Three investment trust discounts that caught my eye

8th February 2018 11:12

by David Liddell from interactive investor

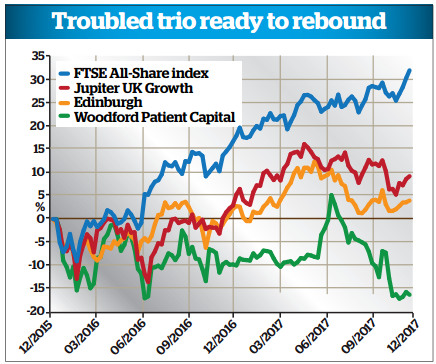

The UK stockmarket ended 2017 brightly, but it still lags most other developed stockmarkets. The has gained 36.5% over the past five years to the end of 2017, compared with 119% and 87.5% for Japan's Nikkei and the US's S&P 500 indices respectively. It has also lagged the MSCI Europe ex-UK index, which is up 57%.

Some of this underperformance reflects the fact that the UK market is heavily weighted to oil and gas, and other commodities. But the UK's specific economic prospects must be a factor.

At any rate, with global stockmarkets bubbling along very well, the UK market may be an area of relative value. It certainly promises to deliver one of the best dividend yields – which currently stands at 3.8% – provided and don't cut their payouts, as both are major contributors to the UK's annual dividends total.

Better bet

For investors searching for an out-of-favour investment trust investing in the UK, is surely a standout choice. In 2017, the trust suffered the same much-publicised woes as the , both being run by Invesco Perpetual's head of UK equities, Mark Barnett.

These troubles were especially striking because Neil Woodford, the high-profile previous manager of both of these funds, suffered in a similar fashion. They were chiefly caused by a spectacular fall in the price of shares in , the doorstep lender, by 68.5% over 2017. Edinburgh underperformed the FTSE All-Share by about 4% in 2017 in net asset value terms, and the discount moved from 2.2 to 9.1%.

For investors looking for a less economically sensitive portfolio with a decent yield, Edinburgh is surely an attractive prospect. In the trust's latest half-year report, published on 23 November, the board increased the first interim dividend from 5.4 to 5.8p – as part of a rebalancing exercise between interims and final – but it said it would at least maintain the final dividend. This implies a total dividend for the year of 26.55p, giving a forward yield of 3.8%.

For those who would like to dive more deeply into the potentially icy waters of the Brexit economy, there is . This is a small trust with a market capitalisation of around £60 million, but it sits alongside the £1.4 billion open ended fund of the same name. Both are managed by the experienced Steve Davies.

The open-ended fund underperformed spectacularly in 2016 and more marginally in 2017. Davies takes a "concentrated, contrarian and unconstrained approach", so the trust is likely to be more volatile than the average trust. But it offers something different from most other investment trusts: a combination of exposure to beaten-up UK domestic stocks and a basket of growth stocks driven by long-term themes.

Although it is not an income trust, the dividend yield from the existing portfolio should be pretty decent. A current discount of 3% is not that generous, but there seems to be an active discount control mechanism in place in terms of the number of share buybacks being done. This trust is definitely not for the faint-hearted, but contrarian investing rarely is.

Ready for anything

And now for something completely different. In a world full of geopolitical 'known unknowns' and 'unknown unknowns', we favour some assets that can perform well almost regardless of the economic and political background. Into this category, to an extent, falls .

This trust, launched at 100p in a blaze of publicity in May 2015, initially shot to an unjustified premium. But a series of casualties among the early-stage companies it invests in reversed its fortunes. The current share price of 83p means it is trading on an 8% discount to its net asset value. Although it could be argued that this is still too low for a trust investing largely in unquoted investments, it will only take a few of these to shine for value to show through.

Being nearly three years into the trust's life, one would expect to see some successes over the next couple of years, but the word 'patient' forms part of the trust's name for a reason.

Our major concerns about this trust are its hefty holdings in biotechnology company Prothena and the still unprofitable , an online-only estate agency. However, Woodford is surely due a better year in 2018.

David Liddell if a former finance director and investment manager, and is the founder of IpsoFacto Investor.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.