Time to turn to alternatives as bear market bites

28th June 2022 09:43

by David Prosser from interactive investor

Alternative investments are holding up well compared to stock markets. David Prosser asks experts to name their favoured funds and trusts for various sub-sectors.

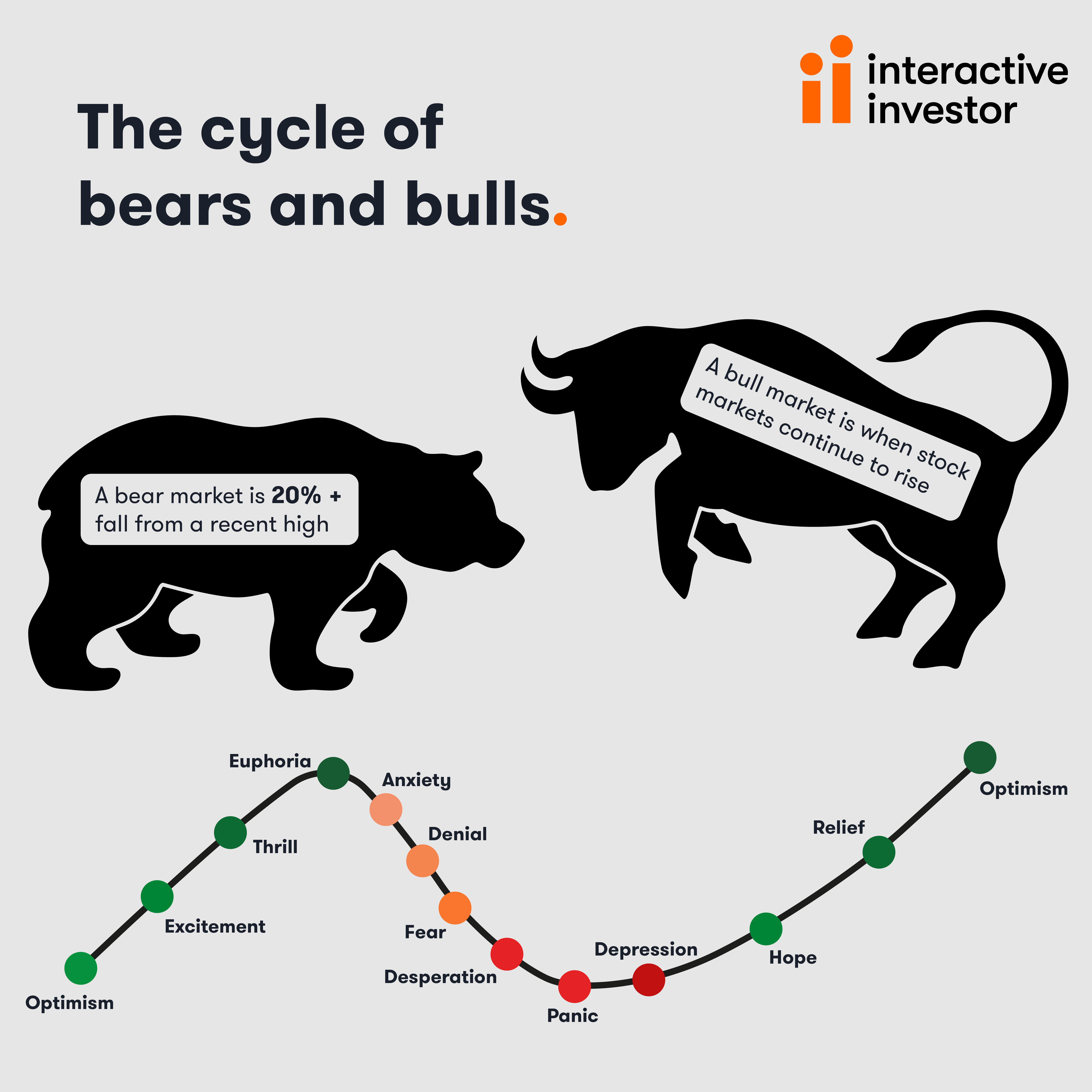

The bear is back. US shares are firmly into bear market territory, more than 20% down on their peaks – and more than 30% down in the case of Nasdaq. In Europe and Asia, the sell-off has not been so calamitous, but stock market investors are nonetheless nursing significant losses. It may just be time to look for some alternatives.

To be more specific, alternative investments are a catch-all description for financial assets that do not fit into the conventional groups to which investors have become accustomed – equities, bonds and cash. Alternatives span well-known asset classes such as private equity and infrastructure – where the average investment trust has fallen 3% and risen 6% respectively over the past year compared to a 27% decline from global equity investment trusts (all figures to 22 June 2022). Alternatives also include more esoteric areas of the market – everything from music royalties to airplane leasing contracts – where performance has also held up well.

“I think most investors could benefit from increasing exposure to alternatives,” says Ewan Lovett-Turner, a director at the broker Numis Securities. “Some investors may have exposure through multi-asset funds, but allocations remain low in many areas.”

The two main reasons to hold alternative investments

The case for alternative investments is twofold. First, increasing the diversification of your portfolio makes sense at the best of times, and certainly when the market is suffering with heightened volatility. Alternative investments typically generate returns that are uncorrelated with the performance of more conventional assets – that is, they do not rise and fall in line with stocks or bonds.

