Three charts that make the case for UK equities

Out-of-favour UK shares could be due a comeback, and a trio of charts make a data-led case for investing in the UK.

30th July 2024 09:21

by Sam Benstead from interactive investor

British shares are unloved, which has been the case for a long time. Data from the Investment Association (IA), the trade body for the funds industry, shows that £13.6 billion was withdrawn from UK equity funds in 2023, and £12 billion was withdrawn in 2022. Outflows have continued this year.

Returns have been disappointing versus other markets, with the FTSE All-Share index, including reinvested dividends, returning 77% over the past decade, compared with 308% for America’s S&P 500 index.

- Invest with ii: Top Investment Funds| Index Tracker Funds | What is a Managed ISA?

UK shares are now only about 4% of the MSCI World Index due to their diminishing value compared with American names.

But that’s not to say there isn’t a strong investment case for UK shares. In fact, some data shows that based on valuations, corporate activity and the economic environment, UK shares could be due a comeback.

These three charts, from leading fund managers, make the data-led case for investing in the UK.

Rate cuts coming soon

Stock market prices are influenced by the economy and the interest rates set by central banks. Lower and falling interest rates stimulate economic activity and also generally lead to higher valuations on stocks, as returns from safer assets such as cash and bonds drop.

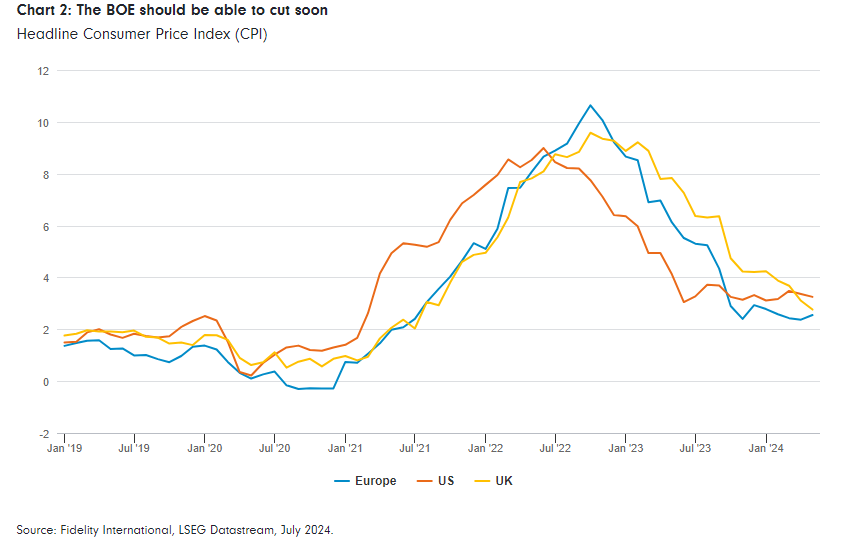

Inflation is one of the key things that the Bank of England watches when it sets interest rates. UK inflation, as measured by the Consumer Price Index (CPI), hit a peak of 11.1% in October 2022, as commodity prices rose and economic activity rebounded following the pandemic lockdowns. This triggered a steep rise in interest rates, from 0.1% to 5.25% today.

- Record monthly outflow from UK equity funds

- Fund managers give their take on what Labour's win means for markets

But now inflation is back at the 2% target, which means when interest rates change, the next move will be down rather than up.

Chris Forgan, a portfolio manager at Fidelity International, says that the inflation picture is looking more positive.

Forgan says: “UK inflation was stickier and appeared more difficult to get under control than many other regions for much of last year, but it has fallen consistently this year. Services inflation is still higher than the Bank of England would like, but we believe it has a dovish bias and that it will begin its rate-cutting cycle before long. We believe this should further stimulate economic activity.”

Some sectors that should behave positively to lower interest rates are property, such as real estate investment trusts and housebuilding shares, and high-growth businesses areas, because their cost of capital will fall.

Buybacks and dividends

Companies can return profits to investors in two key ways: paying dividends and buying back their own shares. The latter increases the share price and reduces the share count, meaning that dividends per share increases.

Dividends are the most common way of rewarding shareholders, but buybacks are becoming more popular as finance bosses look to take advantage of low share prices.

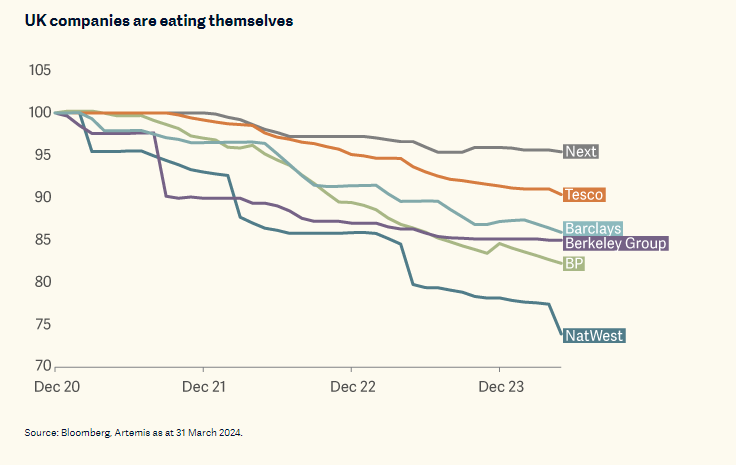

Andy Marsh, co-manager of Artemis Income fund, notes that there is an ongoing trend to buy back more shares, using cash flow and not debt to do so.

