Stockwatch: why I worry about a shift in takeover trends

An army of overseas companies have invaded these shores in recent years, looking for undervalued businesses to buy. Analyst Edmond Jackson has spotted one company that’s too cheap.

10th December 2024 11:07

by Edmond Jackson from interactive investor

It feels like 2024 has seen a big increase in “possible” takeover offers for UK listed companies which boards – even independent directors – may agree to. Furthermore, it seems there’s a view that the London stock market is no longer fit for purpose in terms of financing growth companies: managers would seemingly rather be under private equity ownership for development capital.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

This is a far cry from the 1980s, for example, when firm, indeed often “hostile”, takeovers would burst on the scene, and privatisations boosted popular capitalism such that each week would herald newspaper application forms for exciting flotations.

Possible offers can favour offerors not shareholders

Such approaches for contractor John Wood Group (LSE:WG.) became quasi-comic, where three such “possible” offers were made but nothing materialised. It does look as if the possible offer for Direct Line Insurance Group (LSE:DLG) by Aviva (LSE:AV.) will become real by Christmas, otherwise Aviva loses credibility, leaving the question about whether a combined 20% share of UK motor insurance is approved by the competition regulator.

In some respects, declared “possible” offers are an advance in terms of disclosure, from bid approaches being dealt with covertly. Some directors say it would create a chaotic market if they had to disclose every single approach, albeit frustrating to investors to see a share rising for no apparent reason on higher volume, then a takeover be presented as a fait accompli.

Yet this shift towards “declared possible” offers is creating a situation potentially weighted towards buyers. They can then request more detail on the business, for example via access to a “data room” and engage directors for weeks – taking their eye off the ball and running up advisory fees, ultimately at shareholders’ expense.

- Income Investor: lower-yielding stocks with dividend appeal

- Insider: director deals include this recovery play

It still seems that with the London market struggling to value some firms like private owners do, “possible” offers will remain a key feature for 2025.

Learning Technologies: outstanding example of cheap recommended deals

A “possible” offer kicked off for AIM-listed Learning Technologies Group (LSE:LTG) at the end of September. This group has periodically been valued by the market at over £1 billion and describes itself as “a global market leader in learning and talent services...helping organisations transform through their people” by means of “services, content, software and platforms”.

Its business model is software-as-a-service or Saas, which lends itself well to long-term recurring revenues, and such company boards normally argue that they should be rated more highly. Three-quarters of LTG’s revenues are derived like this. Margins and free cash flow are respectable.

