Stockwatch: why you must keep an open mind on dividend income

Amid pandemic uncertainty, our shares analyst names ‘reliable’ dividend payers he’d buy, hold and sell.

3rd April 2020 11:50

by Edmond Jackson from interactive investor

Amid pandemic uncertainty, our shares analyst names ‘reliable’ dividend payers he’d buy, hold and sell.

Is it basically down to fags, big oil and supermarkets for reliable dividends? Banks being told forcibly to suspend returning capital to shareholders, followed by Centrica (LSE:CNA) cancelling its dividend, has this week rammed home how many yields are out the window – along with earnings forecasts.

Possibly water stocks can scrape through but the sense of utilities as defensive has taken a knock. Those companies able to sustain payouts anywhere near pre-Covid-19 levels will be a prized clique – their share prices also buoyed.

The duration of such market bias may last longer than the pandemic given firms compromised or shut will need to rebuild capital – and as those with stretched finances recover from debt restructuring.

Currently, this is perhaps the most vital theme for investment stock-picking versus traders exploiting volatility.

Still impossible to know how long the pandemic will last

Not knowing the timescale for the coronavirus outbreak is why relatively hardcore income stocks will remain in favour. This last week we have been given contrasting scenarios - the UK’s chief deputy medical officer warns of six months before social and travel restrictions are properly lifted, and yet Hong Kong and Singapore have reported fresh infections once out of lockdown, despite Asian countries’ model efforts against the virus.

But, although stock market rebounds have been driven by stimulus packages, I reiterate my belief that markets are also likely to take their cue from any realistic decline in the rate of new infections. Italy and Spain appear to be over this hump despite the shocking lag-effect of rising deaths.

- Where to find dividend income from UK shares

- 11 UK stocks where experts think the dividend is safe

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The London School of Hygiene and Tropical Medicine has suggested that, only after a week or so of UK lockdown, this has reduced social contact to an extent the virus will no longer be able to sustain itself. From a survey of 1,300 people’s social interaction the “R nought” reproduction number (of people each infected person goes on to infect) has fallen to a median average 0.6, where the upper value is 0.9 and a value sub 1.0 implies decline. That’s encouraging for brave buyers of bombed-out equities.

The crux issue longer-term, however, is what extent the population has supposedly had the virus with minimal or no effect, such that we are well on the way to “herd immunity” - given a vaccine may not be properly available for 12-18 months. If tests in due course show the vast majority simply haven’t had it, advice to government on lifting restrictions will be cautious and we could face serial lockdowns.

The extent of social catastrophe in the US is also far more significant to the bigger investment picture than the UK. We shall see soon enough.

