These stocks are the stars of this Autumn Budget

27th October 2021 15:26

by Graeme Evans from interactive investor

A number of shares have risen sharply in value following the unveiling of chancellor Rishi Sunak’s latest fiscal policies.

Business rates relief and the prospect of 3p off the cost of a pint ensured pubs chains were the first port of call for investors during the Autumn Budget.

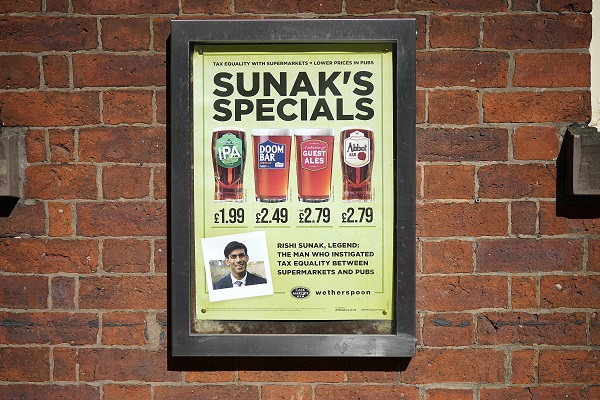

JD Wetherspoon (LSE:JDW) shares surged 6% at one point after Chancellor Rishi Sunak announced a series of reforms to alcohol taxes, including a 5% cut in duty on draught beer.

Sunak called the measures a long-term investment in British pubs to the tune of £100 million a year, meaning a permanent cut in the cost of a pint by 3p.

He also announced £7 billion in business rate cuts following the cancellation of planned increases and a 50% discount for a year for retail and hospitality venues.

Wetherspoon's FTSE 250-listed shares were later 5% or 53p higher, but at 1,040p they are only back where they were at the start of October. The company, which has more than 850 pubs and 42,000 employees, recently announced a full-year loss of £154.7 million.

Offsetting the duty boost is the prospect of higher labour costs after the chancellor confirmed a 6.6% increase in the National Living Wage from £8.51 to £9.50 an hour for those aged over 23.

City Pub Group (LSE:CPC), whose shares rose 4p to 125p, warned earlier today that wage increases alongside higher energy and food costs could mean beer goes up by 25p to 30p a pint.

Among the other pub chains, shares in Harvester owner Mitchells & Butlers (LSE:MAB) rose 8.4p to 255p and Marston's (LSE:MARS) improved 4p to 80.7p to recover the falls seen earlier this month. With Sunak also planning the biggest cut to cider duty since 1923, shares in the Magners and Bulmers maker C&C lifted 2% or 4.6p to 251.6p.

These moves were among the most significant in a session when the domestic-focused FTSE 250 index crept 0.15% higher from the unchanged level seen when the chancellor started his speech at 12.30.

Most of his initiatives were trailed in advance, such as the cut in the surcharge on bank profits from 8% to 3% in order to compensate for the planned increase in corporation tax. Lloyds Banking Group (LSE:LLOY), which reports third-quarter results tomorrow, was 0.1p lower at 48.9p and Barclays (LSE:BARC) fell 3.2p to 199.62p as profit-takers moved in after a strong run.

Lloyds, the other UK-focused lenders and the wider consumer sector stand to benefit more if the chancellor's updated forecasts for GDP growth of 6.5% this year turn out to be correct. The estimate compares with the 4% predicted by the Office for Budget Responsibility in March and would mean the economy is back to pre-Covid levels before Christmas.

- Chancellor’s 4% inflation forecast a real-life scare story for spooked pensioners and savers

- UK economy: forecast up for this year, but 2022 downgraded

The housebuilding sector also faces a new residential property developers tax, which the Treasury intends to levy on companies with profits over £25 million at a rate of 4%. This will contribute towards the creation of a £5 billion fund to remove unsafe cladding, but the potential for this initiative was known as long ago as last spring.

Taylor Wimpey (LSE:TW.) shares were 2.5p higher at 154.65p and Barratt Developments (LSE:BDEV) lifted 8.8p to 675.6p as they look to benefit from the chancellor's multi-year housing settlement that includes £1.8 billion for regenerating brownfield sites.

Harworth Group (LSE:HWG), which is focused on residential and logistics developments in the north of England, fell 0.5p to 169.5p despite further initiatives in the chancellor's levelling up agenda, while brownfield developer Hargreaves Services (LSE:HSP) dipped 3.5p to 435p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.