The three energy funds back to their winning ways

Saltydog Investor shows that the push to clean energy is not currently damaging returns from fossil fuel investments.

13th May 2024 13:25

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

With all the talk of net zero, the increase in wind, solar and other green energy sources, the renewed interest in nuclear power, and the growing number of electric vehicles on the road, you may have thought that the funds investing in the large fossil fuel companies might be struggling.

Our latest analysis would suggest the opposite.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

We have just run our latest 6x6 report. This is where we go back over the last three years in search of funds which have gone up by 5% or more in each of the last six six-month periods.

It is a tough challenge, and this time we did not find any. However, there were four funds that had hit the target five out of six times. Three of them invest in companies from the energy sector.

- Europe’s answer to the Magnificent Seven – at cheaper prices

- The tech funds with low volatility and top returns

Here is a table showing how the three energy funds have performed in each of the six-month periods.

| Saltydog Investor 6x6 Report - May 2024 | May 21 | Nov 21 | May 22 | Nov 22 | May 23 | Nov 23 |

| to | to | to | to | to | to | |

| Oct 21 | Apr 22 | Oct 22 | Apr 23 | Oct 23 | Apr 24 | |

| Funds that have risen by 5% or more in 5 out of 6 periods | ||||||

| WS Guinness Global Energy | 24.2% | 28.1% | 17.2% | -8.9% | 9.5% | 10.8% |

| BGF World Energy | 22.4% | 39.7% | 19.2% | -11.4% | 9.0% | 8.0% |

| Schroder ISF Global Energy | 25.0% | 34.1% | 9.5% | -6.1% | 15.9% | 8.0% |

Source: Morningstar. Past performance is not a guide to future performance.

You can see that they all fell between the beginning of November 2022 and the end of April 2023, but have subsequently recovered.

Although their long-term performance is impressive, these funds can be volatile on a month-by-month basis.

Past performance is not a guide to future performance.