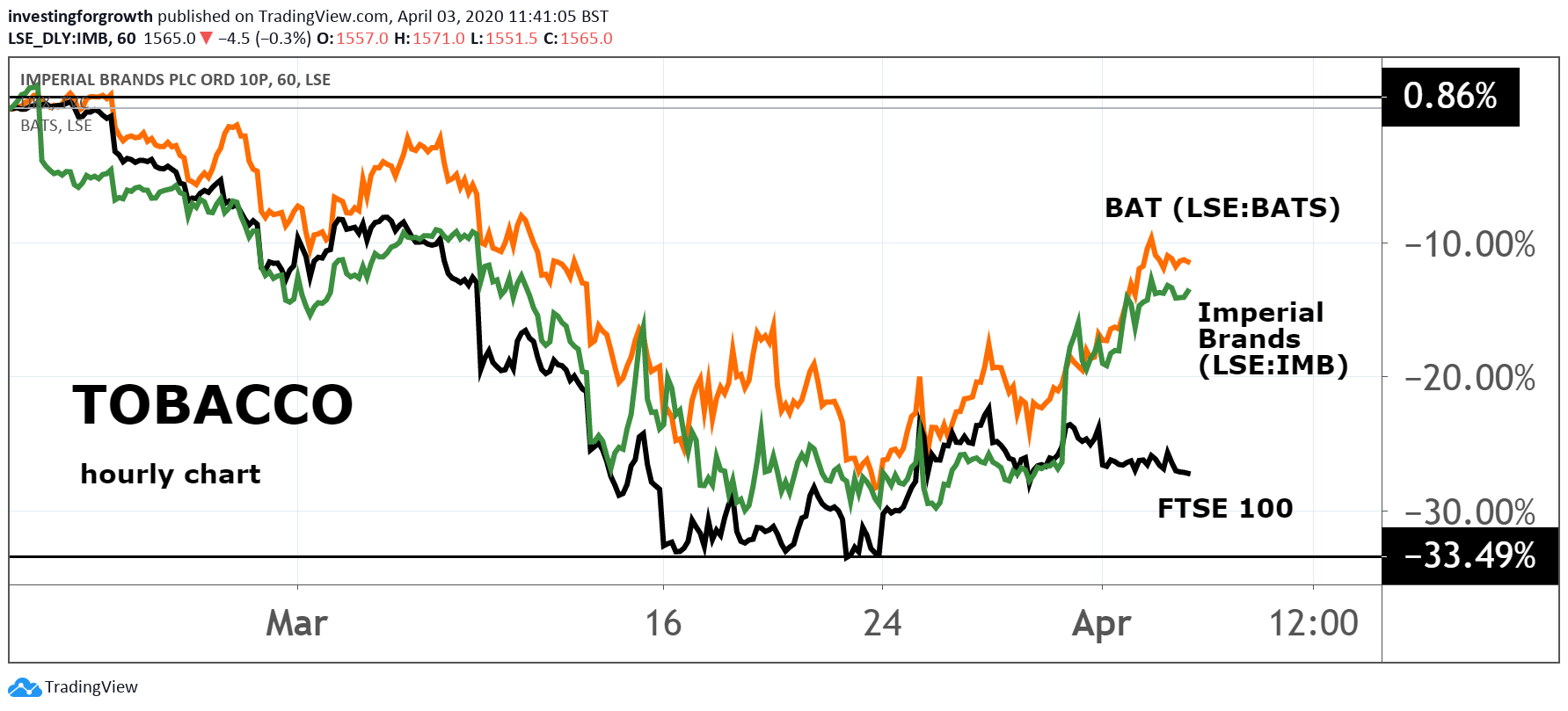

Tobacco stocks enjoy a rare revival

You would think pressures on consumer spending, especially low to middle-income groups exposed to income loss, despite state support, will compromise the likes of British American Tobacco (LSE:BATS) and Imperial Brands (LSE:IMB) – already battling determined health regulators.

Yet Imperial surged 11% last Tuesday after announcing it had seen no material impact from Covid-19, also that it had refinanced a £3 billion equivalent loan facility – given its debt is nowadays crucial to sentiment.

Imperial has around 230% net gearing and an Altman Z1 score of 1.3 indicating a serious risk of financial distress within the next two years. And yet analysts at broker Liberum assert it is “deeply undervalued,” targeting 2,900p.

Over three years or so, Imperial’s stock has fallen from over 4,000p to near 1,300p mid-March, recovering to 1,570p where it yields 12.6%, according to consensus dividend forecasts. The dividend was covered 1.5x by free cashflow in Imperial’s last financial year to end-September, and the search for yield is likely to be so desperate I’d tentatively rate it a “buy” for the duration of this pandemic.

Similarly, British American Tobacco, whose stock was bolstered last week by multiple ironies. On 1 April “BATS” declared its biotech side in the US was working on a plant-based Covid-19 vaccine, going from healthcare pariah to hipster saviour, and on April Fool’s day.

Management claims “tobacco plants offer the potential for faster and safer vaccine development,” although mind it is on a said not-for-profit basis, though could potentially be a valuable public healthcare coup versus future regulatory constraints.

