Third time lucky predicting future of this brilliant company

This company has almost doubled in value since March to become one of the 10 largest American corporations. Overseas investing expert Rodney Hobson give his verdict on the stock.

13th September 2023 08:48

by Rodney Hobson from interactive investor

Shares in drugs company Eli Lilly and Co (NYSE:LLY) continue to defy gravity and the rating has now reached ludicrous levels. The question for investors is whether this ambitious and well-run company can continue to power ahead or whether the share price has run too far ahead of events. It is a tough call.

Revenue and profits were higher in the second quarter than a year earlier and there has been further encouraging news about the drugs pipeline, which has been strengthened by further acquisitions.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

At $8.3 billion, revenue in the April-June quarter was 28% higher while net income soared a remarkable 85% to $1.76 billion. Earnings per share at $1.95 easily covered the increased quarterly dividend of $1.13, leaving plenty of cash to plough back into the business.

This was a distinct improvement on the first quarter of 2023, when revenue slipped 11% year on year to just under $7 billion, mainly because of a fall in sales of Covid-19 antibodies compared with early 2022, and net income was down 29% at $1.34 billion.

After both quarters, Lilly raised its revenue guidance for the full year. While this is partly due to the sale of rights for some drugs, there is also an element of strong underlying business performance in the recalculation. Earnings per share are now expected to easily top $9 compared with $6.90 last year. This implies further significant improvements in the next two quarters.

Pharmaceuticals is an expensive business, with heavy expenditure on developing new drugs that may or may not be the next blockbuster. Most fail along the way, often at a late stage of development. Spending on research and development increased 23% to almost $2 billion in the latest quarter while the cost of launching new products also rose considerably.

Nonetheless, it is highly encouraging that Lilly hopes to launch several new products before this year is out. Breakthroughs in treatments for Alzheimer’s disease, for type 2 diabetes and for obesity have been recorded.

- How not to get left in the dust in the EV boom

- Arm Holdings reveals how much its shares might cost in $52bn IPO

With obesity threatening to become a pandemic in the United States and, perhaps to a lesser extent, the UK, news of a treatment that reduced weight by 15% after 36 weeks with generally only mild gastrointestinal side effects is particularly welcome. Lilly’s existing diabetes drug, Mounjaro, is currently leading the way among the group’s portfolio with significantly higher sales.

The group has also been busy with acquisitions, most recently Sigilon Therapeutics, a biotech company based in Massachusetts that could help to develop a treatment for type 1 diabetes. Earlier this year Lilly bought Versanis Bio, which specialises in researching new drugs for heart problems.

Source: interactive investor. Past performance is not a guide to future performance.

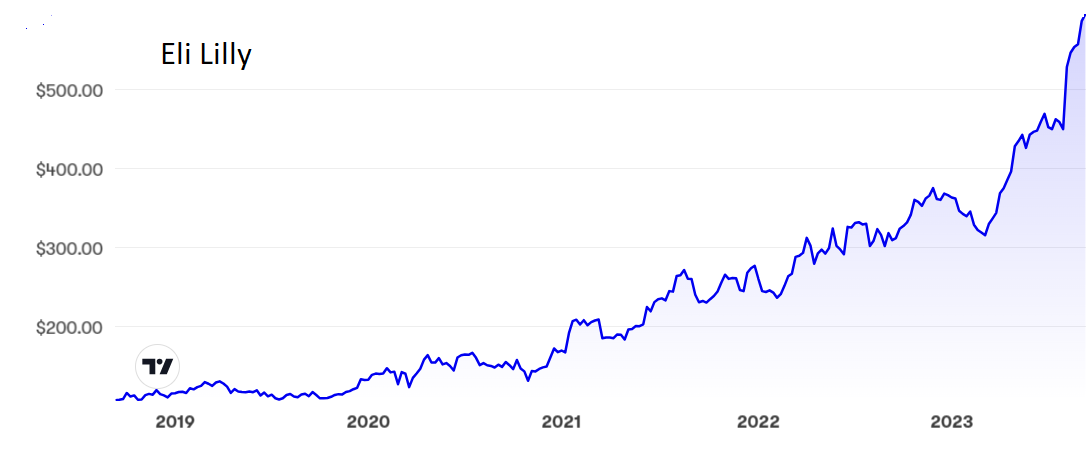

The share price was only $110 just four years ago. Now it is more than five times that level at around $600, where the price/earnings ratio is a massive 83 while the yield is only 0.73%. At this price the market is counting on a meteoric rise in earnings.

Hobson’s choice: There is no disputing that Eli Lilly is a terrific company with a great future, but I have long thought that the share price had run too far ahead of current circumstances. How wrong can you be? I recommended taking profits in February and December last year and can only say that I hope investors ignored my advice and stayed in.

At the risk of being badly wrong for a third time, I bravely suggest that this really is the time to take profits with the hope of buying back in at a lower level. The fundamentals suggest that the shares should be half their current level but that is certainly not going to happen. A correction to around $450, where there was support in July, is a more realistic possibility.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.