Time to take profits from tech and rotate into biotech?

The two industries have experienced contrasting fortunes this year and a Kepler analyst wonders whether contrarian investment trust investors could shift from one hyped-up area to a downtrodden one.

20th October 2023 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

A third of Anguilla’s government monthly budget in September 2023 came from revenues generated by the country’s .ai web address as artificial intelligence (AI) start-ups clamour for a catchy website domain. This is just another sign of the rapidly growing interest in AI in the past few years, which has leapt from the preserve of science fiction to the mainstream, thanks in no small part to the roll-out of services such as ChatGPT.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

Commentators have become increasingly vocal about the future potential of AI, as well as the fears over the implications of its power. This enthusiasm has spilled over into stock markets, with the technology sector again leading the way in 2023 driven by a number of AI-linked companies. However, whilst the technology to potentially replace humans has seen a boom, the technology designed to save humans—biotech—has had contrasting fortunes. The sector has struggled in the past year, despite having its own breakout year in 2020-21 following the successes of the Covid vaccine programmes. Could this be an opportunity for investors to take profits from technology and rotate in biotech?

Tech on the tear

The exponential growth of technology and tech firms has been the driving force in the market for much of the past decade. The proliferation of mobile devices and connectivity driving the adoption of products and services have permeated virtually every facet of our lives. This accelerated in the pandemic with the likes of video conferencing, e-commerce, and health tech. Since then, the sector has suffered from a well-publicised pullback as demand for products and services eased, and higher interest rates to tackle the inflationary environment, led investors’ preference to shift to value-orientated stocks.

However, in 2023 tech has again led the market, and yet again, it has been led by a concentrated range of stocks. The so-called Magnificent Seven of Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), NVIDIA (NASDAQ:NVDA), Tesla (NASDAQ:TSLA), and Meta (NASDAQ:META) have driven the market so far in 2023. In fact, just 15 stocks of the broader S&P 500 Index have delivered 41% of the returns to 17/09/2023, causing pain for active fund managers who don’t hold these stocks. The lack of breadth is often cited by technical investors as a signal of a weak rally and a potentially negative sign for the outlook. It is something Mike Seidenberg, manager of Allianz Technology Trust (LSE:ATT)highlighted in our recent update. He identifies that the current rally is being driven primarily by mega-cap companies. Mike has benefitted from being overweight some of these top performers but believes his performance will continue to benefit if the rally broadens out, due to the mid-cap bias he has in the trust. This bias should help generate alpha over the benchmark should his stock selection be rewarded.

