Stockwatch: why this popular sector is not a one-way bet

Since Labour won the election last month, there’s been a belief that policies will provide a boost to this sector. Analyst Edmond Jackson studies the risk/reward profile of this FTSE 250 company.

13th August 2024 10:00

by Edmond Jackson from interactive investor

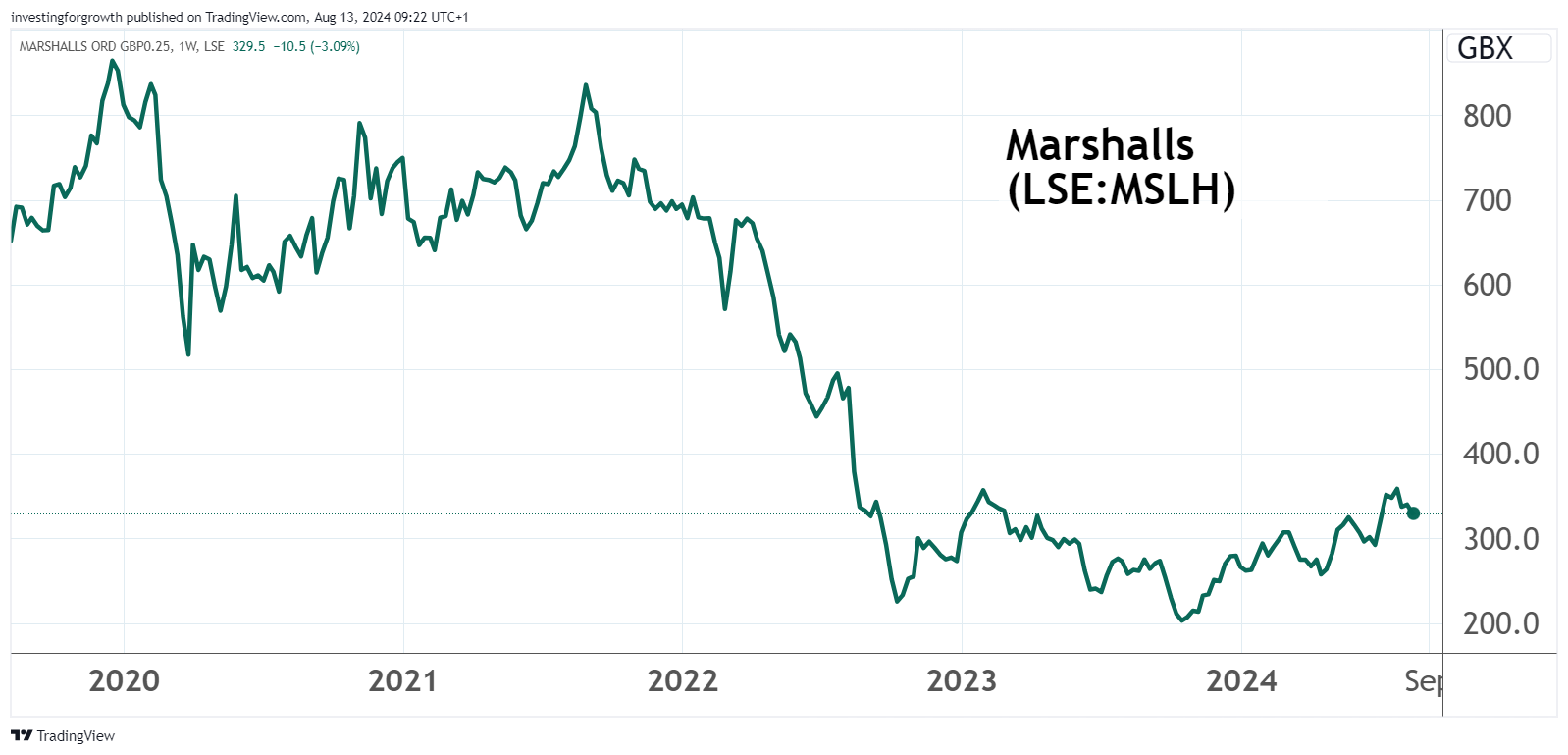

Building products group Marshalls (LSE:MSLH) shows how construction and housebuilding-related shares are more complex than their re-rates since the election of a Labour government imply.