So the stock market is right to acknowledge a potential net benefit, although BATS’ overall net rise from 2,380p on 23 March to around 2,950p today more likely reflects a relatively safe yield – now around 7.6%, according to forecasts, covered nearly twice by free cashflow last year.

Net gearing is around 66%, although a bankruptcy risk score of 1.6, similar to Imperial, flags risk of financial distress in the next two years.

Source: TradingView Past performance is not a guide to future performance

So, tobacco stocks are quite like supermarkets during this pandemic: a thematic trade while the climate of fear lasts, and for relatively dependable income, if likely to see some reversal of this bias after “peak war” versus Covid-19.

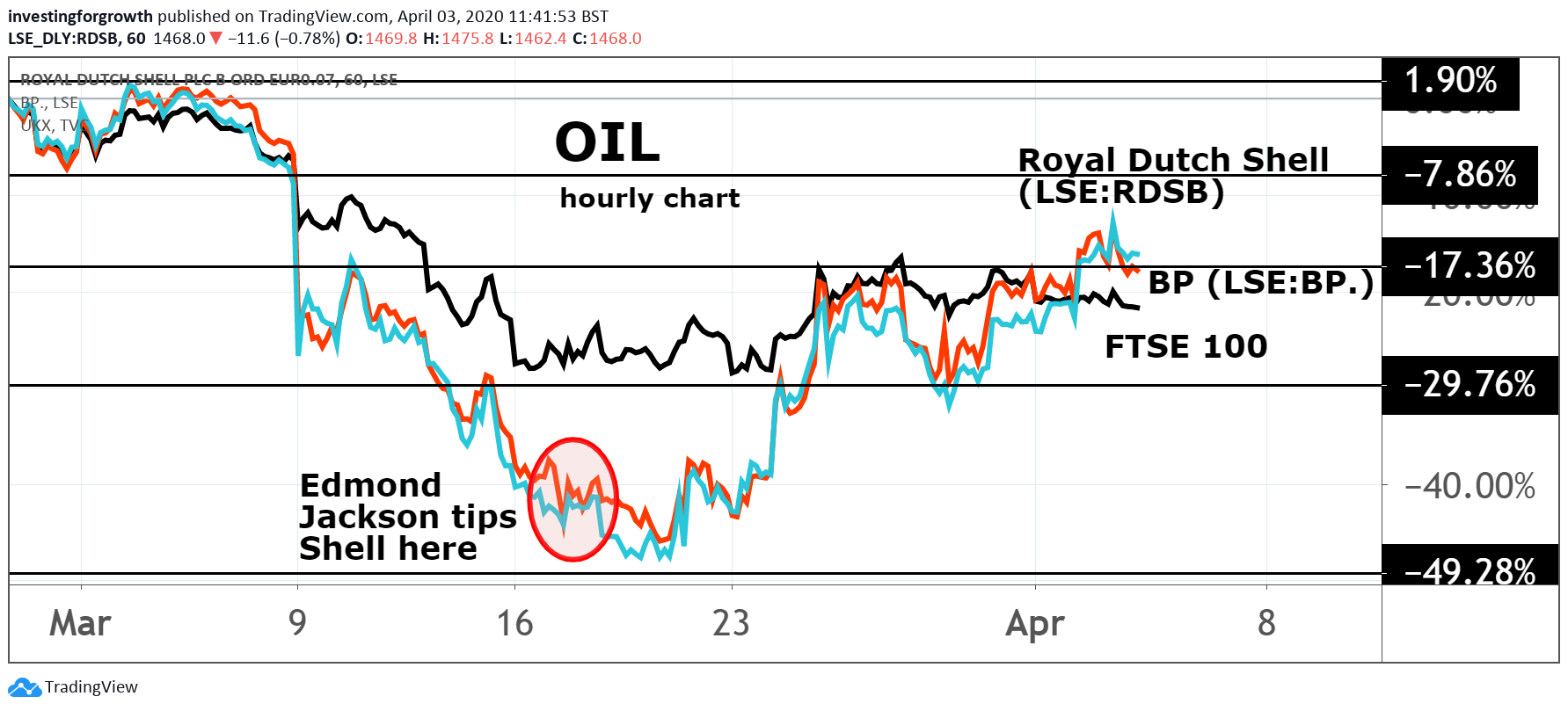

Dividend hopes for Shell, boosted by QE and fresh credit

Potentially, the big integrated oil companies are a more durable long-term investment, although beware market values have just skewed with oil prices after President Trump tweeted that Russia and Saudi Arabia will agree production cuts.