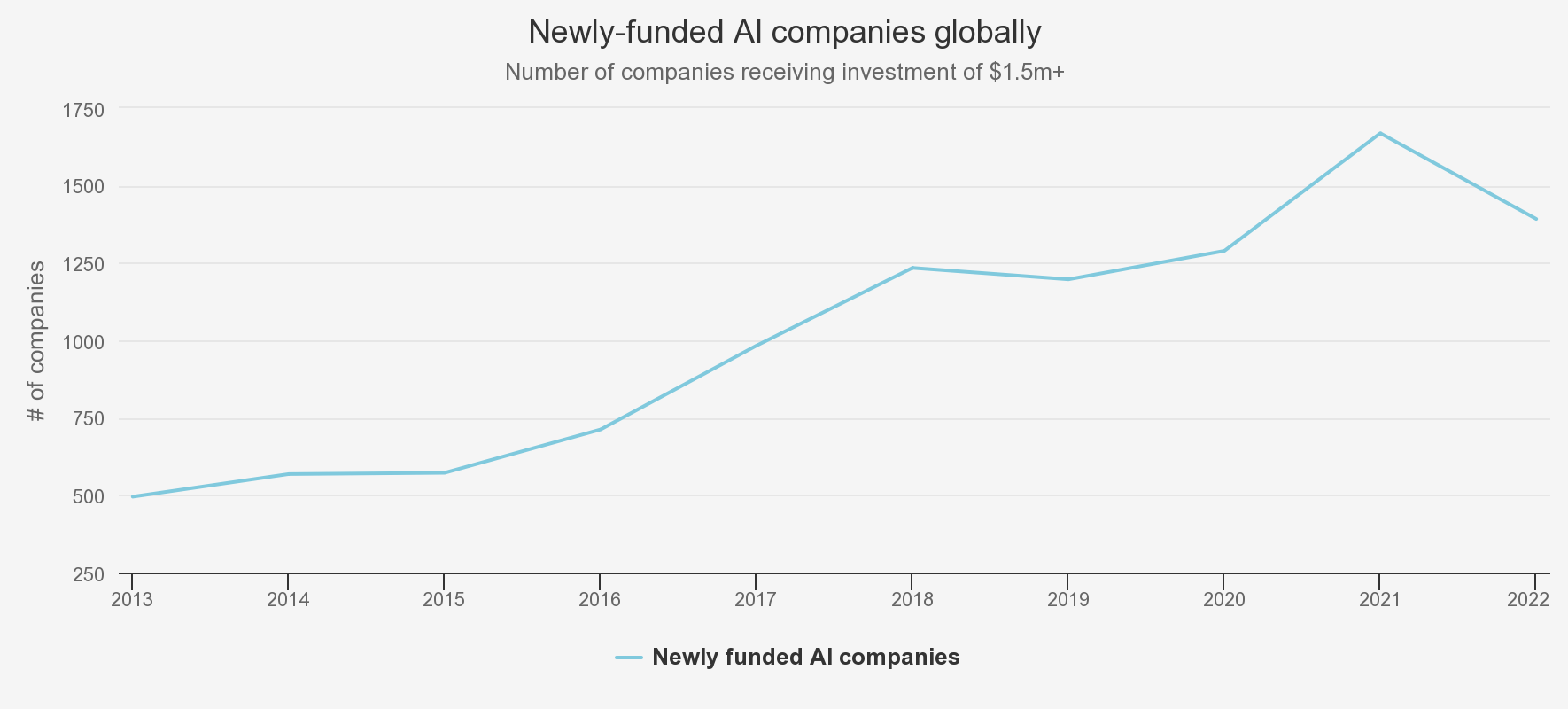

The catalyst that has ignited interest in tech stocks is attributable to the explosion of interest in AI. In November 2022, OpenAI launched its large language model, ChatGPT, which captured the attention of the public and showed the capabilities of AI as a tool for improving productivity. It demonstrated the real-world use for AI to be embedded in a range of services, from medical diagnostics to investment decisions to art, and its use quickly proliferated. In truth, AI is not something that started 12 months ago. In the chart below, we show the expansion of AI-related investment over the past decade, with the number of new companies focused on AI, which have attracted investment of over $1.5 million growing from 495 in 2013, to a peak of 1,669 in 2021. New companies launching fell back in 2022, perhaps more a symptom of the harder fundraising environment, but the hype has potentially reached a fever pitch. During 2023, for example, it was reported that Mistral AI had raised €105 million only a month after having been incorporated. Headlines like this may raise eyebrows, particularly from those who witnessed the original dot.com boom in the late 1990s.

NEWLY FUNDED AI COMPANIES

Source: AI Index Report 2022, Standford University

In 2023, enthusiasm for AI made its way to the stock market. Nvidia has been one of the key beneficiaries thanks to the increase in demand for its products to power AI devices. Its shares have risen over 200% in 2023 alone, with the company hitting a trillion-dollar valuation in May. It is something Mike has capitalised on within ATT. Nvidia is the second-largest holding in the portfolio which has contributed to the trust’s good returns in 2023. Mike believes holdings in semiconductor companies such as Nvidia are the equivalent of selling picks and shovels in the gold rush. He took his position in Nvidia to overweight earlier in the year as he felt that demand for the chips, driven by AI, would exceed supply—a thesis which has proved correct. Despite the run, Mike believes there is little bad news on the horizon for Nvidia and is a happy holder. Even so, he has the benefit of diversification to fall back on with ATT, with a range of diversified subsectors in the portfolio ranging from software to equipment components which often perform at different points in the economic cycle, and which should help smooth performance over the long term.

