Sustainable investing: do guns and oil have a place in portfolios?

25th November 2022 13:54

War in Europe and fossil fuels' role in the energy transition means ESG investing comes with tough decisions and compromises.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Environmental, Social and Governance (ESG) was flying high in 2020 and 2021. As governments committed to net-zero dates and the world was determined to ‘build back better’, companies with low carbon emissions performed well and won the favour of investors for multiple reasons. However, the worm has turned, and energy has been one of the best places to invest in over the past year. Meanwhile, the Russian invasion of Ukraine has thrown into relief the importance of energy security and defence to stable and prosperous societies. Here, we discuss how managers have responded and ask whether ESG is changing – or is it just over?

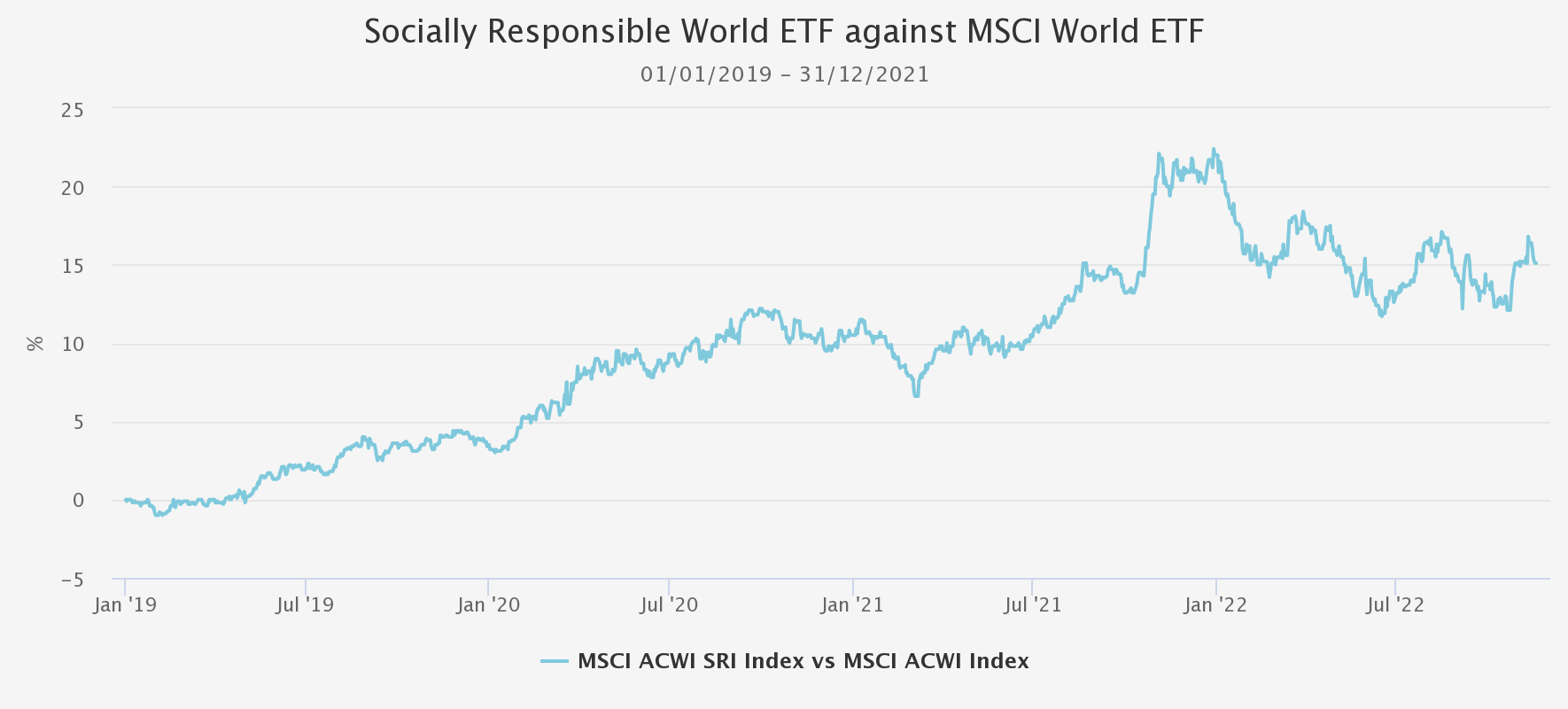

In the ‘bad old days’ it was popularly held that investors would have to sacrifice returns to ensure their capital was being allocated to those companies with strong ESG credentials. However, ESG strategies saw a strong period of outperformance from 2019 to early 2022, which gathered investor interest and assets. ESG questions focused on climate change and reducing carbon emissions, resulting in the exclusion of companies associated with fossil fuels from many indices, while also impacting the industrials and materials sectors that require significant capital expenditure on infrastructure and energy in the production process. Such criteria favoured companies operating in technology and software-related sectors.