As I described in making a “buy” case for Royal Dutch Shell “B” shares (LSE:RDSB) around 1,000p on 17 March, the oil price plunge bakes in a rebound as production capacity winds down – then oil demand recovers once travel restrictions are eased.

- Stockwatch: Can you trust Shell’s 15% dividend yield?

- Share trades that could have made you back a fortune

There have been forecasts not only of $10 a barrel oil, but negative oil prices in due course once storage overflows. Along the way, enough indebted explorers will get restructured, possibly to the detriment of shareholders, which has further encouraged switching to oil majors.

Goldman Sachs for example has now drawn attention to “big oil” maintaining its dividends in economic downturns, e.g. BP (BP.) only cutting its payout in response to the Gulf of Mexico oil disaster in 2010. “We expect this to be the case in the current downturn as well, with improved balance sheet resilience and strong capital discipline further supporting cashflow preservation and dividend preservation,” Goldman says.

I question that, however, lest serial lockdowns persist globally, potentially into 2021 before there’s any widely available vaccine. Moreover, a second wave of the virus is possible according to the 1918 precedent, with no assurance that “passport holders” would be immune. In truth, there is no certainty and no precedent of shutting down global transport.

Shell shares rose this week, partly on news buried towards the end of last Tuesday’s first quarter 2020 update, about how a new $12 billion revolving credit facility has been agreed - additional to a $10 billion facility signed last December – taking available liquidity over $40 billion (when considering cash reserves around $20 billion).

This wasn’t cited in relation to the dividend, but it shows how sentiment is so yield-obsessed that the update was interpreted wholly in terms of the credit facility underwriting a $1.88 (£1.52) total dividend, for now, I would say.

Source: TradingView Past performance is not a guide to future performance

Compare this with Shell’s 2019 cash flow statement showing around $16 billion going out annually in the last two years, as dividends.

So, yes, the extra borrowing availability can be seen as bridging finance, enabling flexibility to maintain a circa $1.88 dividend – hence a prospective yield around 10% at the current share price of 1,540p.

It is also a weary reminder of how ultra-low interest rates and successive rounds of QE are manifesting perversions. I show my age, recalling times when boards would buckle down, cut the dividend, prioritise lower debt to enable investment for the eventual upturn.

Reassessing my stance on Shell

It is tricky to assert stances currently when stocks are so volatile, and when their underlying values are a moving feast. Shell comfortably breached 1,500p yesterday.

But I would adjust my stance from “buy” to “hold” on current evidence, and potentially to a trading “sell” if Covid-19 disruption drags on. The flip-side of a few elite stocks being perceived as yield havens, is an opposite reaction on the downside (in chart terms) if dividend assurances crack.

Arguably, the likes of Shell and BP (LSE:BP.) should, for genuine long-term shareholder value, now be cancelling dividends as a pre-emptive measure both to de-gear and bolster their green energy credentials – using the setback for oil demand to re-invent themselves.

Of course, that’s far less how capitalism works: shareholders demand dividends and boards are in a classic “agency” dilemma where remuneration links to share prices – hence dividends are maintained by almost any means.

But in a scenario where Covid-19 drags on, of yet more government intervention, Trump voted out with a different – more environmental-conscious– political economy emerging, it is by no means impossible that government dictates such priorities to the oil industry.

I make conjecture, if only to show how investors must now think laterally from old assumptions.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.