets. Companies with high price to trailing earnings ratios showed significant falls in earnings in subsequent years which were by far the dominant factor in the change in P/E. Companies with high price to forward earnings ratios showed deteriorating financial performance on a number of metrics. Most significant were unusual charges and the difference between GAAP earnings and analyst earnings suggesting that analysts were excluding a large swathe of expenses from their estimates for these stocks.

This analysis suggests that by buying low P/E or P/B stocks, you are buying stocks with inflated earnings or book values, and the valuation metrics mean revert in a bad way – by earnings and book values being revised downwards. This suggests that active investors are in aggregate doing their jobs by identifying companies with inflated numbers and refusing to pay the same multiple for them as for their competitors or relative to their history. So by investing in an ETF based on these rules, such as those listed by the main providers to the retail market, an investor could be considered to be tilting his portfolio towards bad companies.

Has the "value" factor been arbitraged away?

The evidence therefore suggests that active investors have created a market that is efficient in aggregate. It is not surprising to see that the alpha from pure rules-based values investing has ebbed in recent years. This suggests that the growing awareness of the efficacy of buying cheap stocks and the massive expansion of ways to access the markets for all sorts of investors in recent decades has led to an inefficiency being arbitraged away.

This is in line with what academic research tells us happens with all factors: once variables that are shown to explain stockmarket returns are documented and published, the returns attributable to those variables diminish dramatically.

In a 2015 paper McLean and Pontiff investigated 97 variables shown in academic studies to predict future returns (and to therefore be potential rules-based investment strategies). They found that the returns to the portfolios built on these variables was on average 58% lower after the studies had been published, suggesting that investors read the work, implemented it, and the anomaly lost most of its investment benefit.

They also found that the correlation of the anomalies in the publications to yet-to-be-published anomalies decreased after publication, and the correlation to already-published predictors increased, strongly supporting the idea that sophisticated investors started trading on the results.

What are these simple strategies missing?

But the results of the KRS paper are aggregate results, and this does not mean it is impossible for value investors to find opportunities in mispriced stocks. All that the research shows is that a pure rules-based value investing strategy has not worked for many years, and when it did work it was isolated to certain segments of the market.

In his 1984 speech to students at Columbia Business School, "The Superinvestors of Graham-and-Doddsville", Warren Buffett discussed the exceptional returns of a number of fellow ex-students and employees of Ben Graham. Each of the investors Buffett selected had produced exceptional excess returns from following Graham's value philosophy of estimating the value of a business and buying only when there was a "margin of safety" between the value and the market price.

Buffett acknowledges that his collection of investors are not selected scientifically, and it is here that the argument parts ways with statistical analysis. However, it is clear that some active investors are capable of generating significant excess returns from following a value strategy. Graham and his co-author Dodds argued back in 1934, however, that quantitative strategies alone would not work, and the evidence backs them up. They insisted that the quantitative steps of calculating intrinsic value, comparing it to market price and forecasting future earnings potential were only intermediary stages on the way to an investment decision. And they also caution that book value is far from the final word on intrinsic value, and in fact is "worthless" as a predictor of stock price. Meanwhile they deride earnings as an easily manipulated metric which should not be relied upon. The qualitative input of the analyst is crucial to forming an assessment of the intrinsic value of the stock and its potential.

One closed-ended trust which is faithful to the Ben Graham philosophy is Gabelli Value Plus. This trust's process, Gabelli Private Market Value with a Catalyst, identifies US companies which are trading well below the price they would fetch to a strategic buyer, where there is a catalyst in place that could generate a reversion of this value gap. It therefore involves not just a quantitative analysis of the books, but also an understanding of the strategic and industry context. As a consequence of the focus on companies with attractive assets to strategic buyers, a high proportion of the company's holdings are subject to takeovers. The managers believe we are currently going through a fifth wave of M&A caused by the imperatives of globalization; in the first half of 2018 deal activity was $2.5 trillion, a record first half since 1980. We have updated our research on this trust this week.

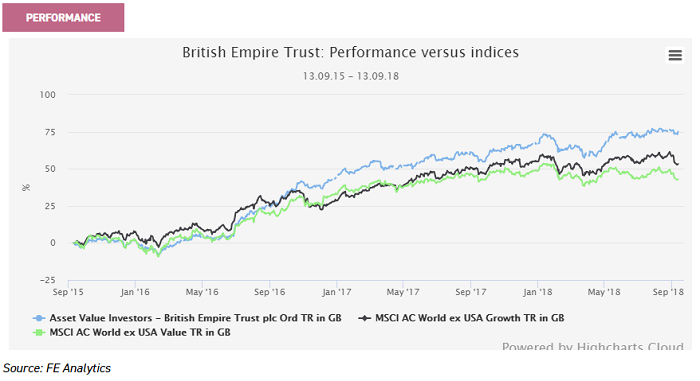

British Empire invests in closed-ended funds, family-owned holding companies and asset-backed companies which the managers believe are trading well below intrinsic value, looking for situations with a catalyst to unlock the value. Frequently this catalyst is their own activism, where they are a "behind the scenes" activist shareholder in many of their holdings. The trust has performed well in recent years despite the underperformance of the formulaic value indices. Successful activism and good stock-picking have been the main drivers of these returns. Exceptional returns have come from investing in private equity trusts trading on wide discounts, for example, as well as Japanese small caps with net cash balance sheets. One other factor is the strong growth in the family holding companies, which shows that investing in cheap companies doesn’t have to mean buying slow-growing businesses.

Past performance is not a guide to future performance

Lazard World Trust also invests heavily in investment trusts and asset-backed holding companies. To identify potential investments, the managers look for companies that are trading at a discount to NAV, or at a discount to the 'sum of their parts'. Once the initial screening process has identified potential ideas, the investment team examines them closely, using Lazard's significant resources to create a macro context for the stock’s valuation, and at the same time examining the company fundamentals to create a clear picture of its real underlying value, or potential value.

The final part of the process is to consider the catalysts for change and the potential actions the team can take to encourage that change. Lazard's significant scale, and the weight of money behind the Discounted Assets strategy, means the investment team has a loud voice when it comes to influencing corporate behaviour among the companies they own; the team has been known to initiate changes of management, and less dramatic - but equally impactful – changes such as the introduction of a dividend to increase the appeal of a company's shares.

In the UK, Aberforth Smaller Companies implements a disciplined value strategy in the small cap market. The basic philosophy is that buying good, cheap companies will be rewarded in the long term, so the team looks to find attractive businesses that have fallen out of favour for one reason or another. This means uncovering why a company is cheap and deciding whether it is justified: is it being punished for previous management mistakes? Is the company out of favour because of macro trends? They believe the market habitually over-rates winners and under-rates losers, and "there is a price for everything", meaning that companies facing real difficulties can be good investments if they have been over-punished by the market and there is a clear route to a re-rating.

The trust has produced strong returns this year of 5% in NAV total return terms while the MSCI United Kingdom Small Value index is flat. The trust trades on a discount of 12.5% thanks to value investing being out of fashion.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.