Time to take your profits on this stock?

This company has delivered strong results, but the sector still carries substantial risk. Rodney Hobson gives his view on what investors should do now.

26th February 2025 09:01

by Rodney Hobson from interactive investor

It was a strong end to 2024 for United Airlines Holdings Inc (NASDAQ:UAL) but the shares have rather run ahead of the news and have already come off the boil. Shareholders should consider whether this is a good time to take substantial profits.

The airline reported that pre-tax income leapt 70% to a record $1.3 billion (£1.0 billion) in the fourth quarter compared with the same three months a year earlier. That was really impressive on revenue up just 7.8% to $14.7 billion, but it did lend considerable credence to United’s promise to improve its profit margins this year.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The late spurt meant that profits for the full year were up 23% to $4.2 billion and revenue by 6.2% to $57.1 billion. Pre-tax margins were 7.3% but United reckons it’s on track to take that into double figures this year. Adjusted diluted earnings per share of $10.61 were towards the higher end of guidance of between $9 and $11 provided at the start of the year.

The company operated the most flights and carried the most customers in its history, with capacity 6.2% higher in the fourth quarter year-on-year. It claims that United’s significant investment resulted in it beating other airlines for punctuality at all seven of its US hubs.

- Watch our video: Nick Train: ‘the Americans have discovered Guinness!’

- Three simple rules from the man who inspired Warren Buffett

The airline has benefited more than most of its rivals from the rebound in air travel after the disastrous Covid-19 years, but so far the improvement in passenger numbers has come mainly in economy class, up 20% last year, and less in the more lucrative premium class, with corporate revenue up just 7%. Cargo is really racing away with 30% revenue growth, which provides good alternative profits if passenger travel starts to plateau. “Robust demand trends” have continued into the first quarter of 2025.

Source: interactive investor. Past performance is not a guide to future performance.

The fourth-quarter figures were a massive improvement on the previous three months, when net income fell 15% to $965 million despite operating revenue nudging up 2.5% to $14.8 billion.

When those figures were released in October, Scott Kirby, the chief executive, preferred to stress that the third-quarter figures beat expectations, with a sharp drop in empty capacity from mid-August leading to the airline’s busiest third quarter ever. He was sufficiently emboldened to launch a new share repurchase programme up to $1.5 billion. This is easily affordable out of the $3.4 billion generated in free cash flow last year.

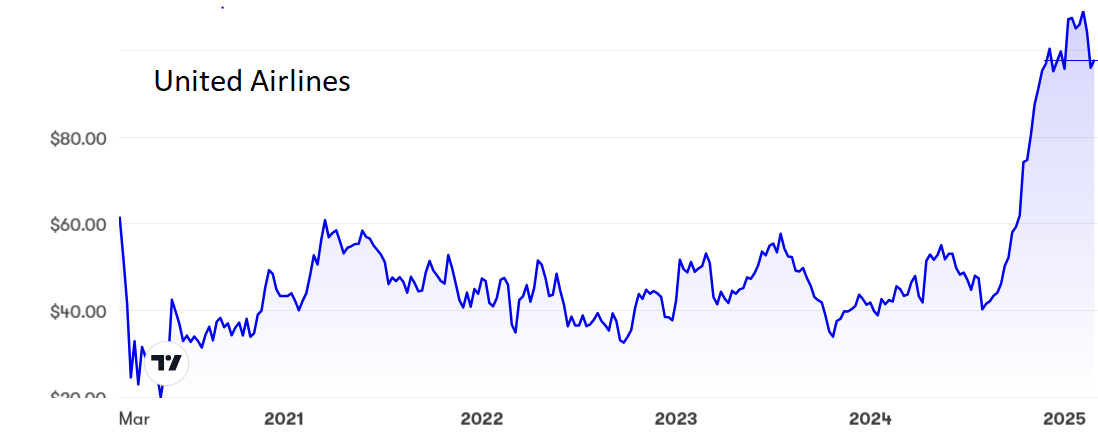

The shares slipped briefly below $40 in early August but then rose steadily until hitting $110 in January. That is an amazing performance given that $60 had proved a solid ceiling over the previous five years.

- A solid long-term investment plus my view on Palantir Technologies

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Three attempts to push higher failed before the stock slipped back below $100, which could well now form a new ceiling. At around the current $95, the price/earnings ratio is far from daunting at just over 10 but there is no dividend and there could be a long wait for one. For the time being, share buybacks are the preferred route for returning cash to shareholders.

Hobson’s choice: Airlines still carry a substantial risk even though the darkest days of the pandemic are fading into the past. Just as businesses have learned to cope with working from home, so too have they mastered the art of video and audio communications rather than waste hours in travelling to business meetings. The least profitable part of the business, economy, will continue to recover fastest. Meanwhile, all the Trump-inspired drilling will not bring down the price of jet fuel.

Those who bought United shares at lower levels can pat themselves on the back, but this is a good time to sell and take the money. Buy back in if the price drops below $60.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.