Three great tech stocks, but which one to buy?

1st September 2021 09:16

by Rodney Hobson from interactive investor

At least two of this trio are household names, and all three have surged in value. Our overseas investing expert gives his view on prospects for each.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Few scenarios are more frustrating for any business than finding that supply constraints are thwarting production just as demand for the end products is taking off. That has been the situation for computer manufacturers so far this year and latest updates suggest that life is not about to get any easier. Although the largest companies are able to use their market muscle to get priority access to whatever supplies are available, they expect shortages to continue.

- Invest with ii: Most-traded US Stocks| Share Tips & Ideas | Cashback Offers

Sales of personal computers have soared during the pandemic and though the need to work or do schoolwork from home is easing along with the dropping of lockdowns, the sector is still reporting strong growth.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

- Read all of Rodney's articles by clicking here

Dell Technologies (NYSE:DELL) reported second-quarter sales to 30 July up 15% on a year earlier at $26.1 billion, while earnings per share gained 17% on an adjusted basis to $2.24. Both figures comfortably beat expectations.

Source: interactive investor. Past performance is not a guide to future performance

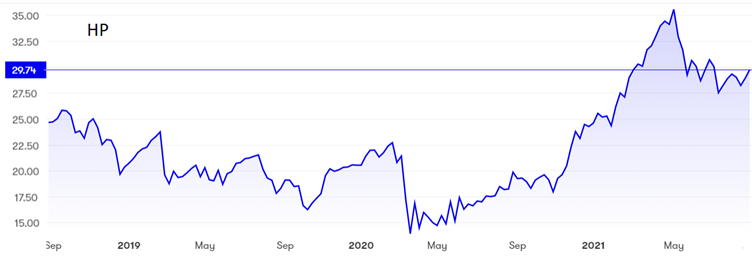

HP’s (NYSE:HPQ) total revenue in the same three months rose 7% to $15.3 billion, a little short of expectations, although net income of $1.1 billion, equal to 92 cents a share, was well ahead of forecasts. HP, established when Hewlett-Packard split in half in 2015, is a leading provider of computers, printers, and printer supplies.

Chip shortages will continue, probably for best part of the next 12 months. Dell pointed in particular to microcontrollers, power management chips and display drivers as being hard to source. However, the impact on both companies will be offset by price rises that desperate consumers are willing to accept, so margins and earnings are likely to hold up well in the current quarter.

Of the two, Dell should do better, with revenue growing by at least 15% compared with August-October last year. Dell is also tidying up its sprawling operations, which include servers and storage products as well as PCs, monitors, computer peripherals and hardware and software for cloud computing. It will spin off two subsidiaries, VMware and Boomi, by the end of this year, leaving management better focused.

- Anthony Scaramucci: The ii Family Money Show

- Stockwatch: look no further than this amazing tech giant

- Check out our award-winning stocks and shares ISA

HP profits could ease a little from the latest quarter, although investors should bear in mind that it could surprise on the upside again. As HP chief executive officer Enrique Lores put it: “We could have grown more if it wasn’t for the shortages of components.”

Dell shares edged above $100 in April for the first time but are off their best. The future looks a little brighter than at HP but there is no dividend. HP topped $35 in May but has since slipped back to just below $30, where the price/earnings (PE) ratio is in single figures, an unnecessarily cautious rating, and the yield is 2.55%.

Source: interactive investor. Past performance is not a guide to future performance

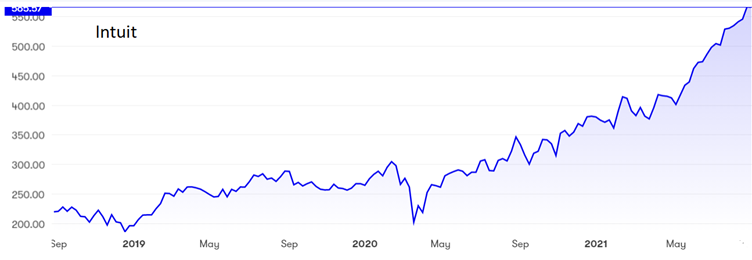

Elsewhere among technology stocks, financial software provider Intuit (NASDAQ:INTU) reported net income 15% lower at $380 million in the May-July quarter, mainly because of a doubling of selling and marketing costs.

The 62% rise in total costs more than offset a 41% increase in revenue aided by the acquisition last December of credit score monitoring service Credit Karma, which recorded its best revenue figures under the new ownership.

Intuit is in a strong position in its main businesses of accounting software for small businesses, accountants and individuals filling in their own tax returns. Indeed, the company remained upbeat despite the blow to profits, claiming that its financial year to 31 July had been outstanding.

Chief executive Sasan Goodarzi claimed that momentum is continuing across the company, with revenue growth expected to be around 36-38% in the current quarter and about 15-16% for the full financial year. However, earnings per share are expected to show little or no improvement.

Despite the mixed messages, Intuit shares remain around their all-time peak at $565. The yield is only 0.4% and the PE ratio is an extremely demanding 75, so an awful burden of hope is factored in.

Source: interactive investor. Past performance is not a guide to future performance

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.