Ten dangerous investment myths: busted

12th May 2023 12:58

by Theodora Lee Joseph from Finimize

The world of investing is a minefield: especially in this digital age, there are charlatans, fear-mongering news, and wrong assumptions lurking around every corner. Because those false beliefs could hinder your success, I’ve gone ahead and busted ten of the most common dangerous investing myths.

Real estate and high-dividend stocks may seem attractive, but they’re not always stellar investments.

Diversification isn’t just about the number of stocks and funds you own, and high risk doesn’t always mean higher returns.

It can pay to invest in expensive stocks – especially if you believe it’s time in the market, not timing the market, that counts.

The world of investing is a minefield: especially in this digital age, there are charlatans, fear-mongering news, and wrong assumptions lurking around every corner. And while some of them are easy to spot, many of them – often with an ounce of truth behind them – work their way into our psyches, even if we’re not aware of it. So because those false beliefs could hinder your success, I’ve gone ahead and busted ten of the most common dangerous investing myths.

Myth 1: Real estate’s always a good investment.

Reality: Real estate can be a good investment, it’s true, but that doesn’t mean it’s always the best option. That’s because when interest rates are low, you can make decent returns from rental income. But when rates are high like they are today, you could make equally impressive gains from high-interest savings accounts. And while folks wax lyrical about how your investment will be worth more over time, that will really depend on the area you choose. House prices in the US have gone up in value by an average of 5.4% over the last two decades, sure, but that still lags behind the S&P 500’s 9% average over the same period. Remember, too, real estate not only requires a lot of time and effort, but a lot of capital. You’ll likely borrow to afford any house-sized investment, and while that leveraged value will magnify your returns, higher mortgage payments will eat into the money you could make.

Myth 2: “Buy low, sell high" is always the best strategy.

Reality: If you had only gone by this strategy, you’d never have bought Microsoft, Berkshire Hathaway, or any big hitters in the US tech sector – they have just always been expensive. You simply can’t always catch a low price, so sometimes it's better to buy high and sell even higher, especially if a company looks to have sturdy momentum and prospects. Valuation is one handy metric you can use to gauge future potential returns and risk, for sure, but it’s not your only option.

Myth 3: The more stocks or funds you own, the more diversified you are.

Reality: Diversification can reduce your portfolio’s overall risk, and it’s true: the more stocks you own, the lower the risk of a single one bringing down your portfolio. That said, the type of stocks you own is arguably more important. A portfolio with 15 different US tech stocks won’t behave in the same way as one with 15 stocks from different sectors, and one spread across different countries and asset classes will act another way entirely. To be truly diversified, you’ll want to hold assets that aren’t tightly correlated to each other, meaning they don’t respond the same way to varying market environments.

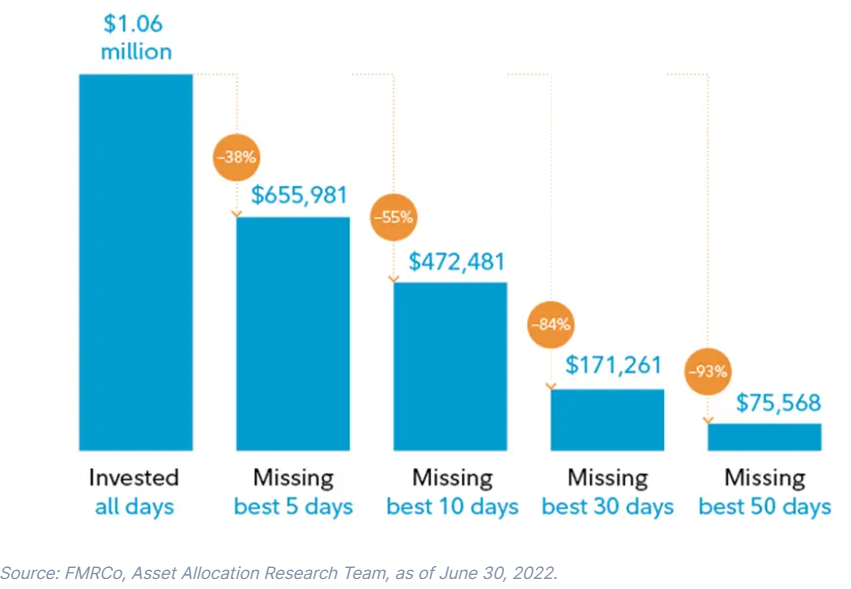

Myth 4: Timing the market is the secret to success.

Reality: You can’t argue against the theory of this one. Thing is, no one is perfectly precise and on-the-button in reality, which makes timing the market notoriously difficult – even for the pros. The next best thing may be to develop a long-term investment strategy and stick to it, rather than reacting to short-term market fluctuations. That way, you stay constantly invested and won’t miss out on the market’s biggest “up” days, which can have a huge impact on your returns.

Myth 5: You need a lot of money to start investing.

Reality: On the contrary, the reason to start investing early is precisely driven by a lack of initial funds. It’s easier than ever to start regularly investing small amounts nowadays, especially if you explore exchange-traded funds (ETFs). Over time, you don’t only expose yourself to more opportunities, but you’ll reap the benefit of compounding returns. Case in point: if you had invested $1,000 in solid-waste management company Waste Connections (WCN) 25 years ago, you’d be sitting on a pile of cash worth $50,000 now.