At the start of July, this mid-cap stock traded around 290p, similar to when I last examined it in May 2023. Back then, consensus forecasts implied a 12-month forward price/earnings (PE) ratio around 12x and a dividend yield covered just over twice by expected earnings. I described this as “pretty much what you might expect of a quality cyclical, possibly at the early stage of business slowing”. I concluded with a “hold” stance amid reasons to take comfort albeit risk of a persistent slowdown.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

The stock bottomed last October just below 200p and its jump to near 360p amid expectations and reality of a Labour landslide, maintains a volatile uptrend. The sense has just recently been that Labour’s housebuilding priorities imply cyclical upturn ahead for builders and materials supply. Yet civil construction hopes have already been quashed as the new chancellor got to grips with the UK’s constrained public finances. Marshalls’ interim results yesterday saw a further 2% drop to 335p.

Source: TradingView. Past performance is not a guide to future performance.

Management asserts the likely 2024 outcome as “broadly in line” and, while this could imply a bit of slippage from consensus numbers, guidance for those was probably conservative anyway. So, taking them with a pinch of salt, Marshalls is currently on 21x likely 2024 earnings per share (EPS), easing to 18x for 2025 – assuming an 18% EPS advance that year, respecting a new chief executive’s optimism and this group’s operational gearing.

Unlike various builders, however, the prospective yield is only around 2.5% and the stock trades at nearly 10x tangible book value. I think the market is being respectfully generous of Marshalls’ operational gearing leaving no room for disappointment. The current assumption appears to be that the stock’s underlying value can “grow into” a seemingly high market value, as a CEO of six months prepares to unveil a new strategy on 19 November.

The company said: “The review is helping identify opportunities to leverage our diversified portfolio and create greater value and returns over the medium term. This will extend beyond our core landscape and roofing businesses into increasingly attractive, sustainability-driven end markets across bricks and masonry, water management and energy transition.”

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- The taxes Labour might hike in its first Budget

Those latter two activities imply relative sustainability if concurring with Labour’s agenda for water companies and “making Britain a clean energy superpower.” Bricks and masonry align with government housebuilding plans if remaining essentially cyclical.

It makes strategic sense, hence a “hold” stance is justified again by UK macro prospects and management actions. Marshalls already describes itself as “the UK’s leading hard landscaping, building and roofing products – from paving to drainage, bollards to roof tiles.”

But it’s still not clear whether the market valuation tips in favour of “buy”?

Contradicting recent UK purchasing manager indicators

While the PMI indicators have consistently been above 50 – implying expansion for the UK construction industry in a 0 to 100 context – Marshalls’ first-half 2024 numbers deny them.

Revenue is down 3% to £307 million and operational gearing (revenue changes amplified in profit) means profit measures are down around 20% and earnings per share by 23% to 7.9p. The adjusted operating margin has eased from 11.8% to 11.1%, albeit still good. The interim dividend is held at 2.6p per share but is anyway a modest portion of around 8p expected for the full year.

Trade payables as a percentage of interim turnover have risen from 43.5% to 45.5%, but could simply be timing issues relative to the change in turnover rather than any deliberate attempt to check the profit fall by delaying payments.

The landscape side (45% of revenue, albeit 29% of revenue/profit) was affected most, with revenue down 21%, said to be a result of weakness in new-build housing and some loss in market share. It appears to show housebuilding still pressured by demand (linked to affordability) rather than “landscape” implying discretionary spend on garden makeovers and the like.

- Stockwatch: four stocks to back a UK building boom

- Trading Strategies: FTSE 100 volatility is a buying opportunity

Otherwise, building products (27% of revenue, 22% of profit) eased 6% and roofing (29% of revenue, 80% of profit) by 5%. Demand related to new-build housing and repair, maintenance and developments (RMI) has been particularly weak, albeit commercial and infrastructure demand is relatively robust.

While the 2022 acquisition of Marley pitched roofing supplies for £535 million appeared late-cycle and (consequently) high-priced, it has affirmed the diversification strategy – providing a bulwark for profitability

Marshalls said: “The board remains cautiously optimistic of a modest recovery in its end markets during the second half of the year predicated on a progressive improvement in the macro-economic environment.”