The chart below shows the cumulative relative performance of the iShares MSCI World SRI ETF (LSE:SUSW) against the iShares Core MSCI World ETF (LSE:SWDA) from 2019 to the end of 2021, with a rising line indicating outperformance of the SRI Index and vice versa. An increasing number of ESG investment strategies came to the market to take advantage in 2020 and 2021 and, according to Morningstar, during 2021 there were more than 1,200 global sustainable fund launches with over three-quarters of these coming from Europe, matched by progressive sustainable asset flows.

CUMULATIVE RELATIVE PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

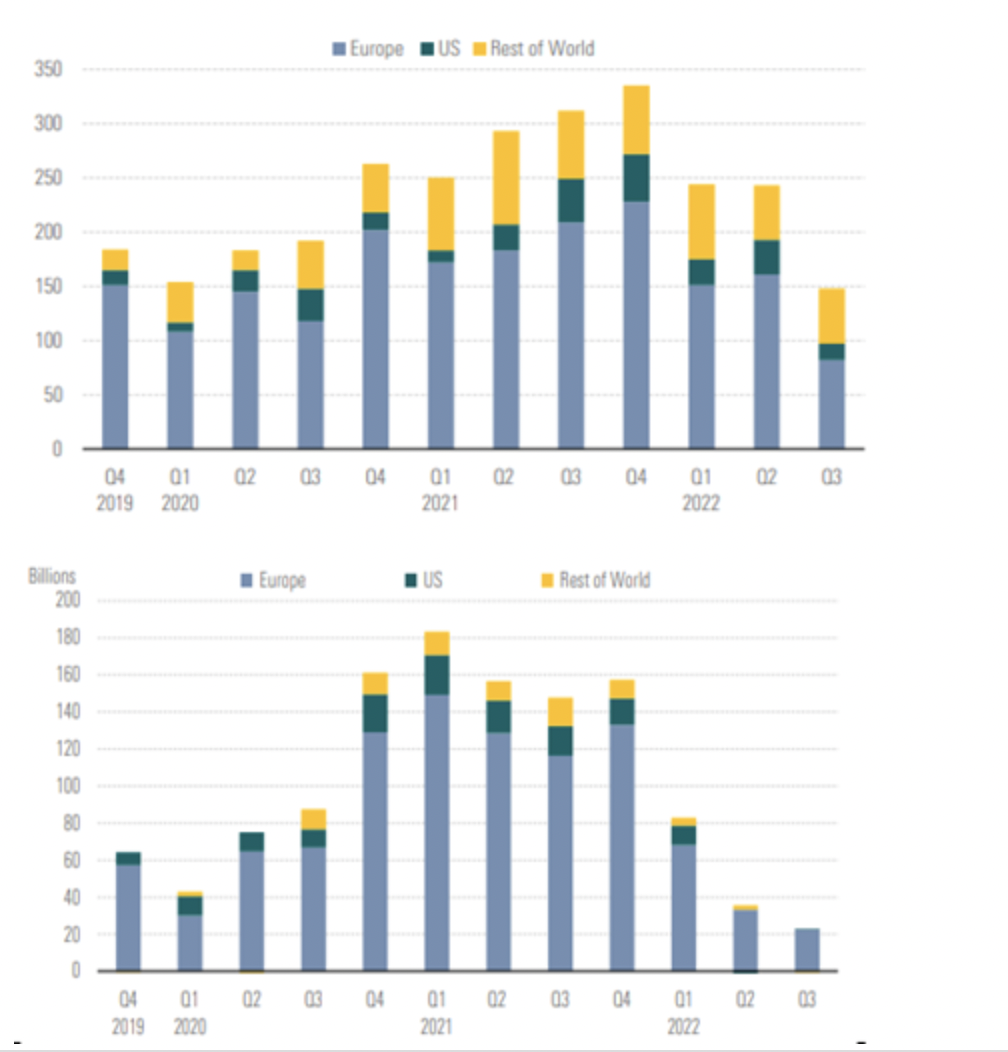

However, the reflationary rally that followed the pandemic saw demand for commodities go through the roof. Industries which limited capex in recent years, partly due to ESG pressures, benefited, chiefly fossil fuels and the energy-intensive miners. As polluting industries outperformed, there was a significant drop in ESG-focused fund launches and asset flows, particularly compared to Q4 2021, as can be shown in the charts below.

