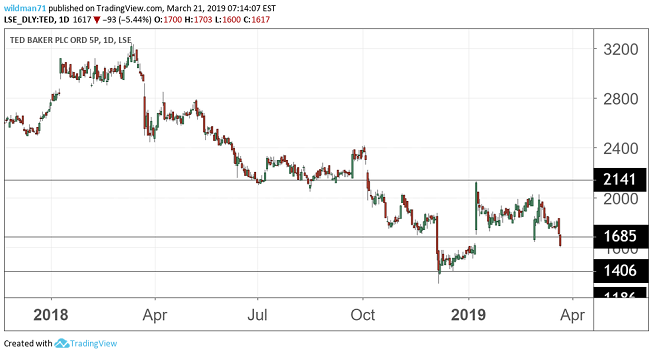

Ted Baker better value, but is it a buy?

All its gains for 2019 have now unwound, and investors are still shunning TED shares.

21st March 2019 12:24

by Graeme Evans from interactive investor

All its gains for 2019 have now unwound, but investors are shunning TED shares.

A former retail high-flyer with a valuation to match, Ted Baker (LSE:TED) was forced to endure more pain today as it reported an uncharacteristic fall in annual profits and cut to its dividend.

Even if its performance has been resilient in the face of well-documented cyclical and structural issues facing the retail sector, there's little evidence to suggest this year will be any easier.

In fact, shares were marked down another 5% to 1,627p today as analysts scaled back their expectations for 2019/20 in the wake of the results and cautious outlook statement. In particular, the company referred to an elevated level of promotional activity across many global markets, as well as recent unseasonal weather in North America.

There's the additional pressure of leadership issues after Ray Kelvin, who founded the business 32 years ago, stepped down as chief executive in the wake of harassment allegations. He has been replaced on an interim basis by Lindsay Page.

The de-rating of the stock recently left the lifestyle brand trading with a forecast price/earnings multiple of just over 11 times, compared with the 30 times figure in its heyday. This represents the lowest rating for nearly ten years after a 45% slide in the share price in the past year.

House broker Liberum continues to see value in the depressed FTSE 250 stock, even if it did cut back its price target today to 2,300p from the 2,800p seen previously.

It is backing the brand's ability to materially outperform its peers, a trait highlighted over Christmas when Ted Baker's retail sales rose 12.2% in the five-week period to January 5.

Source: TradingView (*) Past performance is not a guide to future performance

E-commerce sales have remained strong and rose more than 20% in today's results. Ongoing investment in IT, systems, logistics and the supply chain should also put the business in a strong position for the long term, while free cash flow is also improving.

Despite these plus points, it is hard to see too many catalysts for an upturn in fortunes in the coming months. The short-term outlook is hugely uncertain, particularly given Ted Baker's significant exposure to sales in the structurally challenged department store sector.

The group's gross margin fell from 61% to 58.3% in the recent financial year, squeezed by an increase in promotional activity in response to the challenging conditions. As forecast in an unscheduled trading update last month, underlying profits were down 14% to £63 million.

Analysts are now looking for a figure closer to £70 million in this financial year, down from the previous consensus forecasts of between £75 million and £82 million. Adjusted earnings per share fell 10.6% to 114.2p today, with the dividend cut by 2.5% to 58.6p a share in line with the company's usual two times coverage.

The lifestyle brand has 560 stores and concessions worldwide, comprised of 201 in the UK, 122 in Europe, 130 in North America, 98 in the Middle East, Africa and Asia, and nine in Australasia.

Mr Page said recent investment meant the brand was well-placed for long-term development.

He added:

"We are excited by our Spring/Summer collections and the board remains focussed on identifying opportunities in the evolving retail market to further expand the brand."

*Horizontal lines on charts represent levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.