Stockwatch: why I’m upgrading this small-cap share

Trading at the lowest levels since summer 2020, and while a riskier investment, this company offers assets at a discount and could be a sitting duck, believes analyst Edmond Jackson.

21st January 2025 12:31

by Edmond Jackson from interactive investor

It looks a significant week for the “luxury” sector by way of trading updates from Sanderson Design Group Ordinary Shares (LSE:SDG) interior furnishings – nowadays a mere £34 million AIM share in interior home furnishings – and more significantly mid-cap Burberry Group (LSE:BRBY), which at £3.5 billion will update investors on Friday.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

The Christmas period trading will be a significant test of a new CEO since last July and where the chart appeared to put in a 580p low last September:

Source: TradingView. Past performance is not a guide to future performance.

Comparison between the two companies is interesting, both in terms of whether adept marketing can offset a challenging macro context, and if it is true to say “the rich are different” and willing to maintain spending when the pitch is right. When Sanderson was known as Walker Greenbank pre-2020, it traded resiliently throughout the 2008 financial crisis.

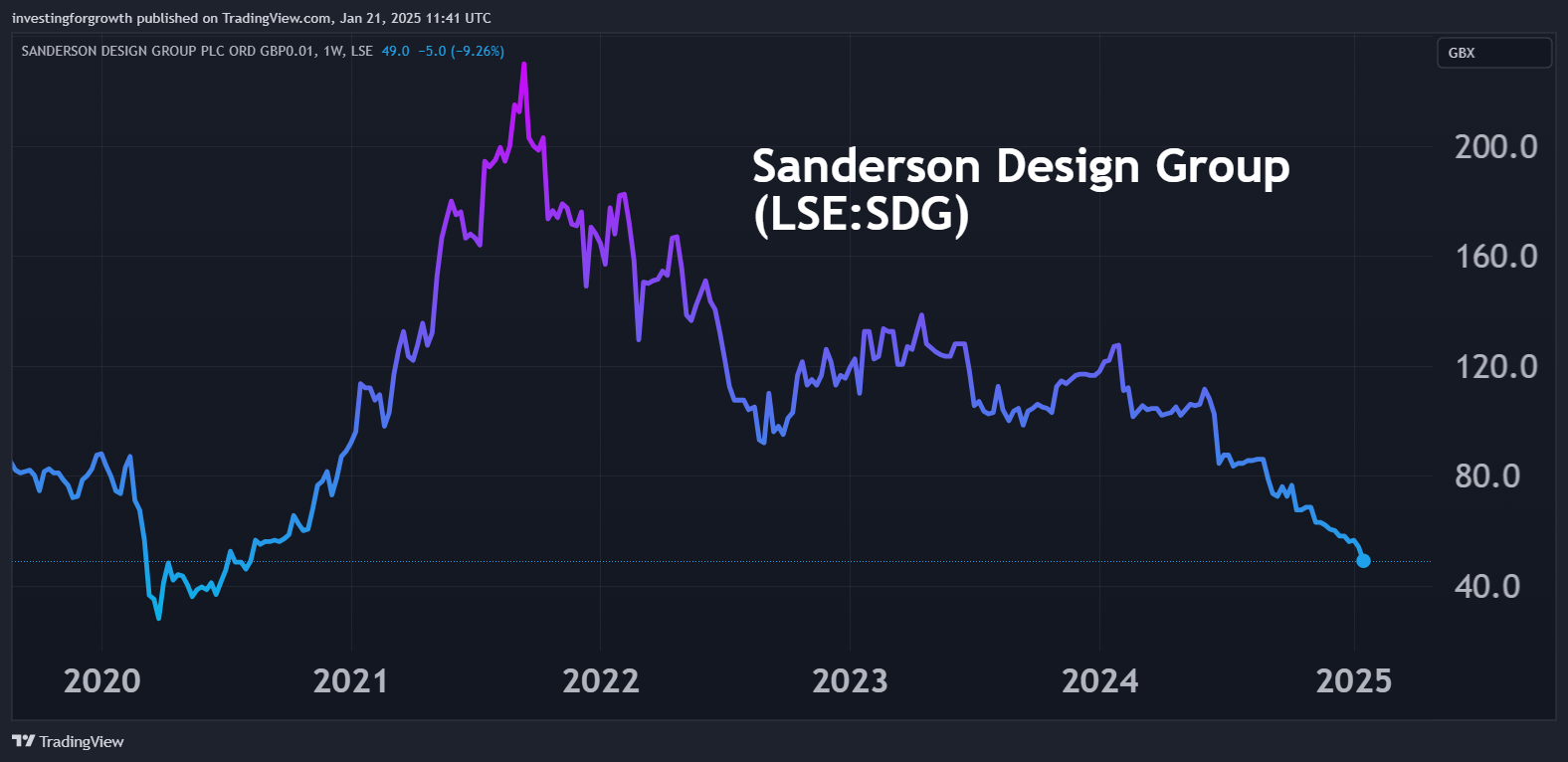

Yet its shares were a roller coaster during and since the Covid lockdowns, triggered partly by a sudden craze for re-locating to the countryside – often requiring big homes to be refurbished – and also speculation in small-cap shares. Possibly a reversal of “working from home” towards people seeking smaller urban homes, may help explain Sanderson’s current predicament.

Source: TradingView. Past performance is not a guide to future performance.

Whether or to what extent managerial issues are involved – for example, designs - Sanderson has been suffering to an extent that its shares at around 48p trade below 0.6x tangible asset value. Remarkably, it is below the £42.5 million the group paid for just one business in its portfolio, Lancashire-based Clarke & Clarke, in 2016. This potentially flags “deep value”, minding that business assets are worth what they can earn.

Sanderson is also relevant as reflecting a current slide in UK consumer confidence despite a strong UK housing market just lately, according to Rightmove (LSE:RMV). Sanderson cites an overall 5% slip in group sales expectations for its year to 31 January. However, brand product sales are down 9% and, despite a 5% like-for-like recovery in December, the first two weeks of January are down 13%.

Can UK consumer confidence recover from latest cliff fall?

This tallies with the S&P Global UK consumer sentiment index falling sharply this month to a 12-month low of 43.6 from 46.6 in December, as households saw the biggest deterioration in their finances since August 2023.