A good example is commodities, says interactive investor’s head of funds research Dzmitry Lipski. He points out: “Commodities show less correlation with global equities. Historically, investors have turned to commodities as a source of portfolio diversification and a hedge against rising levels of inflation.” Indeed, some commodity funds are up by more than 35% over the past 12 months.

The second argument focuses on the versatility of alternatives. In some cases, these are assets that offer downside protection in difficult times. Other types of alternative investment will add spice to your portfolio, offering at least the potential for growth that equities and fixed-income assets seem incapable of delivering right now.

- Top investors share their biggest investment lessons

- What you need to know about investing in commodities

In the first of these categories, says Nick Britton, head of intermediary communications at the Association of Investment Companies (AIC), fall assets where investors have greater visibility about what is to come. “The most defensive alternatives are those with predictable income streams, such as infrastructure and certain types of property with long leases,” he explains. “Income is often inflation-linked and based on contracts with government bodies or large blue-chip companies that can last for 20 years or longer.”

Private equity may also be considered in this light. Valuations of businesses not listed on the stock market may fall when the economy falters, but they don’t suffer from day-to-day volatility in the same way as listed equities. Plus, private equity managers tend to invest cautiously, focusing on businesses where they can add value through operational improvements.

“Historically, private equity does well coming out of a downturn, and many private equity investment companies trade at deep discounts, adding to the appeal for bargain hunters,” adds Britton.

Private equity and infrastructure provide defensive growth

Both these asset classes are worth considering in the current environment, argues Ben Yearsley, investment director at Shore Financial Planning. “Infrastructure should be a core asset class in most portfolios: it can, depending on the type of infrastructure, provide a high level of regular income as well as defensive growth”, he argues, picking out funds such as First Sentier Responsible Listed Infrastructure and TIME UK Infrastructure Income as good examples. The favoured option in interactive investor’s Super 60 list is FTF ClearBridge Global Infrastructure Income.

“Private equity is still mainly equity investment but with the benefit of companies being away from market scrutiny and not having to worry about quarterly earnings figures,” Yearsley adds.

“I’m still a fan over the long term, but it will probably be more challenging in the short term.” Pantheon and NB Private Equity (LSE:NBPE) are two funds to consider, he suggests.

Investment trusts the best fit for property

Property is a third example of a more defensive alternative investment, says Numis’s Lovett-Turner, since ultimately, you’re buying an asset that is real and tangible, plus it generates a steady stream of income as long as it is let. “There has been significant growth in the listed property investment companies market in recent years because investors and management groups have acknowledged the flawed nature of open-ended property funds, which have had to restrict redemptions.” Indeed, investment trusts are a good option for many alternative assets, since these tend to be less liquid, and therefore poorly suited to open-ended structures.

Some parts of the real estate sector are more sensitive to the economic cycle than others; property leased to businesses in struggling areas of the economy carries more risk. But in other cases, long leases, signed with creditworthy tenants, provide security – and there is also potential for capital growth in areas where demand is buoyant; logistics and warehousing space has been one recent example.

Similarly, Shayan Ratnasingam, an analyst at Winterflood Securities, says: “Digital assets such as data centres, fibre networks and towers are increasingly becoming the backbone of economic growth and the sector is considered a fourth utility.” In fact, he argues, this is an area of the alternatives universe that offers both defensive and offensive qualities.

“Assets tend to fall under the higher value-add risk-profile but can offer higher returns and attractive real-estate-like characteristics,” Ratnasingam explains.

“At the current point in the cycle, the asset class could prove defensive and we may see interesting bolt-on acquisitions and restructuring, which will be accretive to returns.”

The alternative investments that aim to add spice

What about areas of the alternatives space that would be considered outright as potential sources of spice for your portfolio?

“Royalties is an interesting angle and some of the funds we use invest in these,” says Scott Gallacher, a chartered financial planner at independent financial adviser Rowley Turton. Music royalty funds such Hipgnosis Songs (LSE:SONG) and Round Hill Music Royalty (LSE:RHM) buy up the back catalogues of performing artists and are then entitled to royalty payments when the music they own is played – on streaming services, for example.

Music consumption appears to have little correlation to the prevailing economic conditions and is increasing over time. The owners of song rights can also drive up the value of their intellectual property through strategies such as licensing deals.

Elsewhere, Lovett-Turner singles out two other opportunities worth considering for spice. “In shipping, Taylor Maritime (LSE:TMI) has a high-quality manager team with a history in the shipping industry, and positive supply and demand dynamics are likely to support cash flows in the coming years,” he says.

After all, the importance of freight services to the global economy has been painfully obvious during the supply chain disruption of the past year.

There is also specialist debt, points out Lovett-Turner. “Highly experienced managers can generate yield premiums in specialist and less liquid areas of the debt markets.” He picks out TwentyFour Income (LSE:TFIF) and TwentyFour Select Monthly Income (LSE:SMIF) as funds that offer exposure to this area.

Finally, for investors not sure how to build exposure to alternative investments into their portfolio, a fund that does the work on your behalf could be a good option. The Flexible Investment sector of the investment trust industry comprises funds where managers have very wide discretion on how to invest, including freedom to invest across asset classes, and many have exposure to alternatives alongside their more traditional holdings. Three “wealth preservation” trusts that have held up well this year and during previous downturns are Ruffer Investment Company (LSE:RICA), Capital Gearing (LSE:CGT) and Personal Assets (LSE:PNL).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.