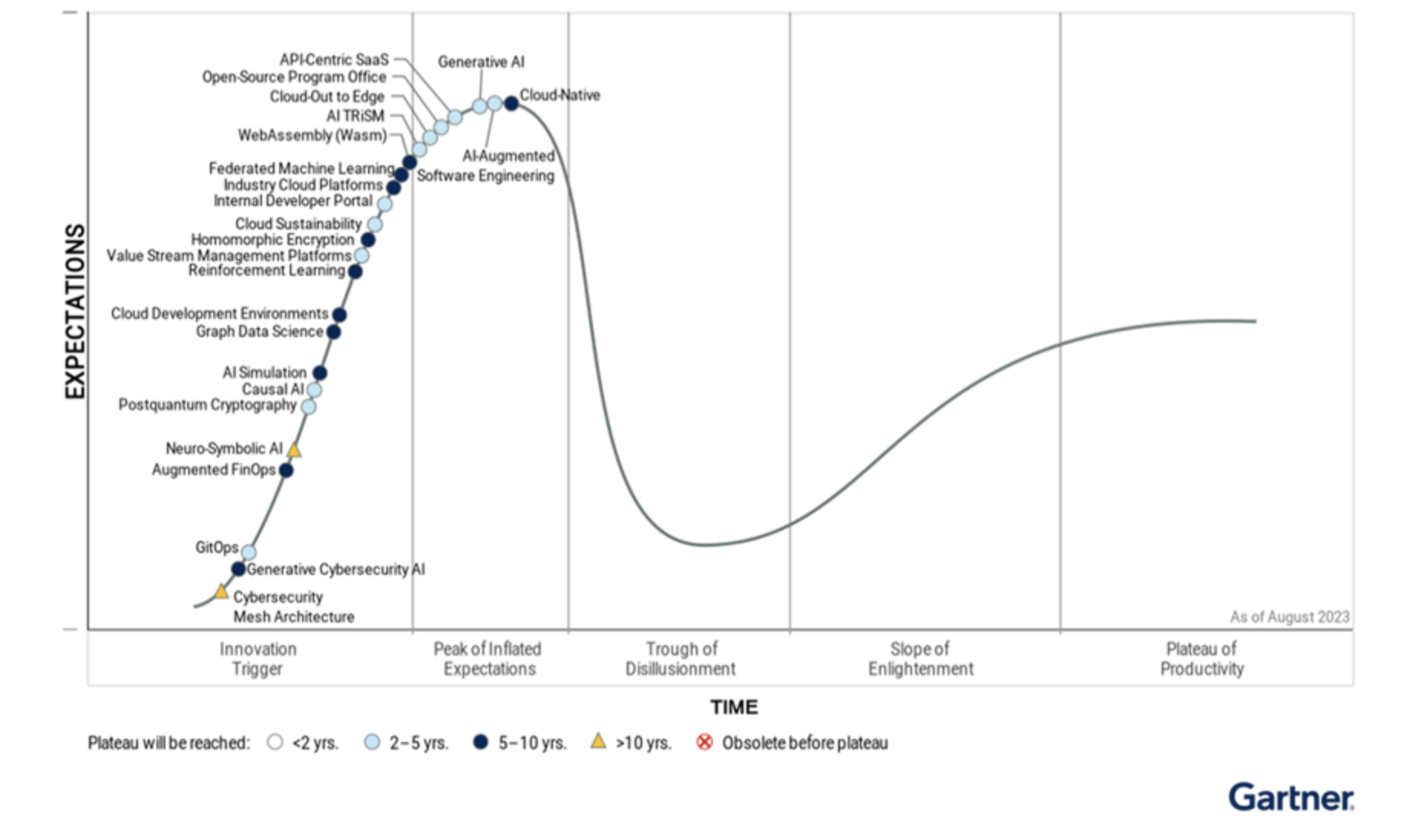

Whilst diversification can help the likes of ATT, it’s possible that the recent run-up, especially in relation to AI, could be unsustainable. Many of the signs fit the pattern of a ‘hype cycle’. This is a methodology developed by American research firm Gartner to visually represent the typical phases emerging technologies go through. While AI has had a breakout year, even its standard bearer ChatGPT is unprofitable. In its last financial year to December 2022, the company lost $540 million, and while revenue growth since has been strong, the CEO has described the operating costs as “eye-watering”. Fortunately, the company has some high-profile, and deep-pocketed, backers including Microsoft and Sequoia Capital, which should enable its expansion. However, many experts believe the technology is at the peak of expectations, and that a trough is due. If this is the case, we believe there is a strong argument for taking some profit and rotating into more out of favour areas.

