Time to put tech funds back into our portfolios

28th June 2021 13:00

by Douglas Chadwick from ii contributor

Saltydog has trimmed exposure to UK funds and reintroduced technology to its two portfolios.

It has been an interesting 18 months for trend investors. At the beginning of 2020, equity markets were performing well, especially in the US. At the time, the Dow Jones Industrial Average, S&P 500 and Nasdaq all set new all-time highs.

In the UK, the FTSE 250 also peaked and although the FTSE 100 was not doing quite as well, it was heading back towards the record it set in May 2018.

Then markets around the world suffered during the Covid-19 market sell-off, with some losing more than 30% of their value in a few weeks.

- How Saltydog invests: a guide to its momentum approach

- Four funds that helped power our portfolios to all-time highs

- Funds Fan: ‘skin in the game’, space launches and UK quality shares

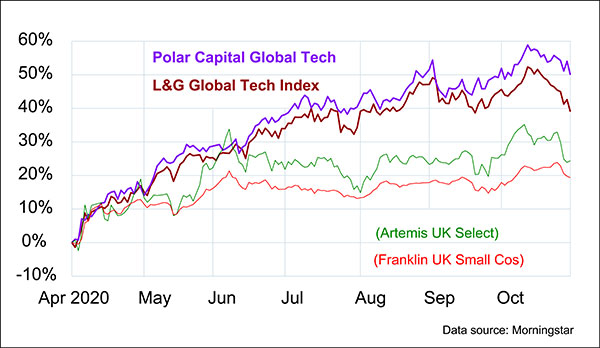

Fortunately, markets then started to recover, but some definitely moved quicker than others. The ‘tech’ stocks in the US did particularly well, significantly outperforming our domestic market. We picked up on this and last April our Tugboat Portfolio invested in the Polar Capital Global Technology fund and the Ocean Liner portfolio bought the L&G Global Technology Index.

Here is a graph showing how they performed up until the end of October (we actually sold them in late September).

Past performance is not a guide to future performance.

For comparison, I have shown a fund from the IA UK All Companies sector and another from the IA UK Smaller Companies sector - we were not holding them at the time, but we were about to go into them.

As you can see, all four funds were going down at the end of October, but at that point none of them were actually in our portfolios.

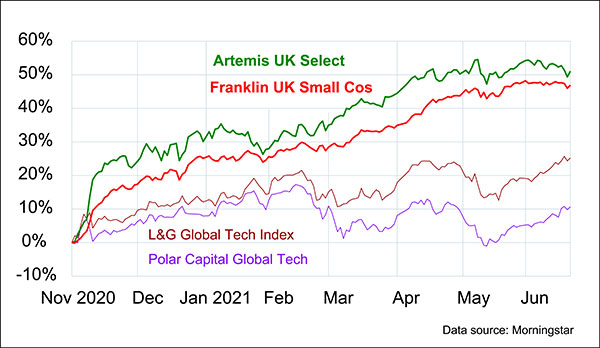

When markets picked up in November, the UK fund sectors were leading the way and that's when we changed tack and went into the Artemis UK Select and Franklin UK Smaller Companies funds.

In recent months, these sectors have performed well and we have increased our holdings. However, in the last few weeks it looks as though the tide may be changing again as performance has levelled off.

Past performance is not a guide to future performance.

We have already reduced the Franklin fund and last week we sold the Artemis UK Select fund. We still have some exposure to the UK Equity sectors, but are cutting back a little and giving the technology funds another chance.

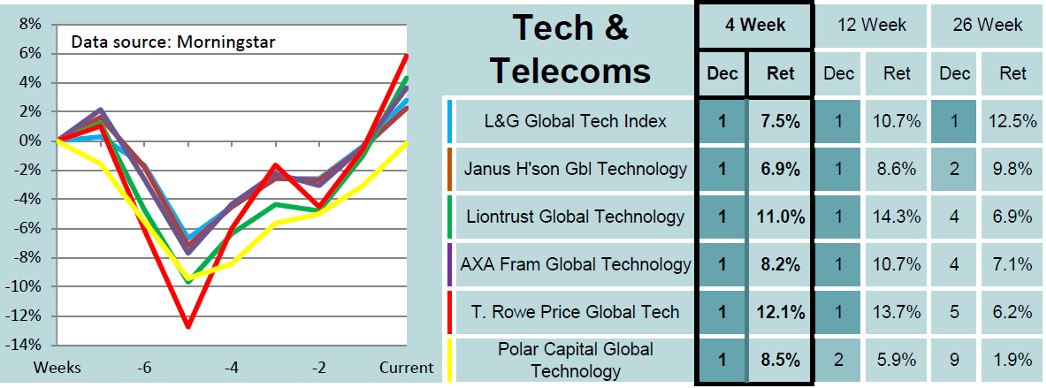

We have gone back into the L&G Global Tech Index in Tugboat. In addition, this time we have also picked the AXA Framlington Global Technology fund for our Ocean Liner portfolio. But we would have been just as happy with any of the funds in this week's shortlists.

When the large technology stocks do well, it is not just the technology funds that benefit. They have such a large effect on the US economy that anything with exposure to the S&P 500 or Nasdaq will get a boost.

Last year, this was particularly noticeable in the Baillie Gifford funds, regardless of which sector they were in. If the current trend continues, we would expect the Baillie Gifford Managed fund (from the Mixed Investment 40-85% Shares sector) and the Baillie Gifford Long-Term Global Growth fund (from the Global sector) to perform well. We have recently added these to our portfolios.

- Open an ISA with interactive investor. Click here to find out how

- Subscribe to the ii YouTube channel to watch all our latest interviews

It is early days, so we are not getting too carried away. However, the numbers would suggest that it is time to be slightly less focused on the UK and spread our nets a little wider.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.