Financial well-being is taking a hit across all income levels and, notably in terms of “luxury”, buying sentiment among high-earning households has turned negative for the first time in nearly a year. Spending on major purchases is being drastically curtailed, and appetite for buying expensive goods is falling at the fastest pace in a year and a half.

- Insider: over £500k spent on these big stocks at 5-year low

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

A key question for Sanderson’s fortunes – indeed other UK “luxury” suppliers – is whether this marks a post-Christmas lull while spending on holidays is being maintained, or is likely to fester in 2025. A crux would be whether Chancellor Rachel Reeves can navigate UK public finances through constraints or whether further tax rises are inevitable – amid Labour rhetoric of “the broadest shoulders supporting the heaviest burden”.

Extent of potential US tariff net is key for exporters

Sanderson’s sales are 55% UK-driven, the rest international, with the US constituting 30% of total brand product sales. The company cites “softness in the contract market at the end of the year, particularly in North America” but my main concern is what possible extent of tariffs may be applied – and how selectively or general they might be.

President Trump has so far been merciful not to assert a 10-20% general tariff on US imports – as was a key election pledge. The likes of Sanderson and other smaller UK exporters especially, need that like a hole in the head given that they tend to be operationally geared.

This is shown by the way underlying pre-tax profit guidance has been cut to £4.0 million from £4.8 million, implying median earnings per share of 4.6p, hence a trailing price/earnings (PE) multiple just over 10x and a circa 3% yield if the dividend expectation is halved to 1.2p a share.

The update did not cite dividends (could be premature anyway), but the trend in net cash has fallen from £16.3 million nearly a year ago to £9.6 million at 31 July and around £5 million expected now. Capital will be required if higher inventory persists, after £3 million of recent capital expenditure and one-off £2.3 million pension contribution last June.

A sitting duck for takeover

A private equity-type operator might figure that a change of leadership together with fresh designs could re-invigorate Sanderson, although in fairness its woes are relatively recent, and its financial history has been relatively consistent until just lately:

Sanderson Design Group - financial summary

Year end 31 Jan

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 87.8 | 92.4 | 112 | 113 | 112 | 93.8 | 112 | 112 | 109 |

| Operating margin (%) | 9.3 | 8.3 | 11.8 | 5.2 | 4.3 | 5.4 | 9.2 | 9.5 | 9 |

| Operating profit (£m) | 8.2 | 7.7 | 13.2 | 5.9 | 4.8 | 5.1 | 10.3 | 10.6 | 9.7 |

| Net profit (£m) | 5.9 | 5.4 | 11.9 | 4.4 | 3.8 | 3.8 | 7.8 | 8.8 | 8.2 |

| Reported earnings/share (p) | 9.5 | 8.1 | 16.8 | 6.2 | 5.2 | 5.3 | 10.8 | 12.3 | 11.3 |