GARTNER’S EMERGING TECHNOLOGY HYPE CYCLE

Source: Gartner

Biotech blues

One potential destination could be biotech. The biotech industry has gone through a journey of its own in the past few years. The sector is relatively young, only emerging as a sector in its own right in the 2000s, but since then, it has demonstrated high-growth potential due to growing demand from an ageing population, as well as improvements in supportive technology such as gene sequencing. It is a sector that is at the forefront of innovation, helping drive the much larger healthcare industry and deliver a significant improvement to human lifespans. The sector showed its true worth in 2020, producing a number of vaccines for Covid-19 in record time, doubtlessly saving millions of lives and shortening the pandemic. More recently, the sector has also begun to look at the incorporation of AI into the research and development of new treatments, though many have cautioned that this early excitement needs to be kept in perspective.

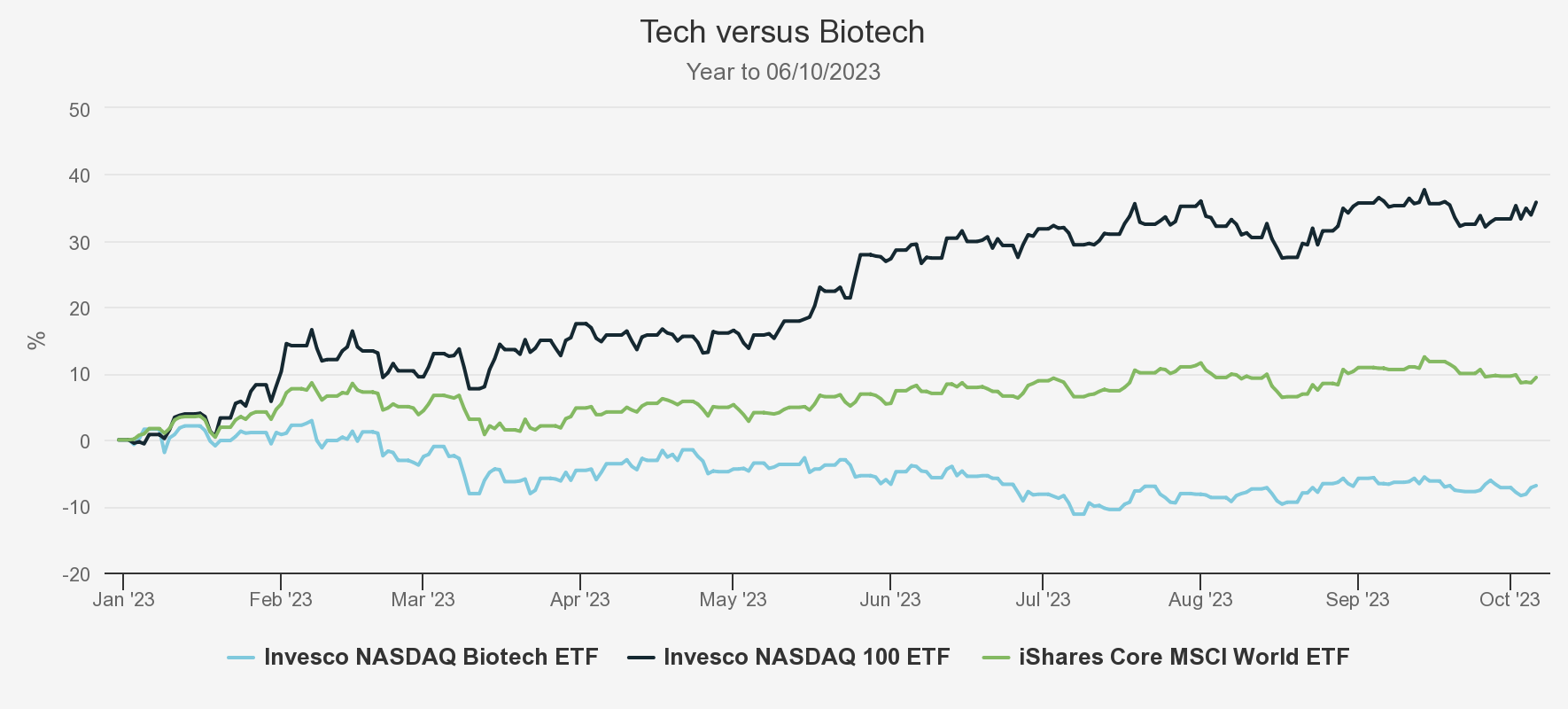

The biotechnology sector has struggled in absolute and relative terms when compared to broad equity markets and most especially the tech sector this year. Whilst the Nasdaq 100 Technology Index has returned 21.6% in the year to 06/10/2023, the Nasdaq Biotechnology Index has fallen by 3.8%. For context, the MSCI World Index returned 3.9% in the same period. We have used ETFs as proxies in the chart below.