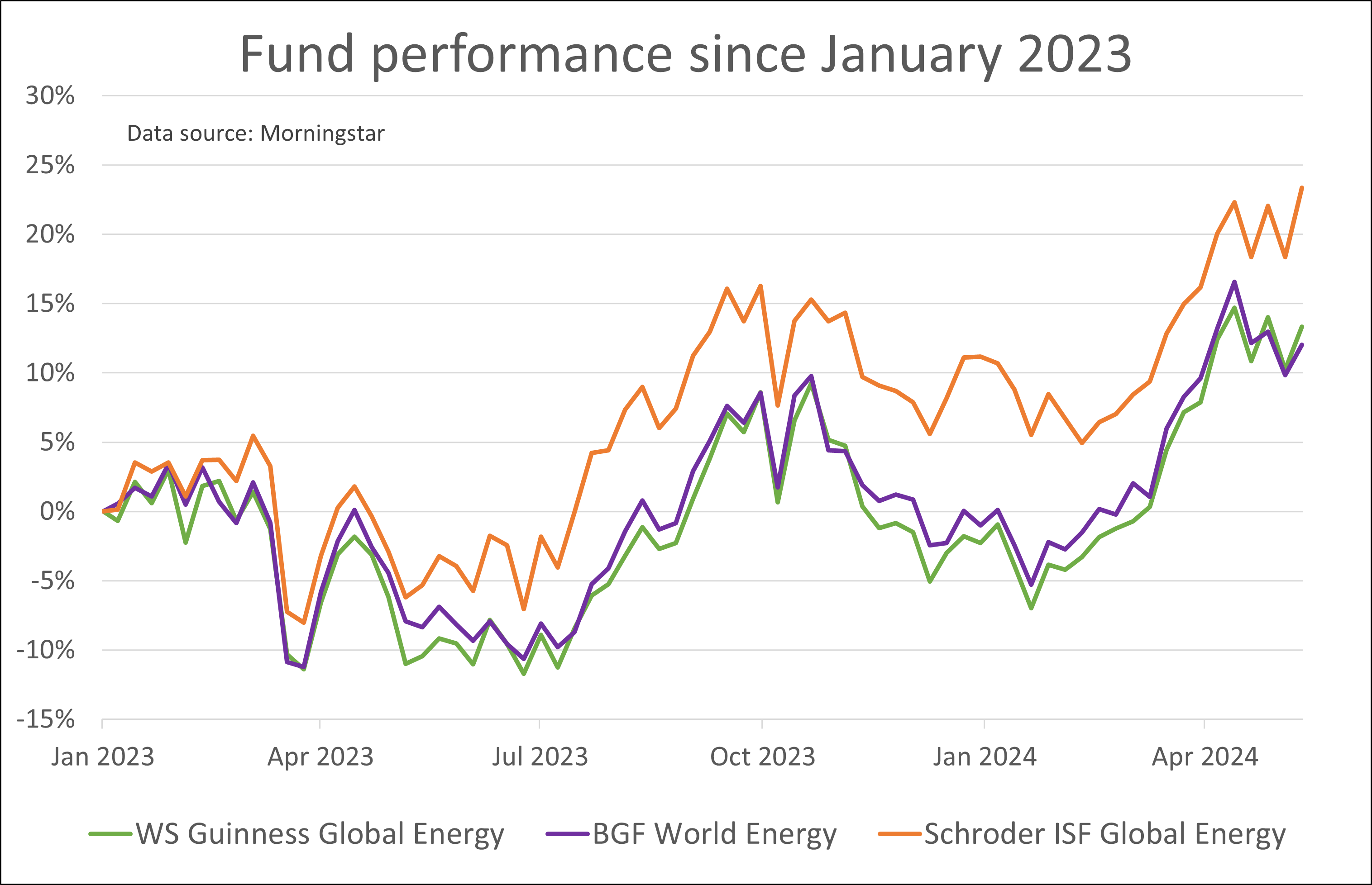

Looking at the graph showing their performance since the beginning of last year, you can see that they all fell sharply in March 2023. You may recall the sudden collapse of Silicon Valley Bank and Signature Bank in the US, fuelling concerns that it could be the start of another banking crisis. That, along with central banks increasing interest rates to curb inflation, raised fears of an economic slowdown and global recession.

The energy funds bounced back in April, as the oil price was boosted by production cuts by the OPEC+ countries, but then fell again in May amid ongoing economic concerns.

From the beginning of July to the end of September, the three funds all picked up before dropping off in the final quarter of 2023. Over the course of the year, the Schroder ISF Global Energy C Dis GBP AV (B2QM296) fund had gained 11.2%, but the BGF World Energy D4 GBP (B3Y9G49) fund had fallen by 1%, and the WS Guinness Global Energy I Acc (B56FW07) fund was down 2.3%.

However, since then they have rallied and gone on to reach new 12-month highs. So far this year, the Schroder ISF Global Energy fund risen 11%, the BGF World Energy fund has risen by 13.2%, and the WS Guinness Global Energy fund has gone up by 16%.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Why fund managers have turned even more bullish

The performance of these funds tends to be closely correlated with the price of oil and gas. They invest in companies such as BP (LSE:BP.), Shell (LSE:SHEL), TotalEnergies SE (EURONEXT:TTE), ConocoPhillips (NYSE:COP) and Exxon Mobil Corp (NYSE:XOM).

The price of oil has gone up in 2024, primarily due to a tighter global supply-demand balance and heightened geopolitical risks.

OPEC and its allies have maintained significant crude oil production cuts, limiting global supply. Even though they are not as powerful as they used to be, the OPEC+ countries still account for around half the world’s oil production. At the same time, demand has been increasing, especially in countries like China and India. Then, there are concerns over potential supply disruptions due to the wars in Ukraine and Gaza.

Although I would not be surprised to see similar levels of volatility in these funds over the next few months, the underlying reasons supporting the recent price rise seem unlikely to change.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.