A system that picks shares for the future

23rd March 2018 16:10

by Richard Beddard from interactive investor

Before I share the latest update from my Decision Engine, a reader, let's call him Leo, comments by email:

"I'm... wondering how Finsbury [Food] slipped through the cogs of the engine! Too much oil in the crankshaft perhaps?"

I need to tell Leo the Decision Engine is fuelled by coffee and hysteria, not oil, but his question is a good one. According to his definition of a good business, , a baker supplying supermarkets and caterers, is wanting. To paraphrase, he looks for:

1. Double-digit profit margins

2. High returns on capital

3. Unique businesses

4. Businesses that are not labour intensive

5. Low debt

6. Growth

7. Good cash flow

8. Modest executive pay

9. High dividend cover

Leo's email was timely because I've just tidied up my template for analysing businesses, which describes what I'm looking for.

What is a good company really?

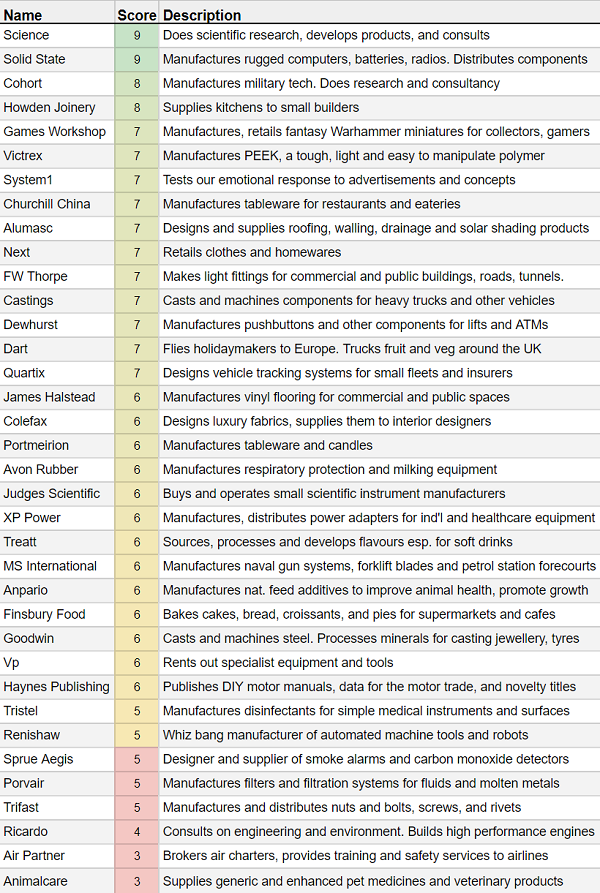

This template is one half of the Decision Engine. The other half is a spreadsheet, which takes the output of the business analysis, a score (out of eight), and adds it to a valuation score (from 2 to -2, giving a total score out of 10).

The spreadsheet ranks all the shares I follow using that score, which is how I compare cake makers to robot manufacturers.

In the business template, I score each of the four categories below from zero to two. I'm looking for, but rarely find, companies that total eight out of eight:

How does the business make money?

Describe the business model and how it performs through thick and thin. Give points if it is profitable in cash and accounting terms and has clear advantages.

Is it profitable?

How will it make more money?

Describe the strategy. Give points if it is coherent, i.e. the strategy flows logically from the business model.

Is it adaptable?

What could go wrong?

Describe the risks, cyclical, financial, but most importantly competitive. Give points if the business model and strategy address the risks.

Is it resilient?

Will shareholders benefit in the long-term?

Describe management incentives and stewardship. Give points if managers are experienced, own large shareholdings and pay themselves modestly. Reward firms that look after staff, suppliers and customers.

Is it equitable?

Does Finsbury shape up?

I don't consider dividends or labour intensity, but beyond that Leo and I are fishing in the same pond stocked with profitable, distinctive, well managed businesses.