BIOTECH PERFORMANCE IN 2023

Source: Morningstar. Past performance is not a reliable indicator of future results

There are a number of reasons for this diverging performance. The biotech sector tends to be quite sentiment-driven and therefore typically has a higher beta than the market. As such, when negativity is high, the sector tends to underperform. Conversely, when investors are more positive, the sector typically outperforms. At present, investors continue to be concerned over interest rates. As these have climbed, appetites for higher-risk investments have waned, adversely affecting biotech. Furthermore, higher rates are a headwind for an industry which typically rewards investors over the longer term.

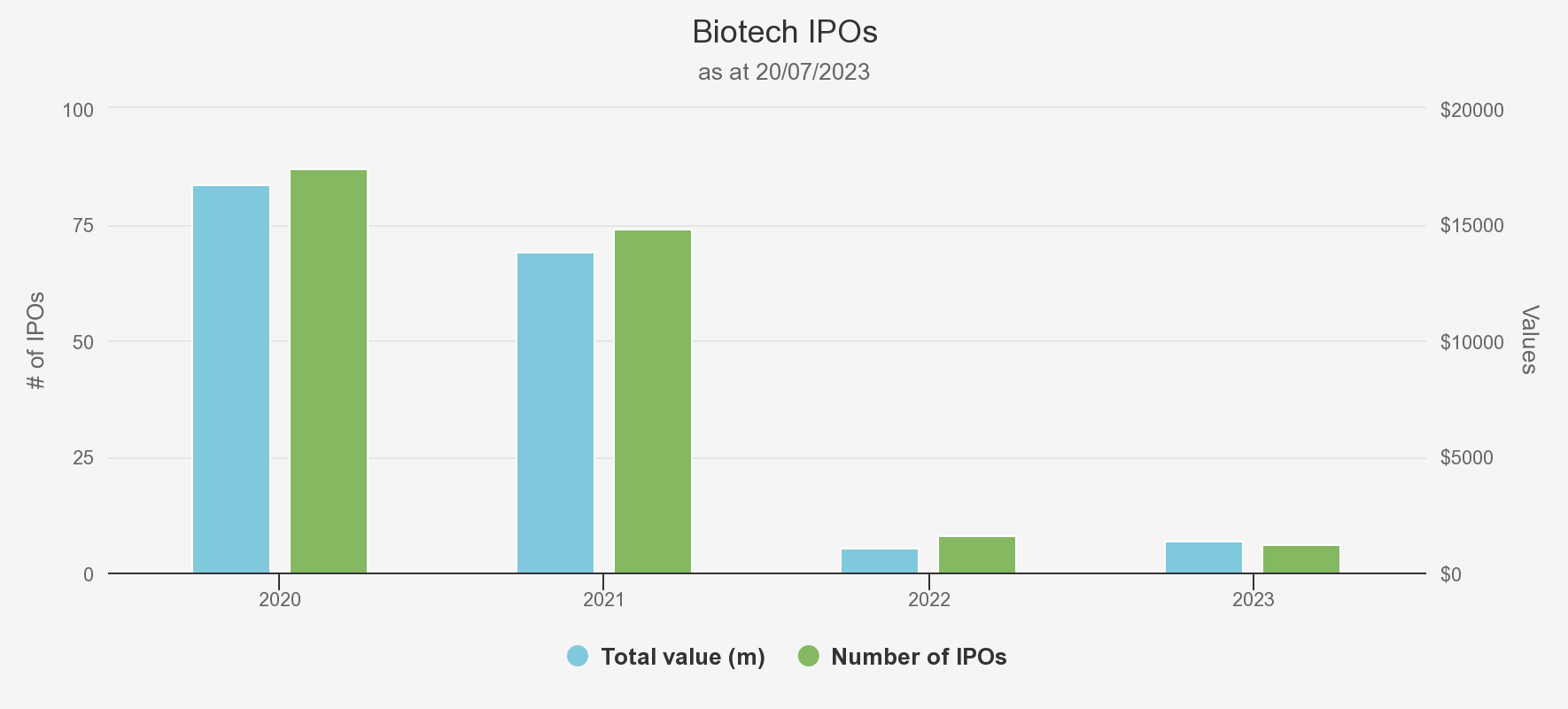

There have been some sector-specific factors which have also affected the industry. A large number of IPOs came to market during 2020 and 2021, as we have shown in the chart below, but investors are now struggling to digest these, especially since higher interest rates have led to a change in market leadership. In 2022, the US published the wide-ranging Inflation Reduction Act, which includes the power to negotiate drug prices which has created concerns for future biotech revenues. Furthermore, the industry had a relatively poor year for drug approvals in the last couple of years as well as suffering from a hangover of its post-pandemic boom. These factors have led to underperformance and a very difficult fundraising environment.

BIOTECH IPO MARKET

Source: Goodwin

Many investors in the space believe this period of weakness is temporary and could be seen as an opportunity. Ailsa Craig the manager of International Biotechnology (LSE:IBT)believes that these tougher periods are a predictable part of the classic cyclicality evident in the sector. In a recent podcast, Ailsa highlights that biotech investing goes through a life cycle, peaking with hyped values and a booming IPO market, moving towards periods of depressed valuations. These cycles typically occur every three to five years but, likely as a result of the pandemic, the cycle has been shortened this time around. The success of the vaccine led to a lot of positivity in the sector, with a number of IPOs coming out at lofty valuations to capture the ‘halo effect’ of the time. Since then, sentiment reversed and the market fell, hitting a nadir in June 2022. Since then, things have recovered, and the sector has rallied around 20%. Ailsa highlights that M&A is a persistent feature of the biotech sector, with the desire and need for global, mega-cap pharmaceutical companies to extend their product portfolios, as patents expire.

