Three key stats to know ahead of the Budget

We explore the pounds and pence impact of potential changes to fiscal drag, capital gains tax and employer pension contributions.

29th October 2024 13:52

by Myron Jobson from interactive investor

- Fiscal drag: if the deep freeze in tax thresholds is extended from 2028 to 2030, a median earner (£35,000) could end up with a £366 higher tax bill due to fiscal drag, rising to £1,099 for higher-rate taxpayers.

- Capital gains tax (CGT): the CGT burden would double for basic and higher-rate taxpayers if the government aligns CGT rates with income tax. A basic-rate taxpayer and a higher-rate taxpayer could pay £700 and £1,400 more on a £10,000 gain, respectively.

- Less generous workplace pension scheme: someone earning £35,000 would lose out on £700 in pension contributions each year if their employer decides not to raise their pension contributions from 5% to 7%. This could add up to a lost pension wealth of £177,000 over 40 years.

On the eve of the hotly anticipated Autumn Budget, interactive investor has crunched some numbers to explore the possible pounds and pence impact of freezing tax thresholds beyond 2028, increasing capital gains tax rates, and making workplace pension schemes less generous.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

1) Fiscal drag

If the deep freeze in tax thresholds is extended from 2028 to 2030, a median earner (£35K) could end up with a £366 higher tax bill due to fiscal drag, rising to £1,099 for higher-rate taxpayers. This assumes earnings rising by 2% (target inflation) a year compared with if the personal allowance threshold went up by the same percentage.

2024/25 | 2027/28 | 2029/30 | ||

Low earner | Salary | £20,000 | £21,224 | £22,082 |

Tax with frozen thresholds | £2,080 | £2,423 | £2,663 | |

Tax if 23/24 thresholds increased with inflation | £2,080 | £2,208 | £2,297 | |

Additional tax | - | £215 | £366 |

Middle earner | Salary | £35,000 | £37,142 | £38,643 |

Tax with frozen thresholds | £6,280 | £6,880 | £7,300 | |

Tax if 23/24 thresholds increased with inflation | £6,280 | £6,665 | £6,934 | |

Additional tax | - | £215 | £366 |

High earner | Salary | £60,000 | £63,672 | £66,245 |

Tax with frozen thresholds | £14,643 | £16,185 | £17,265 | |

Tax if 23/24 thresholds increased with inflation | £14,643 | £15,539 | £16,167 | |

Additional tax | - | £646 | £1,099 |

Source: interactive investor. Assumes earnings rising by 2% (target inflation) a year compared with if the personal allowance threshold went up by the same percentage.

Myron Jobson, Senior Personal Finance Analyst at interactive investor, says: “We’re facing the highest overall tax burden in a generation thanks to the deep freeze of tax thresholds and allowances. In tandem with wage inflation, this means we’ll be paying more in tax in the years to come. Known as ‘fiscal drag,’ this is the ultimate stealth tax as people might not realize they are paying more simply due to inflation, making it less transparent compared to explicit tax increases.

“Our calculations show that a middle earner could face an additional £366 tax bill a year if the personal allowance remains frozen until the end of the 2029-30 tax year, rising to £1,099 for a high earner.”

2) Capital gains tax

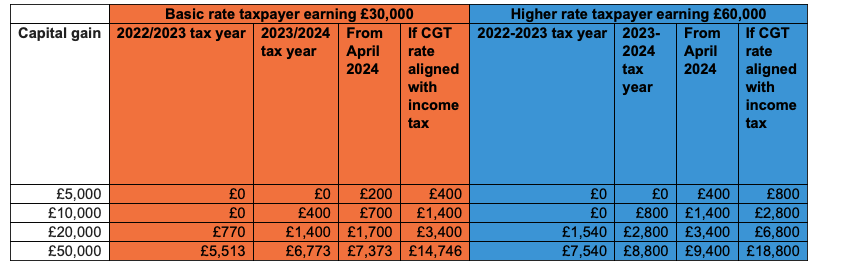

There has been growing speculation that CGT rates might be increased. Currently, higher-rate taxpayers face CGT rates of 20% on most assets and 24% on residential property. Basic-rate taxpayers pay 10% and 18%, respectively.

The government might raise these rates or align them more closely with income tax rates. There is also a rumour that the government would introduce a single rate of CGT.

If aligned with income tax, the CGT rate for basic-rate taxpayers would rise from 10% to 20%, doubling the amount paid in tax above the £3,000 tax-free allowance. This translates to a CGT liability of £400 on capital gains of £5,000 (up from £200 under the current CGT regime); £1,400 on capital gains of £10,000 (up from £700); and £3,400 on capital gains of £20,000 (up from £1,700).

The situation is similar for higher-rate taxpayers, who would also face a heightened tax burden if their CGT rate doubled from 20% to 40%. The CGT liability would double from £400 to £800 on capital gains of £5,000. On gains of £10,000, £20,000, and £50,000, the CGT liability would increase to £2,800, £6,800, and £18,800, respectively.

These potential increases could be even more painful for basic-rate taxpayers with larger gains, who could be pushed into a higher tax bracket. If CGT rates increase to 20% and 40%, a basic-rate taxpayer earning £30,000 could end up paying £14,746 in tax on a £50,000 gain, of which over £10,000 is higher-rate tax.

Source: interactive investor. The figures take into account the annual £3,000 CGT tax exemption, assuming a basic-rate taxpayer earns £30,000 and a higher-rate taxpayer earns £60,000.

Myron Jobson says: “Reading between the lines of what both the prime minister and the chancellor have publicly stated, increasing CGT rates seems the likely course of action in the upcoming Budget. Our calculations show that CGT liability for investors across the income spectrum could double, at best, if CGT rates are aligned with income tax.

“Fears of a less generous investment taxation regime have provided extra impetus for investors to do what they should already be doing: making the most of the tax-efficient ISA wrapper, which shields gains and income generated from investments from tax.”

3) Less generous workplace pension scheme

While speculation about the introduction of a national insurance charge on employer pension contributions has been quelled, there have been rumours that the chancellor could raise the employers’ rate of national insurance on a worker’s earnings and cut the threshold at which employers start paying the tax.

In addition, the chancellor is expected to announce a 6% rise in the national minimum wage in 2025, which would also put pressure on employers’ bottom lines.

interactive investor calculates that if an employer opts not to raise their pension contributions from 5% to 7% to absorb heightened cost pressures, someone earning £35,000 would lose out on £700 in pension contributions each year. This could add up to a lost pension wealth of £177,000 over 40 years, assuming a 5% investment growth and contributions rising by 2% (target inflation rate) each year.

5% | 7% | Additional contributions | |

Monthly employer contributions | 146 | 204 | £58 |

Yearly contributions | 1,750 | 2,450 | £700 |

Potential pension after 40 years | 286,703 | 403,298 | £116,595 |

Source interactive investor.

Myron Jobson says: “For most workers, the retirement nest egg they accrue as employees, which is topped up by employer contributions, is likely to form the bulk of their income at retirement. As such, a decision by an employer to forgo stepping up contributions above the legal requirement to offset heightened cost and tax burdens could have a profound impact on an employee’s retirement outcome.

“Even a modest increase in contributions could lead to substantial gains over the long term, which would be turbocharged by the magic of compounding. Over the years, the additional contributions could bridge the gap between a modest and comfortable retirement.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.