Time to take some profits in these two top funds

Buy low, sell high is Saltydog Investor’s mantra. That means these star funds have to go.

28th September 2020 14:47

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Buy low, sell high is Saltydog Investor’s mantra. That means these star funds have to go.

The way to make money in the stock markets is to sell your investments at a higher price than you paid for them.

There are many different ways of trying to do this. Two of the most popular are value investing and momentum investing.

Value investing is very clearly and ably represented by its most famous advocate Warren Buffett, one of the wealthiest men in the world. It means that you are looking for good companies that are perhaps trading in unloved sectors, or those which are just simply overlooked and undervalued.

You buy their shares cheaply and sell a long time in the future at a very much higher price. At least that is what you hope.

There are many professional investors who specialise in this approach. To be successful, it requires a detailed investigation of the company’s balance sheet, sales plans and accounts.

Even so, having done all of this, due to unforeseen circumstances, it can all still go horribly wrong. If you are going down the route of value investing it is worth remembering the expression “Man plans and God laughs”. In 2016 and 2017, Buffet invested heavily in the largest American airline companies. Unfortunately, when the coronavirus pandemic struck earlier this year, airline stocks plummeted. His company, Berkshire Hathaway (NYSE:BRK.B), sold their shares in April at a significant loss.

- Ian Cowie: the bargain basement country Warren Buffett is backing

- ii Super 60 investments: quality options for your portfolio, rigorously selected by our impartial experts

At Saltydog Investor, we are unashamedly believers in momentum investing. Provided that you have access to accurate up-to-date information, we believe that this is the only method that makes long-term sense to the private DIY investor, especially when investing in funds.

By using funds, you spread your risk away from individual companies, and you also avail yourself of the knowledge of the various fund managers and their research teams.

A scientific definition of momentum might be “The force possessed by matter that is in motion”. The product of the mass and velocity of a body gives it impetus, and so it is with investing. The greater the money that is being invested into a sector, or fund, the quicker its value will rise and it will acquire greater and greater impetus as it attracts more and more investors.

For a time its rise will become self-fulfilling. Obviously, the opposite also applies. The idea is that once a trend is established, either upwards or downwards, then it is more likely to continue in that direction than to move against the trend.

Put simply, momentum investing can be likened to a relay race. When a sector is doing well, then you choose a performing fund from that sector to carry the baton, and when that sector runs out of puff, then you hand it on to the next fund, in the next sector that is pulling ahead and gaining momentum.

You are in fact making use of the knowledge of the fund managers and their analysts when they are right and moving on to another team of winners as your current ones start to falter.

You all know from your childhood that it is better to be on the ladder and off the snake. The idea is to see the trends and to move your money into them on the up and out on the down – without overtrading or fussing too much about getting to the very top or the very bottom of every movement.

Since the stock market correction in March, the technology sector has been performing well, led by the US tech giants such as Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOGL).

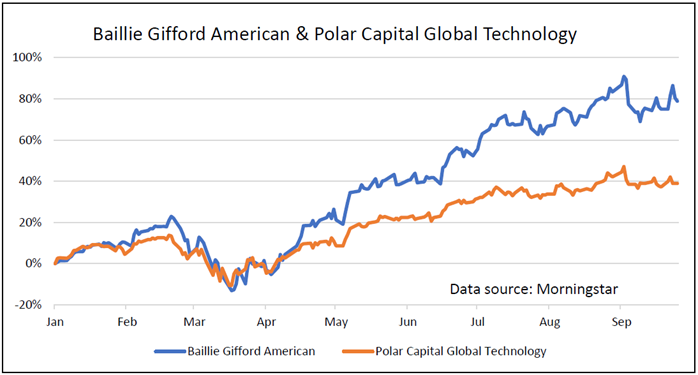

In April, our demonstration portfolios invested in two funds that have taken advantage of this trend: Polar Capital Global Technology and Baillie Gifford American.

- These fund portfolios have never been better

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Although they have done very well over the last six months, they have slowed down in recent weeks.

Past performance is not a guide to future performance.

Last week we sold our holdings in these funds. Although it is possible that they may continue to go up, we have had a good run and are happy to bank the profits and hold a little more cash.

I have always been a great advocate of technology funds, but feel uneasy about the valuations being placed on many of the American FAANG businesses. Going forward, the American Presidential election and the end of the Brexit transition period could definitely rock the boat, potentially affecting the relationship between the pound and the dollar. So, maybe now is the time to be a little more cautious.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.