Three bank stocks to buy and one to get rid of

A trio of heavyweight lenders have caught the eye of overseas investing expert Rodney Hobson, who thinks selling of shares since the summer has been overdone. These are the companies he’d own right now.

18th October 2023 09:06

by Rodney Hobson from interactive investor

Rising interest rates are propelling earnings at American banks. If mergers and acquisitions pick up on major stock exchanges, then advisory fees will be the icing on the cake. It is fair to argue that every investment portfolio should include at least one bank’s shares.

So far, labour markets in the US have held up well and inflation, although remaining stubbornly higher than the Federal Reserve Bank would like, has at least come back from recent peaks. Consumers and businesses remain generally optimistic.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Some observers claim there is evidence of consumers starting to curb their spending, with those living partly off their savings forced to cut back first. If this is true, it has not yet shown through in retail sales figures, with the latest set coming in well above expectations.

The main concern will be whether the level of bad debts will increase as borrowers find they cannot or will not meet higher interest rates. That does not seem to be happening yet but there is inevitably a time lag between interest rate rises and defaults.

JPMorgan Chase & Co (NYSE:JPM) can usually be relied on to get the quarterly reporting season off to a solid start and this time was no exception, with net income easily beating analysts’ expectations at $13.15 billion, up 15% year-on-year. Despite some uncertainty over how far US interest rates still have to rise, the good news will continue for the rest of this year and beyond. See Keith Bowman’s expert analysis ii view: JP Morgan profits beat but CEO offers bleak outlook .

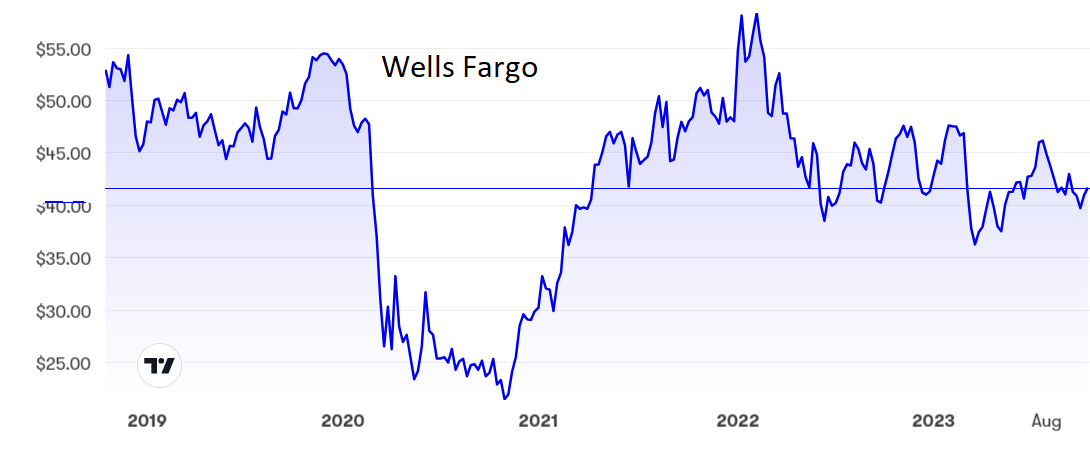

Wells Fargo & Co (NYSE:WFC) also did better than expected, with revenue up 6.5% at $20.9 billion and net income leaping 58% to $5.7 billion. This was a particularly good outcome for a bank that has put adverse legacy issues behind it. Not only was net income higher, as one would expect, but the hefty improvement was reflected across the business.

Source: interactive investor. Past performance is not a guide to future performance.