In fact, Ailsa highlights M&A often marks the start of a new biotech cycle, with corporates the first to exploit valuations. The weak funding environment is also contributing, with many biotech companies having only a limited runway of cash to survive on, and weighing the benefits of independence against the chances of equity markets reopening before they run out of cash. Ailsa highlights that IBT has enjoyed six takeovers in the past financial year, helping the trust to outperform its benchmark and sector average. Despite this, IBT is trading at a discount of 6.2%, wider than the five-year average of 2.8%. In her view, depressed valuations in the sector, combined with the cyclical potential could offer investors an attractive entry point. As the table below shows, the performance differential between the Biotechnology and Tech sectors is massive, yet they both are underpinned by similar drivers such as scientific research and innovation, AI, and the competitive landscape.

It is not just IBT that is trading at a discount though. As we show in the table below, all the trusts in both the Biotechnology & Healthcare and Technology sectors are trading at discounts, with all but one of these trusts trading at a discount wider than their one-year average.

NAV PERFORMANCE TO 30/09/2023 AND DISCOUNTS

| BIOTECH & HEALTHCARE TRUSTS/ INDEX | DISCOUNT % (11/10/2023) | 1-YEAR AVERAGE DISCOUNT % | 1 YEAR NAV TOTAL RETURN % | 3 YEARS NAV TOTAL RETURN % | 5 YEARS NAV TOTAL RETURN % |

| Bellevue Healthcare Ord (LSE:BBH) | -11.5 | -6.7 | -11.8 | -1.1 | 18.4 |

| Biotech Growth Ord (LSE:BIOG) | -6.1 | -8.2 | -22.9 | -41.0 | -8.7 |

| International Biotechnology | -6.2 | -5.8 | -5.1 | -8.8 | 13.2 |

| Polar Capital Glb Healthcare Ord (LSE:PCGH) | -7.3 | -5.7 | 4.1 | 31.4 | 48.1 |

| RTW Biotech Opportunities Ord (LSE:RTW) | -29.0 | -24.3 | 11.8 | 17.5 | - |

| Syncona Ord (LSE:SYNC) | -32.8 | -18.1 | -9.1 | -9.2 | -10.4 |

| Worldwide Healthcare Ord (LSE:WWH) | -9.7 | -9.0 | -4.1 | -1.1 | 22.9 |

| NASDAQ Biotechnology (USD) | - | - | 3.3 | 0.7 | 14.0 |

| Average | -14.7 | -11.11 | -5.3 | -1.8 | 13.9 |

| TECHNOLOGY TRUSTS / INDEX | DISCOUNT % (11/10/2023) | 1-YEAR AVERAGE DISCOUNT % | 1 YEAR NAV TOTAL RETURN % | 3 YEARS NAV TOTAL RETURN % | 5 YEARS NAV TOTAL RETURN % |