Myth 6: Buying stocks is a quick way to get rich.

Reality: Unfortunately, there aren’t any guarantees in investing. You would’ve made double-digit returns by investing in the S&P 500 over the last five years, it’s true, but that – and longer-running investments – requires patience, discipline, and a long-term perspective. These days, we’re used to stuff happening instantaneously, but when it comes to your portfolio, you’ll want to invest for the long run and give your investments time. And okay, some people may have become overnight millionaires from crypto, but they’re the exception rather than the rule.

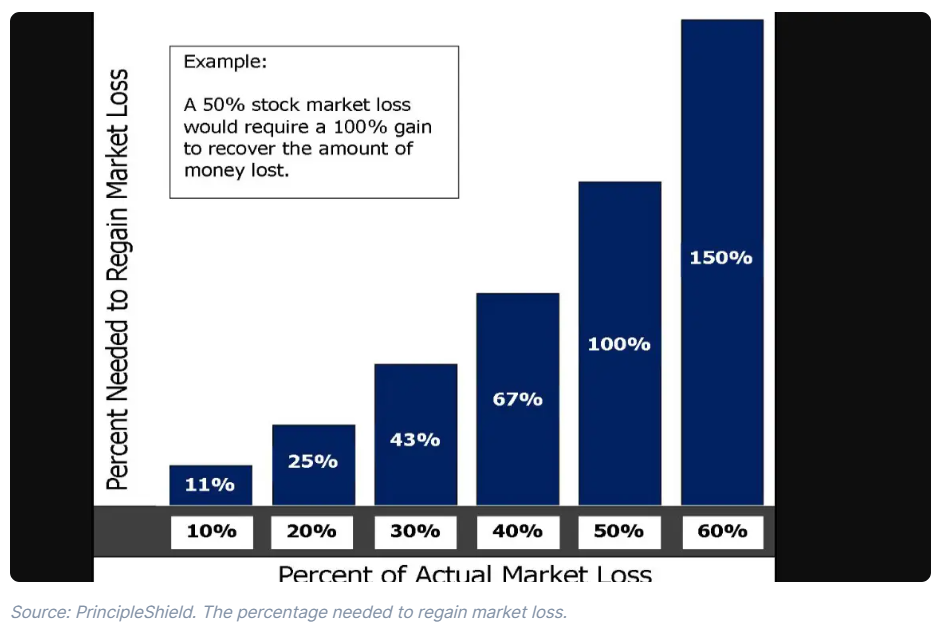

Myth 7: The higher the risk, the higher the returns.

Reality: You’ll often hear that you should expect higher returns if you’re taking on more risk. Just think, stocks are riskier than bonds but they make up for it by offering higher returns over time. Thing is, not all high-risk investments offer you higher returns, and it depends on what type of risk you’re taking on. Academic research* actually shows that low-risk stocks have historically delivered higher returns than high-risk ones, a phenomenon known as the “low-volatility anomaly.” That’s because more stable stocks can chug away in a rising market while being less prone to volatile swings in downturns. Simple math shows you can win just by avoiding risky losses: a steep decline in your investments will require a greater recovery to break even.

Myth 8: Past performance is an indicator of future returns.

Reality: Past performance can provide accurate insights into a company, but it doesn’t show the whole picture. A stock may have dipped 50% a year ago due to exceptional circumstances, but could now have a new future-fueling initiative in tow that could change the game. So don’t ignore a stock’s history by any means, but remember to also understand the stock’s future drivers – factors like the company's financial health, management, and business prospects.

Myth 9: The efficient market hypothesis is always true.

Reality: The efficient market hypothesis states that all available information about a company is already reflected in its stock price, so it’s effectively impossible to consistently beat the market. There are times, though, when the market’s not efficient, such as during a financial crisis or when a company is undervalued due to temporary factors. But bear in mind, that despite the benefits of active management, most active traders underperform over the long term. Instead, passive management through index funds and ETFs can be a low-cost and effective way to achieve market returns.

Myth 10: Tidy dividends are always a promising indicator.

Reality: Dividends can be a sign of a healthy and profitable company, but they can also indicate that the firm has run out of growth opportunities and is returning cash to shareholders instead of investing in the business. Rather than just looking at dividend yields, pay equal attention to a company’s ability to sustain dividends and grow them over time. And consider that reinvesting your dividends can swell your returns over time. If you invest in mutual funds or ETFs, accumulation funds or units can do that for you. Or if you go for individual shares, you could set up a dividend reinvestment plan (DRIP) with your broker.

Bonus myth: Men make better investors.

Reality: Nuh-uh: research shows that as a group, women are better investors than men. According to Fidelity’s analysis of more than five million customers over the last decade, women outperformed their male counterparts by 0.4%. That could be because women, on average, tend to trade less frequently and be more risk-aware and patient in their investment decisions.

* Robert Haugen and James Heins, “On the Evidence Supporting the Existence of Risk Premiums in the Capital Market,” December 1, 1972.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.