We're in agreement about Finsbury Food too. According to my last evaluation Finsbury only got half marks (4/8). In fact it scores half marks in all four categories. To sum Finsbury up, it's mostly about baking as many cakes in its ovens as cheaply as it can. I don't think there's anything particularly remarkable about the cakes or the ovens, but the more cakes it produces the more efficient Finsbury is (up to a point - see the article below for a more nuanced view).

• What's really going on at Finsbury Food?

Finsbury scores well on valuation (nearly 2/2, for a total score of 6/10), but cheapness is not enough to propel Finsbury out of the bottom ranking cadre of shares. If I were starting a portfolio today, Finsbury wouldn't be in it.

So why follow Finsbury?The short answer is the Decision Engine isn't a collection of shares I would buy now. It's a collection of shares that I am still following. I evaluate them every year, when they publish their annual reports, hopefully learning more about them. Over the years my impression of the companies changes, and the Decision Engine also evolves - my criteria, in other words, change. Ultimately I will drop a share from the Decision Engine if If it's unlikely ever to be ranked highly.

It's a glacial process because I like to be confident I'm making the right decision, and you have to give companies time to prove their strategies, or demonstrate they're not working.

My latest template is probably the least radical of a long line of revisions, so to answer Leo's question, how a not particularly attractive business found its way into the engine, I've got to consider how how the Decision Engine has changed.

That could be a very long and nuanced story, but I think these would be among the highlights:

A change in attitude towards valuation

When I started following Finsbury in 2013 the shares traded on lower valuations than they do today, and early versions of the Decision Engine weighted value more highly (half of a company's score was derived from its valuation, and half from the strength of the business). Finsbury was halfway to a perfect score without even considering the quality of the business, or to put it another way, the business only had to be half decent for the investment to be deemed attractive.

A change in how I measure profitability

Back then Finsbury looked more than half decent to me. Early versions of the Decision Engine only used one measure of profitability, which we might usefully call Return on Operating Capital. This is adjusted after tax profit divided by the capital required by the business to run its offices, factories, buy raw materials and so on.

Finsbury has always been incredibly profitable by this measure; return on capital averages 19% over the last 10 years. It's dangerous to rely on one statistic though, and I believe this measure flatters Finsbury, perhaps because it uses more equipment than the balance sheet shows, possibly fully depreciated equipment acquired when it buys other businesses.

These days I also calculate Return on Total Invested Capital, which includes the cost of acquisitions. I tend to think of RoC as a best case scenario and RoTIC as a worst case scenario. In RoTIC terms, Finsbury is a much less attractive business. Average RoTIC is about 8%. I'm not sure its worth being in business for less than that.

A greater emphasis on strategy

Changes at Finsbury have also affected its score. In 2013, Finsbury was still selling-off businesses and paying down debt built up during a previous acquisition binge. It's since returned to acquisitions as a means of growing scale, fueled this time mostly by equity. In my mind this development has reaffirmed Finsbury's limited strategic options.

Finsbury's not a bad business, and it's been a good investment over the last four years. But my understanding of the company is evolving, and so is the Decision Engine. As a result, Finsbury's score has fallen.

I may well decide my time will be better spent following another company, and then I'll drop Finsbury from the Decision Engine.

I don't think that would mean the Decision Engine was fooled, though. I think that would mean it had done its job. It helped me make a decision, slowly, and methodically.

Shares for the future

I publish a snapshot of these deliberations on interactive investor every five weeks: The current constituents of the Decision Engine, ranked. If I were to start a portfolio today, I would pick from those ranked seven or more (in fact, I did exactly that a couple of weeks ago):

Since the last update, failed to make the grade and I will not be plugging it into the Decision Engine. and remain constituents after recent appraisals.

• The shares are cheap, but this is a question of Character

• Why Treatt shares are a beautiful thing

• Could Alumasc shares be worth your time?

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Finsbury Food

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.