| Allianz Technology Trust | -13.1 | -12.9 | 13.1 | 15.6 | 88.5 |

| Polar Capital Technology Ord (LSE:PCT) | -14.3 | -13.0 | 20.2 | 16.9 | 86.8 |

| NASDAQ 100 (USD) | - | - | 22.7 | 36.5 | 106.1 |

| Average | -16.3 | -13.2 | 9.3 | 17.6 | 63.0 |

Source: Morningstar

A broader exposure than that offered by biotech-focused trusts is Bellevue Healthcare (BBH). Co-managed by Paul Major and Brett Darke, they aim to capture the secular tailwinds to the broader healthcare sector from across the market-cap spectrum, including exposure to biotech through both diversified and focussed therapeutics. This offers investors the opportunity to access biotech, but within a more diversified portfolio of other healthcare companies which are typically less sensitive to market sentiment and have outperformed aggregate markets so far this year. We note that the managers have reduced their exposure to both diversified and focussed therapeutics in the most recent interim statement to 31/05/2023 from 8.1% to 4% and 24.5% and 21.3% respectively.

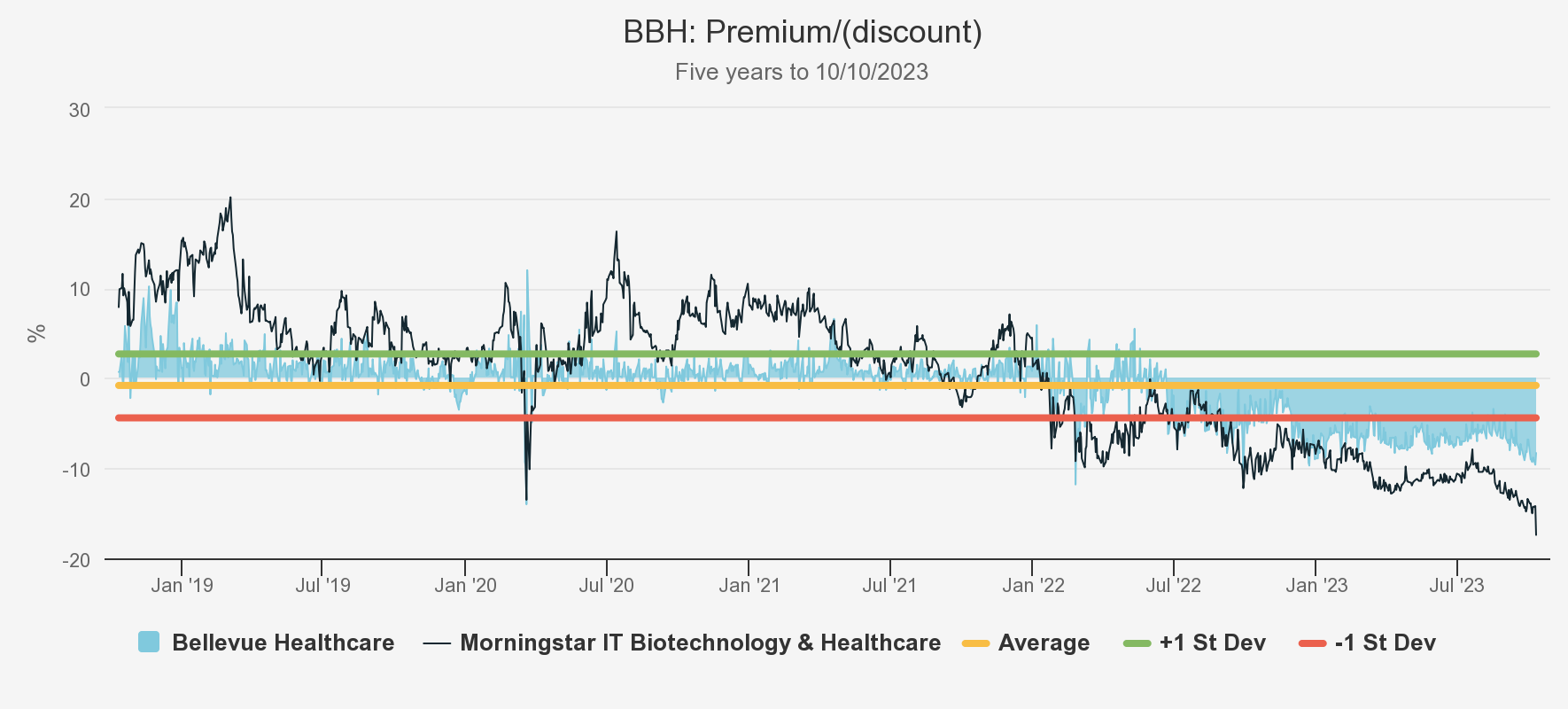

BBH has suffered from just a few stocks driving market performance in 2023. The managers are typically quite concentrated and differentiated to the market meaning there can be periods of underperformance. However over the long term, their approach has delivered strong returns for investors. Having traded close to NAV for much of the past five years, the shares have moved to a discount since mid-2022, currently trading at around a 9% discount. We believe the trust’s small and mid-cap bias means it is likely to perform well in a rising market and be best placed to capture long-term growth and potential for innovation from the industry. The current weakness in valuations and relatively wide discount could be seen as a compelling opportunity for long-term investors.

BBH PREMIUM/(DISCOUNT)

Source: Morningstar

It is not just biotech investors that have highlighted the attractions of the sector. There are a number of trust managers who have recognised the opportunity and have allocated to the space. One of these is Peter Hewitt, the highly experienced manager of CT Global Managed Portfolio Growth Ord (LSE:CMPG). He takes a long-term approach to investing, looking for high-quality investment trusts that have exposure to secular growth themes. Healthcare, of which biotech is a subsector, is one of these key areas. Peter holds BBH, as well as Worldwide Healthcare Trust (WWH) and Swiss biotech holding HBM Healthcare Investments. In total, he has a 13.4% allocation to the broader healthcare sector, which compares to the index’s 12.8% within which there is a specific allocation of 3.2% in the biotech sector, nearly double that of the global index at 1.8% as of 31/07/2023, according to data from Morningstar. At the same time, Peter has also made money on the AI opportunity through the likes of ATT which is now a top ten position in the trust. In the past, he has been pragmatic in his management of the portfolio, having taken profits in growth strategies in 2021 to rotate into more cyclically exposed trusts such as Law Debenture. As such, CMPG gives investors an actively managed exposure to both of these sectors.