That appears to justify consensus for annual net profit to more than double this year to £40 million, after £16 million has been achieved in the first half. It’s pencilled in £47 million for 2025.

Various factors justify high rating for a cyclical stock

Major adjusting charges are gone from the accounts, despite the risk a new CEO can involve “kitchen sinking”. After £30 million adjusting items in respect of 2023, split equally between the half years, they are down to £5 million, with no restructuring or impairment charges. It conveys a break with the past rather than turnaround issues dragging on.

Net debt has continued downwards from £185 million mid-2023 to £173 million end-2023 and £156 million mid-2024, the net interest charge reducing from 38% of interim operating profit to near 25%.

While adjusted return on capital employed has slipped from 10.6% a year ago to 7.6% due to weaker trading, management estimates around 15% in the medium term – based on a recovery in market conditions plus operational leverage.

The table shows how, when return on total capital was 17-18% in 2017 to 2019, Marshalls made net profit in the region of £50 million and more, with EPS accelerating through the 20p range. If this is approximated to, once again, the PE reduces to mid-low teens.

Marshalls- financial summary

Year end 31 Dec

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 430 | 491 | 542 | 469 | 589 | 719 | 671.0 |

| Operating profit (£m) | 53.4 | 64.8 | 73.7 | 9.4 | 76.2 | 47.9 | 41.0 |

| Net profit (£m) | 42.5 | 52.0 | 58.2 | 2.4 | 54.8 | 26.8 | 18.6 |

| Operating margin (%) | 12.4 | 13.2 | 13.6 | 2.0 | 12.9 | 6.7 | 6.1 |

| Reported earnings/share (p) | 21.3 | 26.0 | 29.0 | 1.2 | 27.2 | 11.3 | 7.3 |

| Normalised earnings/share (p) | 21.7 | 26.3 | 29.5 | 11.2 | 27.7 | 33.1 | 23.7 |

| Operational cashflow/share (p) | 28.7 | 31.6 | 43.9 | 6.2 | 32.6 | 36.1 | 30.6 |

| Capital expenditure/share (p) | 10.3 | 14.6 | 11.4 | 7.3 | 10.9 | 12.7 | 8.2 |

| Free cashflow/share (p) | 18.4 | 17.0 | 32.5 | -1.1 | 21.7 | 23.3 | 22.4 |

| Dividend per share (p) | 14.1 | 15.9 | 4.7 | 4.3 | 14.3 | 15.6 | 8.3 |

| Covered by earnings (x) | 1.5 | 1.6 | 6.2 | 0.3 | 1.9 | 0.7 | 0.9 |

| Return on total capital (%) | 17.5 | 17.4 | 18.4 | 2.1 | 17.1 | 4.6 | 4.2 |

| Cash (£m) | 19.8 | 45.7 | 53.3 | 104 | 41.2 | 56.3 | 34.5 |

| Net debt (£m) | 24.3 | 37.4 | 60.0 | 75.6 | 41.1 | 237 | 218 |

| Net assets (£m) | 236 | 266 | 295 | 287 | 343 | 660 | 641 |

| Net assets per share (p) | 118 | 132 | 147 | 143 | 171 | 261 | 254 |

Source: historic company REFS and company accounts.

Call me conservative but I note how a Bank of England rate setter on its monetary policy committee, expressed yesterday that UK inflation could rise again soon due to firm inflation within services, cancelling out a recent lowering of wider inflation due to lower energy prices.

It appears the wider consensus is very much for a series of interest rate reductions to manifest in the US from September; and even if the UK passes on another then, the trend in rates will be downwards.

- Massive UK tax grab would be biggest of its kind in Europe

- Watch our video: The shares and sectors we are backing under Labour

If you are convinced that inflation will fall to central banks’ 2% target due to the accumulated effect of higher interest rates on the wider economy then, yes, it is logical to buy building related equities now.

I am cautious as to that being achieved, and also about Labour’s grand plans, unless radically-raised housing supply improves affordability – which it will need to, unless mortgage rates fall.

I therefore maintain a “hold” stance, acknowledging that the risk/reward profile favours upside. Marshalls exemplifies, however, how the story on UK building is more complex than assumed, and not strong enough yet to assert “buy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.