Three world-class food chains for the price of one

Shares have almost doubled since a mega-merger five years ago and the upward trend is set to continue.

14th August 2019 10:03

by Rodney Hobson from interactive investor

Shares have almost doubled since a mega-merger five years ago and the upward trend is set to continue.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Shares have almost doubled since a mega-merger five years ago and the upward trend is set to continue.

The group name is not as famous as McDonald's (NYSE:MCD) but at least two of the independently-operated three components of Restaurant Brands International (NYSE:QSR) will be more familiar to investors: Burger King, Tim Hortons and Popeyes Louisiana Kitchen.

RBI was formed in 2014 by the merger of two fast food providers, Burger King and Tim Hortons. In reality the American burger chain was the dominant partner in the $12.5 billion deal even though the headquarters was established in Toronto in Hortons' home country Canada.

The combined chain is now the fifth largest operator of fast food restaurants in the world with sales of more than $32 billion in 26,000 restaurants in more than 100 countries.

Burger King was founded in 1954 and is second in size only to McDonald's among burger chains. Famous for "the Whopper", it operates in 17,800 restaurants owned and operated by independent franchisees, many long established and family owned.

Tim Hortons started life 10 years later in a single location in Canada and has not grown as quickly, perhaps because it has tried to appeal to a wider range of tastes rather than settle for a target market.

Its menu includes fresh baked goods, grilled Panini and classic sandwiches, wraps, soups, prepared foods, premium coffee and specialty drinks. It has nearly 5,000 outlets, mainly in Canada but now also in the United States and around the world.

Two years ago the group bought American fast food chain Popeyes Louisiana Kitchen, which was founded in Florida in 1972. It offers a New Orleans style menu featuring mainly chicken but including regional dishes. It has over 3,000 restaurants, mainly in the US.

- A food chain to get your teeth into

- Get exposure to the world's biggest companies via these ii Super 60 recommended funds

RBI's latest figures, for the second quarter of 2019, were better than expected, sending the shares sharply higher on the day they were announced.

Revenue has increased consistently since the group was formed, this time rising 4.2% on the previous second quarter to $1.4 trillion, with all three arms selling more.

Investors should bear in mind, though, that this was mainly down to opening new restaurants. The best performing part of the business was the best known and largest, Burger King, with strong like-for-like sales at existing outlets.

Like Greggs (LSE:GRG) in the UK with its vegan sausage rolls, Burger King has sought to attract non-meat eaters to widen its customer base.

It introduced a plant-based burger in all its 7,200 US outlets this month.

Despite criticism that Burger King had failed to put sufficient resources into its marketing efforts, some outlets ran short of supplies as demand surged.

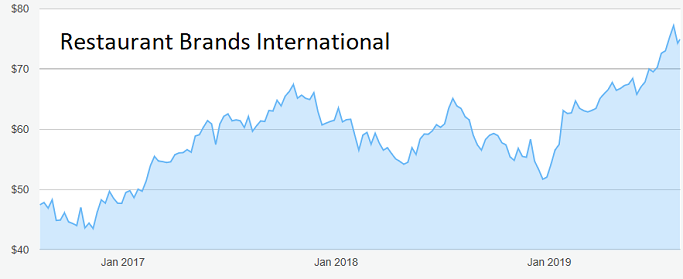

Source: TradingView Past performance is not a guide to future performance

Group debt of $12.3 billion is admittedly substantial but RBI has over $1 billion in cash, more than adequate. A dividend of 50 cents has been declared for the third quarter, reasonably though not generously covered by earnings of 71 cents, which were 7.6% higher than a year ago.

One disadvantage for private investors is that RBI is 51%-owned by Brazilian-American investment company 3G Capital, which owned Burger King at the time of the merger. It does mean that holders of shares that are traded on the New York and Toronto stock exchanges are at the mercy of a single shareholder.

However, 3G has acted in the interests of all shareholders so far, and there is no reason to fear that will come to an end as it focusses on creating value over the long term with the emphasis on maximising the potential of brand names.

Having a majority shareholder has not stopped the shares from more than doubling in value in less than five years. After slipping from an initial $40 to a low of $32 in the first few months they reached a peak of $78 earlier this month. They have eased back in recent days to around $75, presenting a buying opportunity. The yield is 2.6%.

Hobson's choice: Buy below the recent peak of $78. The opportunity may not last long.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.