Monks (LSE:MNKS) managers Spencer Adair and Malcolm MacColl focus on growth companies, able to deliver above-average earnings growth. They aim to diversify the portfolio by focussing on different categories of growth companies: stalwarts, rapid, and cyclical. The latter of these is where the managers have the best example of their biotech exposure through Royalty Pharma. Royalty Pharma helps to fund pharmaceutical research and development in exchange for future royalties from successful drugs. This approach is particularly vital for the industry at the moment due to the difficulty of funding in the higher interest rate environment. This has contributed to the managers also having an overweight allocation to the biotech industry as of 31/07/2023, with a 3.4% position. Spencer and Malcolm are also believers in the transformational potential of AI. Similar to Mike Seidenberg of ATT, they have taken a picks-and-shovels approach to investing in the space through a large holding in chip manufacturer TSMC, as well as a number of companies in the supply chain. They argue that it is these companies that will capture the early growth of the AI revolution through increased data and computing power, though the beneficiaries of AI will likely be a broad range across both tech-focused and non-tech firms.

Conclusion

The tech and biotech industries have endured contrasting stock market fortunes in 2023, both of which are arguably led by sentiment. Whilst the positivity over AI has led to a tech renaissance, wider macro concerns have impacted biotech. We believe this could be an opportunity for contrarian investors to rotate from the exuberant to the downtrodden. While AI undoubtedly has a number of intriguing applications, we believe hype may be triumphing over reality, whereas biotech has arguably more robust drivers over the long term from an ageing population and M&A activity already evident.

Opportune timing may allow investors to capture depressed valuations, potentially enhanced through a number of investment trusts with attractive discounts. Furthermore, trusts offer active management, which could be crucial in two sectors going through a potentially transformative period. We believe manager expertise will be critical in these markets to help pick out the winners or identify takeover targets, as well as avoid over-hyped companies that may be better suited to traversing the Caribbean for the more appropriate Bahamas domain of .bs.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.