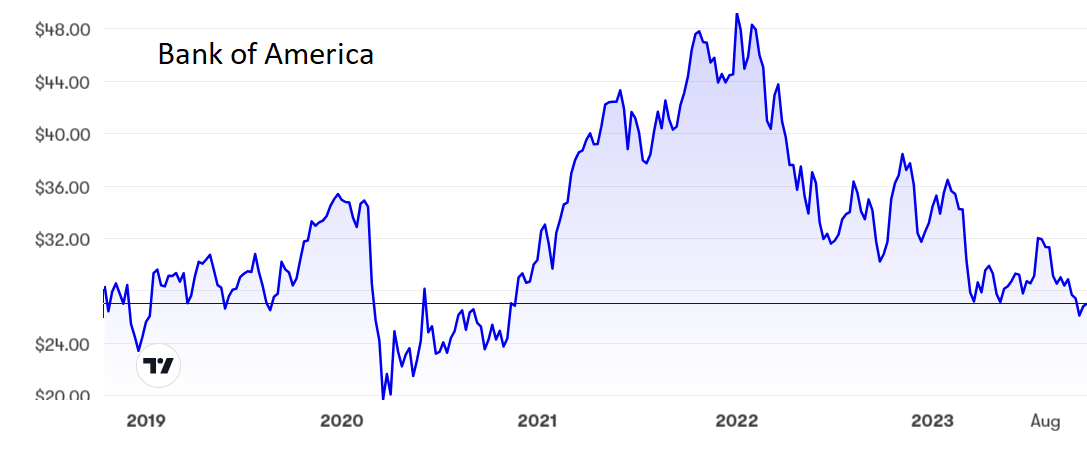

Bank of America Corp (NYSE:BAC) joined in the fun, reporting net income up 10% to $7.8 billion thanks mainly to higher interest rates. Revenue, however, was only 2.7% higher at $25.2 billion.

Source: interactive investor. Past performance is not a guide to future performance.

Although its figures were well received by the markets, Citigroup Inc (NYSE:C) proved a little disappointing by comparison, with a mere 2% rise in net income to $3.5 billion despite a 9% rise in revenue to $20.1 billion.

For analysis see: ii view: Citigroup flags revenue beat as it executes restructuring plan

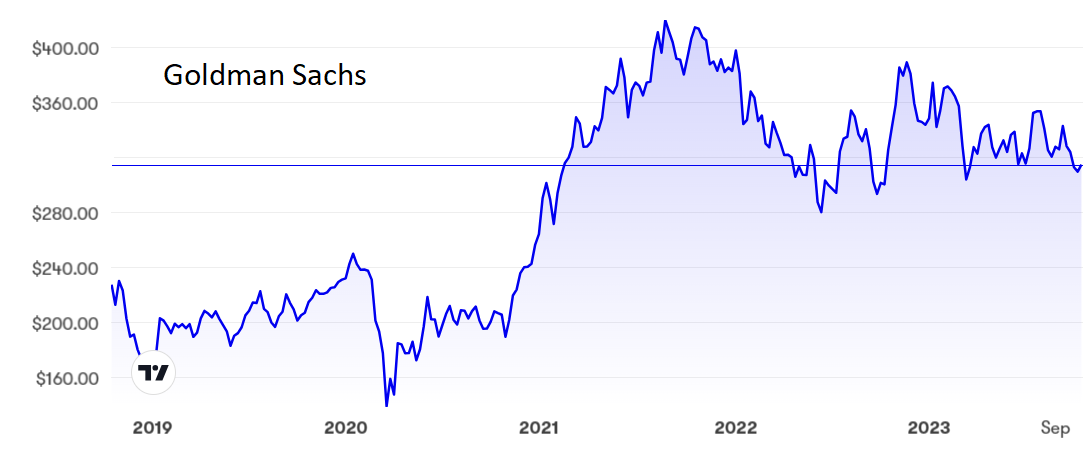

The real booby prize went to The Goldman Sachs Group Inc (NYSE:GS), where third-quarter revenue slipped 1.3% to $11.8 billion and net income slumped by a third to just over $2 billion. As it is primarily an investment bank, Goldman stood to gain less than rivals from interest rate rises but even so, it was worrying to see a 24% decline in net interest income.

Source: interactive investor. Past performance is not a guide to future performance.

JPMorgan shares have come off a recent peak of $157 to stand just below $150, where the price/earnings (PE) ratio is an undemanding 9.5 and the yield 2.7%. They topped $170 two years ago. Wells Fargo at $42 is also off its recent peak of $46 and well down from a two-year high of $58. The PE is slightly higher than for some rivals at 10.5, with a yield of 3%. Bank of America shares were $49 at the start of last year, but now seem to be stabilising around $27 after a long slide that looks to have been overdone. The PE is now only 7.8 and the yield 3.3%.

Citigroup has been on a serious downward trajectory since June 2021, losing nearly half its value to $41. That has pushed the PE down to only 6.5 and the yield up to 5%. At just under $310, Goldman shares are down by just over a quarter from their August 2021 peak, leaving the PE at a more challenging 13.4. The yield of 3.3% is the lowest of the bunch.

Hobson’s choice: For JPMorgan, Wells Fargo and Bank of America, the pullback in share prices has been overdone and these three merit a buy. Citigroup has rightly been punished more but is now at a level where the advice is to hold. Goldman’s higher PE and lower yield is quite unjustifiable, and shareholders should consider selling. There is far better value elsewhere in the sector.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.