Think you want a final salary pension transfer? Think twice

Pension transfers can release eye-popping sums of money, but the cash comes with many caveats, warns Cer…

11th June 2020 09:28

by Ceri Jones from interactive investor

Pension transfers can release eye-popping sums of money, but the cash comes with many caveats, warns Ceri Jones.

As Money Observer readers will know, most people would be unwise to leave a defined benefit (DB) or final salary pension scheme that provides a guaranteed pension, as all the pension risk is taken by the scheme. Most recently, the Covid-19 pandemic has raised concerns around people making panicky or knee-jerk decisions to cash in their DB pensions.

Under new guidance issued by the Pensions Regulator at the end of April, anyone looking to transfer out of a DB scheme will receive a letter from the scheme trustees, warning that moving during the crisis is unlikely to be in their best long-term interests.

Yet in certain circumstances, the loss of a DB scheme’s guaranteed benefits may be justified: if you have an impaired life expectancy, for example, or are sufficiently wealthy that you are in a position to use the transferred cash for purposes other than covering living expenses, such as to set up a business.

- Discover how to: Open a SIPP | Best SIPP Investments | SIPP Withdrawal Rules

The sums of money on offer for people leaving a DB pension scheme can be very enticing: they often amount to 30-35 times the value of the annual DB pension expected at age 60. That’s £1.05 million if your pension is expected to be £30,000 a year. High transfer sums are being quoted because transfers are priced in line with UK gilt yields, which slipped as low as 0.23% in April, having already fallen to historically low levels in the wake of the Brexit vote and the pandemic.

- What does coronavirus mean for your retirement plans?

- Why a ‘partial’ final salary pension transfer could be the right fit

Life-changing decision

If you want to see what you might get by transferring out of a DB scheme, key your data into Tideway’s final salary transfer calculator. If you have been promised an annual pension of £30,000 at age 60, for example, you could be offered a transfer value of between £780,000 and £1.14 million. These are life-changing sums.

For people considering this route, there is a decreasing window of opportunity to get a transfer done, as events are conspiring to hinder all but the largest transactions. First, get advice from an independent financial adviser, as this is compulsory for any transfer of more than £30,000. Note that advisers have been deterred from offering advice by the threat of litigation and the rising cost of professional indemnity insurance. More than 30 firms quit the market in the last quarter of 2019, according to the adviser trade body, the Personal Finance Society (PFS).

Bear in mind too that customer complaints made to the Financial Ombudsman Service relating to DB transfers shot up by 44% to 798 in 2018/19, compared with 2017/18. Just 39% of cases were upheld in favour of the customer.

The Financial Conduct Authority is clamping down on poor advice. It has banned 24 firms from doing transfer business, and it will introduce much more demanding qualifications for pension transfer specialists next year.

Advice fees will also be a problem, as the FCA has banned ‘contingency charging’ for DB transfers (whereby advisers are paid only if the client makes the transfer), which would leave investors no choice but to pay upfront for advice.

Many advisers have been charging 4-5% of the transfer value, which equates to £17,615 for the average transfer of £352,303, a charge most investors would not stomach upfront. A new form of low-cost, ‘abridged’ advice is planned that will cost around 1% of the transfer value. However, advisers accustomed to bigger rewards may exit the market.

What’s more, people looking to transfer will have to wait longer to receive an offer from their employer, as The Pensions Regulator is allowing pension trustees to delay transfers by three months in the wake of the Covid-19 epidemic’s impact on the financial markets and funding levels.

All considered, if you want a DB transfer, you had better get cracking. Around 1,300 advisers are still signed up to the PFS’s pension transfer gold standard on the management of DB transfers (see the end of this article).