| Normalised earnings/share (p) | 13.8 | 25.0 | 21.6 | 10.1 | 7.0 | 5.9 | 12.6 | 14.6 | 14.1 |

| Operating cashflow/share (p) | 10.3 | 15.0 | 6.4 | 16.3 | 11.5 | 25.1 | 12.5 | 8.3 | 12.6 |

| Capex/share (p) | 4.1 | 10.2 | 4.9 | 4.2 | 3.5 | 1.5 | 3.0 | 6.7 | 4.5 |

| Free cashflow/share (p) | 6.2 | 4.8 | 1.4 | 12.0 | 8.0 | 23.6 | 9.5 | 1.6 | 8.1 |

| Dividend per share (p) | 2.9 | 3.6 | 4.4 | 3.2 | 0.5 | 0.0 | 3.5 | 3.5 | 3.5 |

| Covered by earnings (x) | 3.3 | 2.2 | 3.9 | 1.9 | 10.0 | 0.0 | 3.1 | 3.5 | 3.2 |

| Return on Total Capital (%) | 20.6 | 11.9 | 18.7 | 8.2 | 6.2 | 6.6 | 12.2 | 11.9 | 10.5 |

| Return on Equity (%) | 12.4 | 21.1 | 7.1 | 5.9 | 5.8 | 10.6 | 11.0 | 9.8 | |

| Cash (£m) | 2.9 | 1.5 | 1.3 | 2.4 | 3.1 | 15.5 | 19.1 | 15.4 | 16.3 |

| Net debt (£m) | -2.3 | 5.3 | 5.3 | -0.4 | -1.3 | -9.3 | -15.1 | -10.3 | -11.2 |

| Net assets per share (p) | 58.6 | 73.7 | 87.2 | 85.8 | 91.3 | 94.1 | 112 | 114 | 121 |

Source: Historic company REFS and company accounts.

There is no debt beyond £11.6 million of leases, but until there is turnaround in sales prospects it would be reckless to gear this company up anyway. Another option would be raising cash through a break-up, although it’s unclear who would be interested in specific brands and/or manufacturing. Sanderson’s licensing side has recently shown good momentum but is a smaller aspect of revenue at possibly £10.5 million, while in manufacturing orders, expectations of an improved trading environment have not been realised, and have instead declined.

“Although there has been success in new business wins, this is for smaller print runs of new designs which are at lower margins owing to initial set-up costs,” the company says.

- Shares for the future: a top 5 stock that’s ‘absurdly cheap’

- Stockwatch: have housebuilding shares put in a low?

On an embedded value basis, now would be the time to buy – or start averaging in, as a portfolio investor – given the extent of assets’ discount. But whether shares or the whole company, a purchaser has to be steeled for the story to worsen as UK tax rises on affluent people, combined with Trump tariffs, could be disastrous. The decision/rating is therefore substantially beholden to risk appetite.

I last wrote about Sanderson in October 2022, concluding with a “hold” stance and suggesting to wait for a downturn to manifest before buying. That is under way, but it’s not clear how much further it has to go.

At least Sanderson is not so exposed to the US as Colefax Group (LSE:CFX)where 60% of its fabric sales go to the US, this division constituting 84% of group sales in the year to 30 April 2024. Colefax does not appear to be suffering to the extent of Sanderson’s woes, but it has not updated since its 26 September AGM statement cited the core fabric division slightly softer, with US sales up 5% but the UK down 12% and Europe by 2%.

Colefax could easily be affected by the latest January cutbacks in spending even if it had a decent autumn selling season. Last year’s interim results (to 30 October 2023) were published on 30 January, hence the numbers will not be indicative, and current trading is key.

Relatively small director buying at Sanderson

Following the update, the chief executive added £15,000 worth of Sanderson shares at 48p and the chair nearly £10,000 worth at 47p. However, these looked modest relative to 2023 remuneration of £644,000 and £114,000 respectively. The global commercial director has bought £5,000 worth at 48p. This appears consistent with my interpretation of how embedded value exists, yet near-term uncertainty remains as to how deep and long this sudden 2025 downturn could extend.

I upgrade to “buy” on a long-term basis, and on the assumption that this kind of spending will recover, and Sanderson can refresh its market positioning – whether or not under existing management. Be aware that it is very hard to predict the UK and US risk scenarios, and Sanderson’s figures will suffer more in the event of a “double whammy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.