GLOBAL SUSTAINABLE FUND LAUNCHES AND FUND FLOWS (USD BILLION)

Source: Morningstar Global Sustainable Fund Flows: Q3 2022 in Review

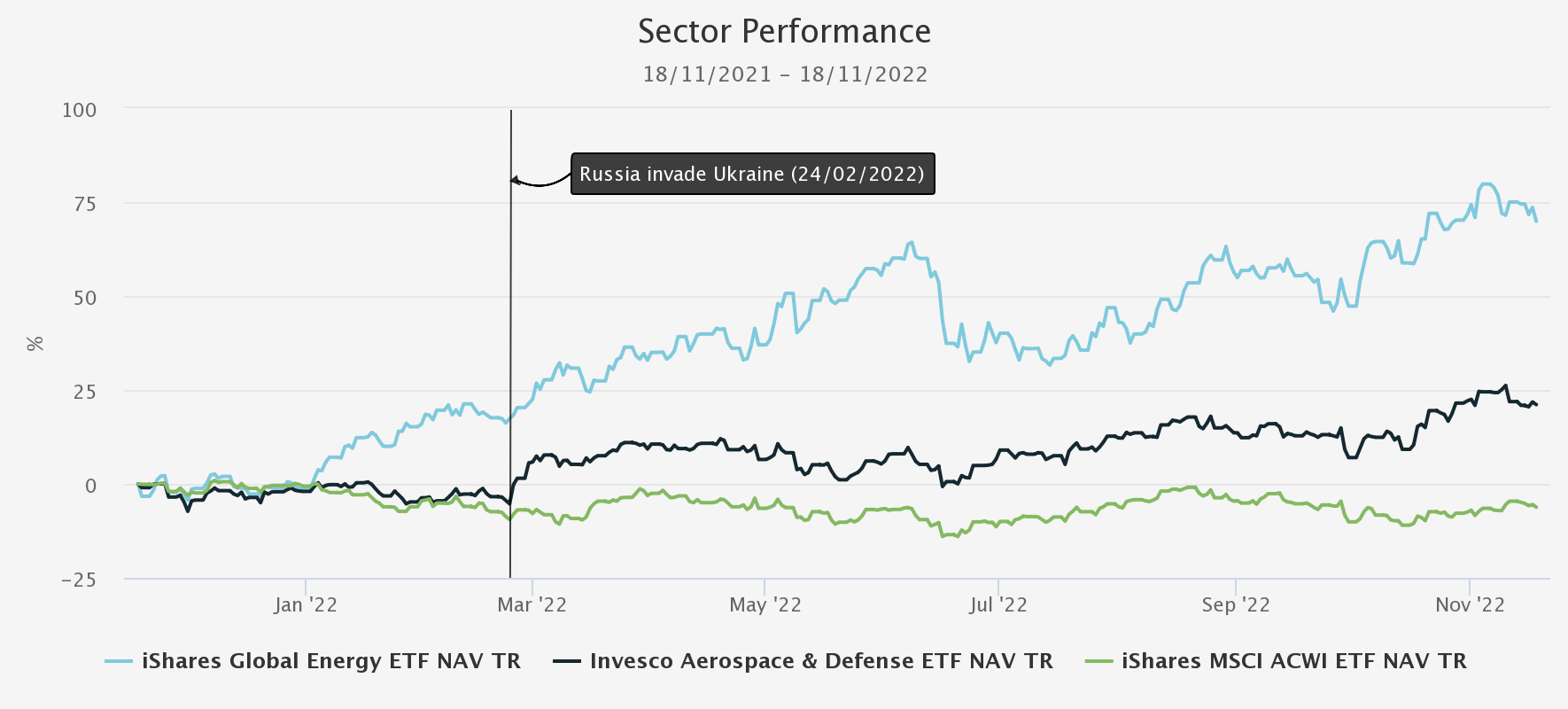

Then, Russia’s invasion of Ukraine, which began on 24 February 2022, boosted further energy prices’ pressures and highlighted the importance of defence and energy security. This has been reflected in the significant outperformance of the energy and defence sectors since the date of the invasion, as shown in the chart below.