He said: “This is a trend we see across the UK market. The likes of Shell and NatWest, which have bought back 17% and 26% of their respective share counts since the beginning of 2021, are gobbling up their own shares and 60% of our portfolio by value have bought back shares in the past year.”

Marsh notes that when companies buy back shares on very cheap valuations, this can create “outsized” returns.

- Top UK funds and shares the pros are backing as the market rebounds

- Top 10 most-bought investment funds in June 2024

“If a share is trading at a single digit price-to-earnings multiple, a company can eat into its share count very quickly and drive up cash flow and dividends per share as a result,” Marsh said.

One company he highlights, which is in his portfolio, is Tesco. “Last year we increased our ownership of Tesco by 5% without lifting a finger, just because of share buybacks,” he said.

The following chart shows how some of Artemis’ positions have reduced their share count over the past four years.

It is not just UK companies that are buying back their own shares, but overseas firms are also taking advantage of cheap valuations to buy UK firms or take them private.

Key deals include a bid for Anglo American by Australian miner BHP, while Currys and Direct Line rejected offers because their boards said they were too low.

- DIY Investor Diary: why I’m ‘all in’ on this volatile gilt

- Alliance Trust combining with Witan to form FTSE 100 company

UK shares are cheap

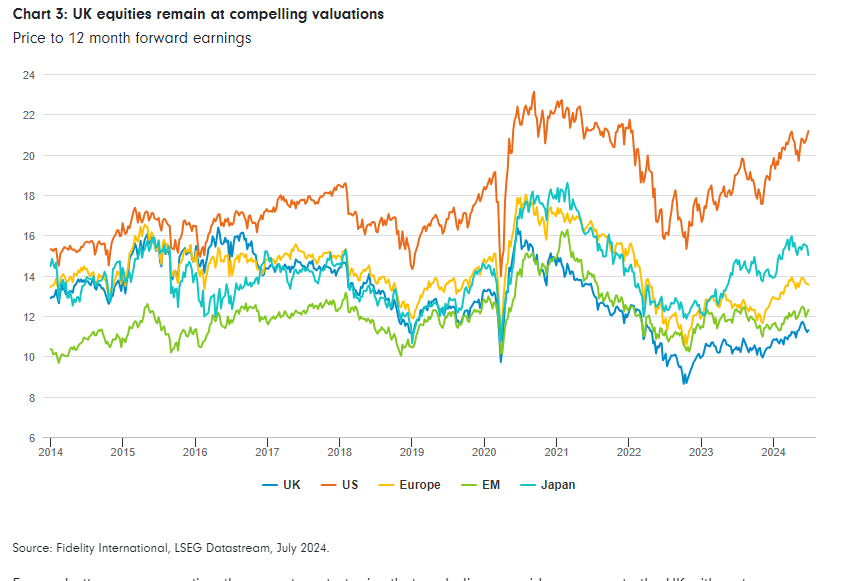

Underpinning the opportunity in UK shares is the view that they are undeservingly cheap compared with international peers.

Forgan says valuations are “compelling”, with the UK market trading at around 11 times earnings, versus nearly 21 times for American companies and 15 times for Japanese shares. Europe has a price-to-earnings ratio of 13.5 times.

Investment manager Ruffer is bullish on UK equities for this reason, and has 11% of the Ruffer Investment Company in UK shares, which is about half its equity allocation.

Ruffer says that there are a couple of catalysts for a UK market rebound today, even though the market has been cheap for a long time.

It said: “We might be running out of sellers, outflows have been relentless for almost the entire period since Brexit. Pension funds and wealth managers have now mostly completed their removal of ‘home bias’ and have record low levels of exposure.”

This means that new buyers are emerging, it argues. “In the first six months of 2024, 32 deals were announced with a value of more than £100 million, adding up to a value of £34 billion. The bid premium is averaging 30% and the quantum is a threefold increase since last year. Within the portfolio we received bids for Hipgnosis Songs Fund and Trident Royalties – more would not surprise us.”

- Top UK funds and shares the pros are backing as the market rebounds

- Bond Watch: Labour landslide calms bond markets

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Another reason to be optimistic is that a new government could deliver stability for the economy.

Ruffer says: “After a disastrous decade or so under the Conservative Party, a new government brings at least the chance of change.”

The investment firm argues that the political uncertainty linked to so many elections across the globe this year makes the UK look relatively benign, and in addition the consumer is feeling confident having weathered Covid and the cost-of-living crisis.

Ruffer Investment Company is one a small number of wealth preservation trusts that prioritise protecting investor capital. Its main rivals are Capital Gearing and Personal Assets Trust.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.