These are the most important numbers for investors

7th January 2019 10:11

by Richard Beddard from interactive investor

Richard Beddard considers why analysing a company's fundamentals is much more important than obsessing about the level of indices.

I experienced one of those "Aha!" moments last Saturday, when I was reading an interview with novelist and author Matt Haig in the money section of The Times. Asked whether he invests in shares, he replied:

"No. Too many numbers and indices. It seems a dull hobby and an inexact pseudoscience, like astrology. It's like gambling without the stigma."

Wow. Talk about making every word count. Those three short sentences triggered a cascade of memories, conversations with friends who have also inadvertently dismissed my life's work in very similar terms. This, I thought, is the attitude I must combat – not just in other people, but should I stray towards numerology and pseudo-science myself.

First of all, numbers. Indices are heinous, I agree, but we don't have to take any notice of them. Until a moment ago I could not have told you the level of the FTSE 100 index, but I thought it would be fun to guess and parade my ignorance about our premier index, the one you hear quoted on the Today programme and the news, and in the headlines every day. I guessed 6,000. Actually, at this precise time it is 7,038.

Excessive worrying about how investments are performing

But, I hear the cries, if we do not know how the index is doing, what can we compare our investments to? I think many investors spend far too long worrying about how investments are performing, and nowhere near enough time understanding what they are invested in. Maybe once every five or 10 years we should compare our performance to an index.

There are other kinds of number that are very important, though, and those are the numbers that account for the profits and losses of businesses and how they are financed. Accounting has a dull reputation, which is probably why people focus on the thrills and spills of share prices and indices.

But I do not think accounting deserves its reputation. It is the language of business, and through it we can better understand the wealth firms create and the frauds they perpetrate.

That doesn't mean we have to pore over every number, however. Some numbers tell us more than others. For the kind of stalwart companies I study, we often need to know little more than return on capital, debt and cash flow (preferably both over a long period) to help us judge the quality of the business. After that it is the words – working out how the company makes money, why it should make more and what might go wrong – that are important, and our own observations of the business.

There is a broader perspective too. Companies and sole traders are the engines of capitalism. As shareholders, we get a little more insight into a machine that finances most of our lives and – should we choose to hold to account the managers of the businesses in which we own shares – a slightly greater say in how it works.

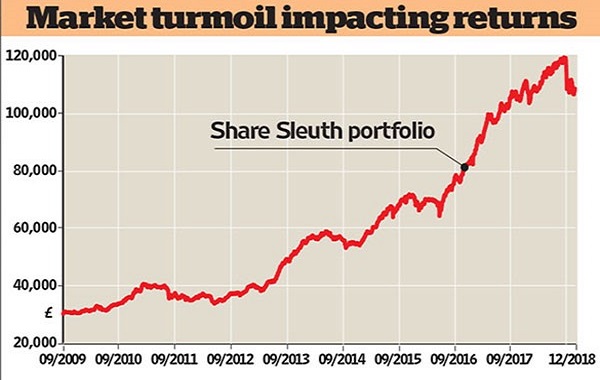

Source: interactive investor Past performance is not a guide to future performance

Not a science

Investing is not scientific, so it should not be dressed up as science. Most of the worthwhile things we do cannot be done with scientific precision, from writing a novel to bringing up a family. Investing requires judgement and when we make judgements we err, so the onus is on investors to be as diligent, honest and thoughtful as we can be.

- Focusing on the mother of all fundamentals

- Fundsmith's Terry Smith reveals his seven guiding investment principles

I am thinking about all this because New Year is approaching. I am looking back and wondering what I can do better in the year ahead. The challenge inadvertently issued by Matt Haig's answer has girded me. In 2019, I will focus more adamantly on the numbers that matter, get closer to the truth about businesses and what makes them special, and in the process, I hope, demonstrate that investing in shares can be fascinating.

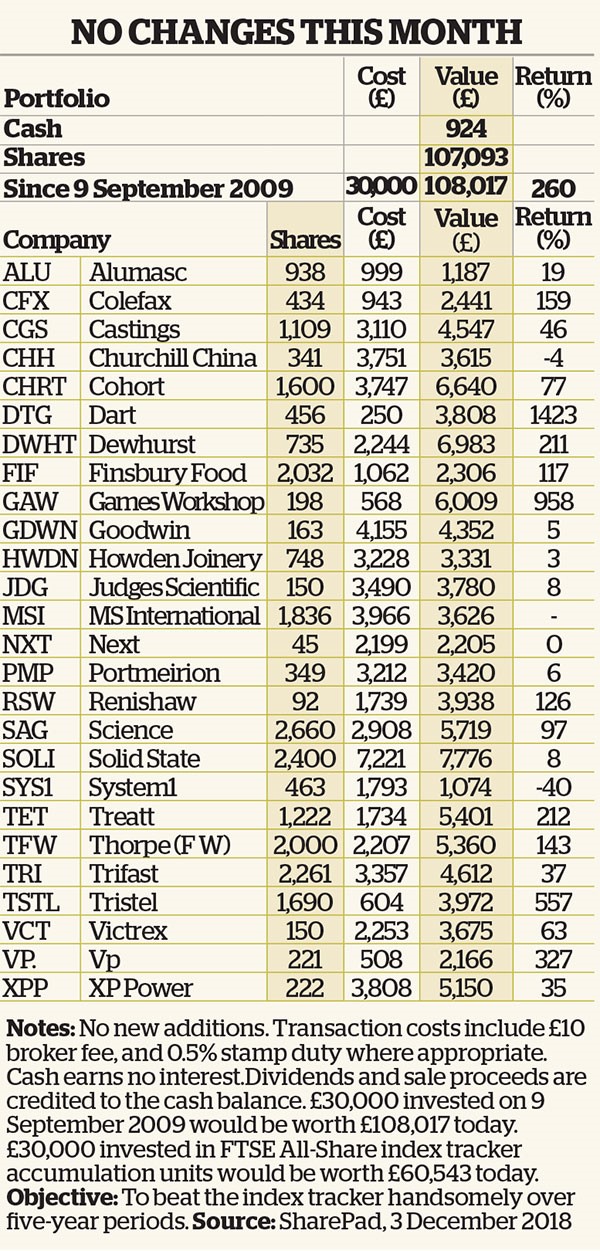

Of the four companies profiled in Share Watch this month, one, Finsbury Food, is already a member of the Share Sleuth portfolio.

An explanation of Share Sleuth's investment philosophy and past monthly blogs are available here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.