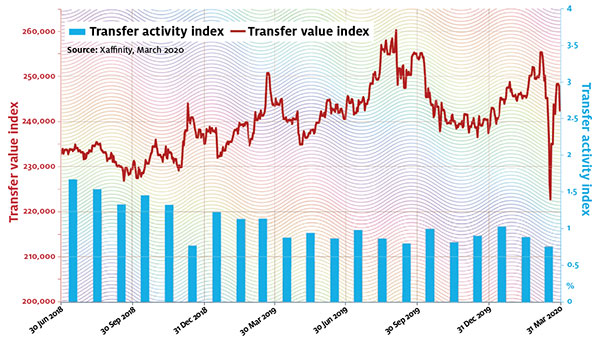

DB pension transfer activity

Notes: Red line (left axis) charts the transfer value per £10,000 of a defined benefit pension,with typical inflation increases, for a 64-year-old scheme member. The bars on the chart represent the annualised proportion of members that transfer out of pension schemes administered by XPS, as a proxy for general transfer activity.

All right for some

Of course, more often than not, an adviser’s recommendation will be that a DB pension transfer is not appropriate, because the DB guarantees, inflation-linked increases and dependants’ pensions that come with it are all so valuable. You may have to persuade an adviser that you have a good reason for wanting a transfer – that, for example, one partner in a relationship has an adequate final salary pension and the couple want the freedom to dip into the other partner’s pension savings.

For people who have built up large pension pots, especially if they are close to retirement, the obvious destination is a flexible Sipp such as those run by interactive investor. These suit DIY investors requiring access to a wide range of investments, including shares, funds and investment trusts. Interactive investor charges a flat Sipp fee of £10 a month (waived until April 2021) plus a £9.99 service plan fee that covers all accounts.

People with smaller transfer values might look at traditional insurers such as Prudential or Royal London, which offer low-cost solutions, if fewer investment choices.

Wealth management companies with an adviser arm – St James’ Place (SJP) or Old Mutual Wealth, part of Quilter, for example – typically charge heavily. SJP takes 4.5% for initial advice, followed by an annual 0.5% for advice, plus an initial product charge of 1.5% and the usual fund charges.

Mid-career transfers

Pension transfers are also possible when you move job. There are several attractions to such transfers, such as lower charges, better oversight of the investment strategy and greater flexibility. What’s more, you could otherwise find you have several pensions to monitor.

Romi Savova, chief executive at PensionBee, says: “Personal pensions typically charge an annual management fee of around 1%, but we still see fees of more than 1% and sometimes up to 5% from legacy providers. A difference of just 1% in pension fees can have a huge impact on the ultimate pension pot value. A parliamentary study found that an individual who saves throughout their working life into a scheme with a 1.0% annual management fee could lose almost a quarter of their pot (24%) to charges, and at the 1.5% level, they could lose around a third (34%), assuming no difference in performance or other factors.”

There will also be more flexibility in a modern pension plan, which will affect the range of investments available, the way you can draw your pension income in retirement, and the way your beneficiaries can draw on the pension after you die. Transferring may be a particularly good idea if your old scheme is being closed, as closed schemes tend not to have the same scrutiny and are sometimes left in the hands of poor fund managers. Modern schemes tend to have better governance, with an active trustee board that keeps a watchful eye on investments.

At the beginning of your career, your pot is relatively small, so it could be best to simply roll an auto-enrolment scheme across to your next employer’s scheme. Providers such as Royal London have dedicated non-advice telephone teams to facilitate this.

- ‘Quickie’ divorces could result in pension losses for women

Another approach is to consolidate old workplace pensions into a personal pension when you move job, rather than move them into your new workplace pension. This way, your personal pension becomes your ‘home’ pot and you’ll only ever have one or two pensions to manage. Having all of your savings in one place will provide greater visibility on fees and performance.

However, before combining pensions, ensure you are not giving up any valuable benefits, such as a guaranteed annuity rate (typically 9-11%, more than double the best rate most people get on the open market). Think twice too about transferring DB schemes mid-career, as they include handsome index-linking, whereby your pension income is guaranteed to keep pace with inflation.

Savova says: “We often come to an impasse where legacy pension companies try hard to prevent customers from moving their pensions.” She suggests choosing an adviser that uses an electronic system such as Origo Options, which can push through transfers in 20 days.

The PFS publishes a consumer ‘gold standard’ transfer guide to help people better understand the final salary transfer system, the guarantees they could be giving up, what to expect from an adviser and how to spot good advice. Tel: +44 (0)20 8530 0852 Email:customer.serv@thepfs.org

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.