A tech stock to buy now while there is a chance

A well-known technology play has fallen sharply, but overseas investing expert Rodney Hobson believes the current level is a floor and that those hoping for capital gains should get their reward soon.

30th October 2024 08:37

by Rodney Hobson from interactive investor

In a world where we have chips with everything, one might have expected ASML Holding NV (EURONEXT:ASML) to be flying high. Yet latest figures from one of the biggest suppliers in the semiconductor industry caused shock waves among investors. Perhaps we have been expecting too much too soon.

The Dutch technology group puts circuit patterns on computer chips so they can be put to a wide range of uses. In some applications it has nearly 90% of the market. It also sells software and services.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

With demand for chips soaring globally, revenue and profits more than doubled over the three years to 2023. However, orders in the third quarter of this year came in at only about half the level that analysts had forecast, prompting ASML to reduce its forecast for next year.

Sales for this year are now likely to be only just ahead of the €27.6 billion recorded last year and net income could fall slightly short of the €7.8 billion achieved in 2023.

Such is the wonderful world of technology that the annual growth of over 20% that ASML enjoyed for several years could return with the next great leap forward, but in the meantime investors would do well to settle for high single digits, which seems eminently attainable. ASML is constantly improving the performance of its products, justifying higher selling prices even as input prices are easing.

Although customers are limited to a select few technology businesses, with the likes of TSMC, Samsung and Intel Corp (NASDAQ:INTC) taking probably half ASML’s output, there is room for one or the other to increase purchases to take up any slack.

A more serious worry is that China, a major player in the chip market and an important customer for ASML, will get caught up in another trade war with the US and the European Union.

- Tech giant and Scottish Mortgage stock ASML plunges

- The Investment Outlook: introduction and house view

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

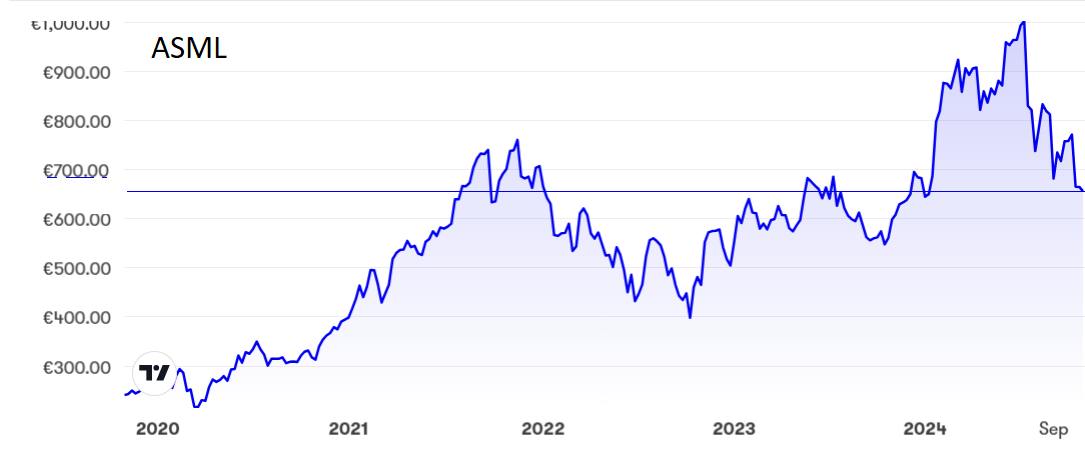

The stock briefly topped €1,000 as recently as July before going into freefall. At around €660 the shares are back where they were three years ago, but this kind of level has proved to be both a ceiling and a floor in the meantime. This should once again provide a floor. In any case, this is a more realistic level after the great surge into American tech stocks earlier this year produced overblown share valuations.

The price/earnings (PE) ratio is factoring in recovery at 38 while the yield is admittedly rather sparse at just under 1%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Demand for chips, especially specialised ones, is bound to bounce back from any short-term decline. Likewise ASML’s share price, so buy now while there is chance. Those hoping for capital gains should get their reward soon; those investing for income will have a somewhat longer wait.

Update: The strong US dollar has dented profits at drinks and snacks maker Coca-Cola Co (NYSE:KO) and will continue to do so into next year. Despite costs staying broadly unchanged, net income fell 7.6% to $2.85 billion in the third quarter to 27 September, with net operating revenue down 0.8% to $11.85 billion.

Although the company is operating at the top end of its long-term growth plans and should be able to boast organic revenue growth of about 10%, adverse foreign exchange movements will chop a similar percentage off earnings and about 4% off comparable revenue. It is already expecting currency headwinds in low single digits in 2025.

Two weeks ago I favoured Coca-Cola over rival PepsiCo Inc (NASDAQ:PEP), which had just produced its own results, although I did say Coca-Cola only just remained a buy at around $72.50 and investors might prefer to see if they could buy in at a lower level. Its shares tumbled 2.1% to $68 on the disappointing results. They have now stabilised at $66 and I feel the downside is limited at this point. Such an iconic brand deserves to have its buy recommendation restored unequivocally.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.