12-MONTH SECTOR PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

Some managers have taken this to show how energy security, and the ‘S’ in ESG, needs to come to prominence. Several managers whom we speak to have been actively allocating to holdings in the defence sectors on ESG grounds. For example, James de Uphaugh, manager of Edinburgh Investment (LSE:EDIN), has highlighted the importance of the defence sector to preserve democracy against aggressors. He has a position in BAE Systems (LSE:BA.), which he notes benefits from the capital-intensive nature of the industry that leads to high barriers to entry and the focus on government contracts provides significant visibility on longer-term order books.

Peter Ewins, lead portfolio manager of the Global Smaller Companies Trust (LSE:GSCT), is another to see the opportunity in the sector and has been increasing positions in defence holdings, including North American component manufacturer Curtiss-Wright and UK-based multinational defence company QinetiQ Group (LSE:QQ.). Meanwhile, City of London (LSE:CTY)portfolio manager Job Curtis also holds BAE systems within the top 10 holdings, and it was the biggest contributor to returns for the 12 months to 30 June 2022. Co-portfolio manager David Smith cited longer-term fundamental improvements in the operations of the business which are related to the management team’s activities and improved Western defence spending, with the war in Ukraine being the stimulating factor for the company’s re-rating.

Another aspect of defence is cyber warfare. Not only is it important for companies, which are more vulnerable through the ever-increasing amount of investment in IT networks to support remote working and enhance customer experiences, but it is also a concern for governments and national security. A study published in March 2022 by McKinsey and Co. projected that $101.5 billion will be spent on cybersecurity service providers by 2025. Alongside this, governments continue to invest in the sector with the UK government having allocated additional funding to improve cyber resilience across government as part of the National Cyber Security Strategy and the National Cyber Force. This Force is supporting UK firms not just to grow and scale up, but also to maintain and extend the UK’s competitive edge as a ‘responsible, democratic’ cyber power on the world stage. The sector has been, increasingly, an area of focus for technology-focussed trusts, including Herald Ord (LSE:HRI). They are investing through companies such as GB Group (LSE:GBG), a global leader in digital identity which helps companies and governments to fight fraud and cybercrime. At the other end of the market cap spectrum, Walter Price, lead manager for the Allianz Technology Trust Ord (LSE:ATT), cites the use of cyber warfare by the Russians in response to sanctions as an example of the threat. Companies that feature in the top 10 of ATT’s portfolio include the world’s largest cloud-based information security provider, Zscaler Inc (NASDAQ:ZS), and Okta Inc Class A (NASDAQ:OKTA), which uses cloud software to help companies manage and secure user authentication in applications.

Conclusion

What constitutes a credible ESG-investment solution has evolved considerably and we believe that it will continue to do so. We are not quite so cynical as to say that the huge wave of interest in ESG in 2020-21 was caused by its outperformance, but there was undoubtedly a sweet spot in which investing seemed easy: investors could have their cake and eat it. It can’t be a coincidence this was the period of the Boris Johnson premiership! Now the decisions seem harder and the trade-offs more apparent. Climate change is going to continue to be a key ESG concern of many investors, but it is likely that in the aftermath of the Russian invasion of Ukraine, more will be sympathetic to the argument that fossil fuels will be necessary during the transition and managers will be looking for alternative ways to display their ESG credentials.

We do not believe investors are giving up on ESG, however it will remain up to the investor to consider the opportunity cost of investing in strict ESG mandates which may underperform during certain economic environments. In the end, there is no substitute for investors examining whether a manager’s ethical stance mirrors their own enough for them to be happy to invest in their funds. Perhaps we should hedge our bets and say whether it is ‘sustainable’ or not to invest in defence, our societies may be, literally, unsustainable if nobody does.

We asked our audience "Should investing in the defence sector be considered good for ESG purposes?" and 65% voted no.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.