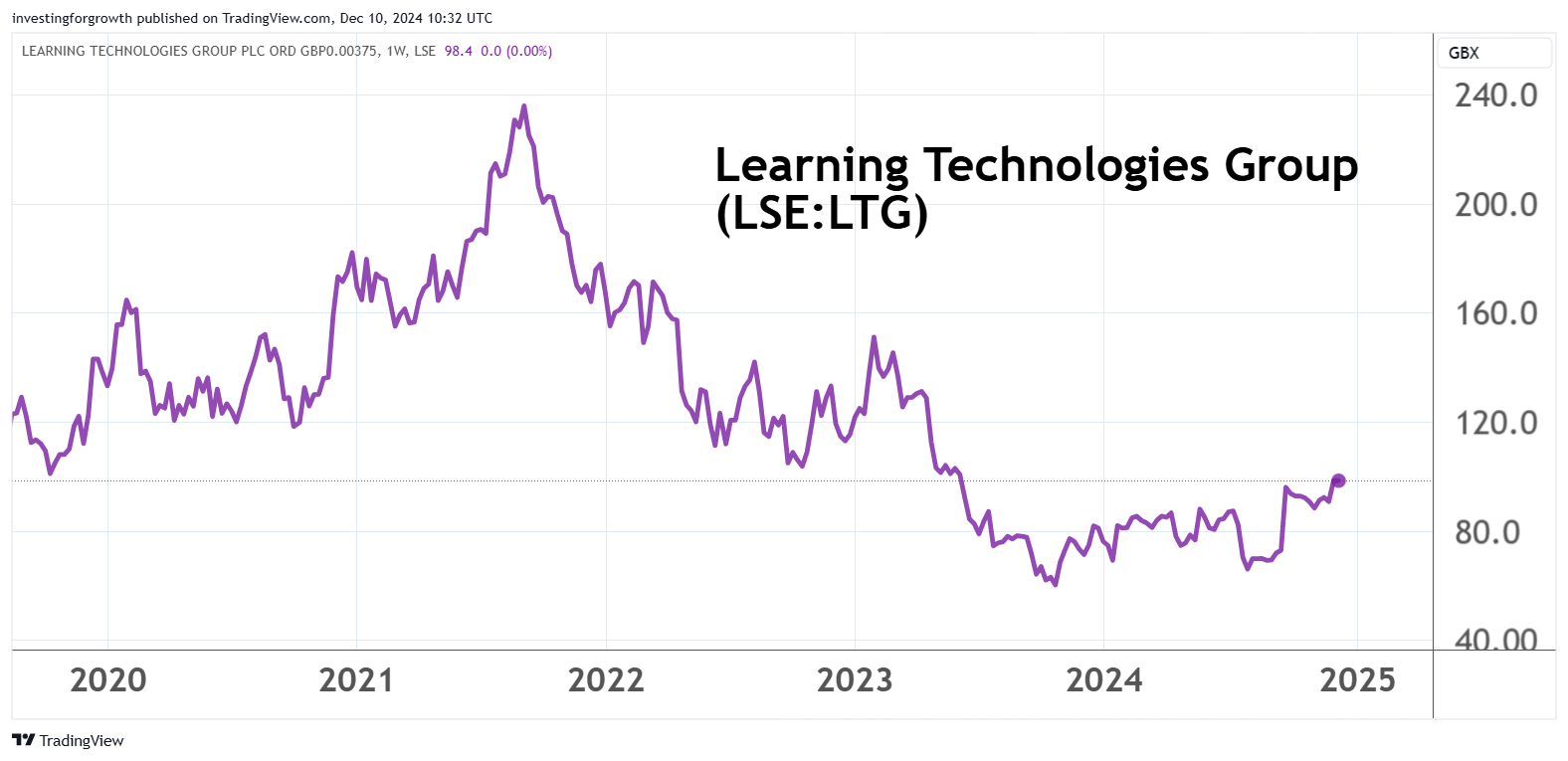

Admittedly, the share’s performance since listing in 2011 at 57p a share does not equate with that of a “growth company”, but there has not been the kind of downside that AIM shares can be notorious for. LTG breached 100p only in 2018 after which it tested 230p amid the Covid lockdown share boom. There was then a downtrend to 63p by October 2023:

Source: TradingView. Past performance is not a guide to future performance.

It is a frustrating disparity between performance of the shares versus underlying business, given its last six years’ progression quite reasonably projects LTG into a growth company league. After a challenging macro context in the last two years, amid inflation and disruption from artificial intelligence (AI), consensus expects net profit of around £58 million in respect of this year and £63 million in 2025. Implied earnings per share (EPS) would be around 7p and 7.5p respectively.

Learning Technologies - financial summary

Year-end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 93.9 | 130 | 132 | 258 | 589 | 562 |

| Operating margin (%) | 1.4 | 12.6 | 11.2 | 4.5 | 8.6 | 10.4 |

| Operating profit (£m) | 1.3 | 16.4 | 14.9 | 11.5 | 50.4 | 58.7 |

| Net profit (£m) | 4.2 | 10.9 | 17.4 | 14.9 | 30.4 | 29.5 |

| EPS - reported (p) | 0.6 | 1.6 | 2.4 | 1.9 | 3.7 | 4.0 |

| EPS - normalised (p) | 1.6 | 2.0 | 2.8 | 3.3 | 5.0 | 4.6 |

| Operating cashflow/share (p) | 3.0 | 5.4 | 5.5 | 4.7 | 8.8 | 9.7 |

| Capital expenditure/share (p) | 0.6 | 0.9 | 0.9 | 1.1 | 1.4 | 1.7 |

| Free cashflow/share (p) | 2.4 | 4.5 | 4.6 | 3.6 | 7.4 | 8.0 |

| Dividends per share (p) | 0.5 | 0.8 | 0.8 | 1.0 | 1.6 | 1.7 |

| Covered by earnings (x) | 1.3 | 2.1 | 3.2 | 1.9 | 2.3 | 2.4 |

| Return on total capital (%) | 0.6 | 6.6 | 4.6 | 1.9 | 7.9 | 10.3 |

| Cash (£m) | 26.8 | 42.0 | 88.6 | 83.9 | 94.8 | 72.5 |

| Net debt (£m) | 11.5 | 8.1 | -60.0 | 163 | 135 | 90.0 |

| Net assets (£m) | 170 | 176 | 269 | 371 | 426 | 427 |

| Net assets per share (p) | 25.6 | 26.3 | 36.4 | 47.2 | 54.0 | 54.0 |

Source: company accounts.

Notionally, you might expect an exit price/earnings (PE) multiple to be at least 15x plus a premium for control – implying something like 130p a share. Yes, LTG traded down to 70p late last summer but then so did plenty of mid to small-cap shares. Currently we are seeing re-ratings in the order of 10% to 20% - just look at charts - and there have takeovers aplenty this year.

So, it is understandable that at least one fund manager has vented frustration about how LTG’s independent directors are recommending an offer at 100p a share, announced on 4 December.

There is an option to accept unlisted “rollover” shares, which on the face of it could work out well; new owner General Atlantic is a US private equity group with a strong track record. Founded in 1980, it has $67 billion (£52 billion) invested in over 640 growth companies with a technology bias.

But this looks like another example of American capital picking up listed British companies on the cheap.

The standard game plan with such financiers is to enhance performance such that maybe five years hence, the business gets sold to a trad buyer who may also pay a premium for synergistic benefits.

So, it is understandable that LTG’s directors feel this is a more intelligent way forwards than remaining listed: the chair will roll over his 15% stake this way, the CEO his 9% stake.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- 2025 – is the future DIGITAL?

Yet fund managers are unlikely to be able to hold such “rollover” shares if their mandate is for listed securities.

The same applies to individuals with shares held in nominee accounts where complications could arise if the set-up cannot cope. As a last resort, best to ensure LTG could be certificated.

In which case, the independent directors are significantly failing in their duty to the existing owners, who are being treated merely as stakeholders with the business as first priority.

It would also affect commentators like me, where a platform is overseen by the Financial Conduct Authority (FCA). An expectation is that the security involved be listed – thereby providing liquidity, hence a limit on financial risk.

Yet for experienced investors, buying in the market at around 98p before de-listing - and tucking away for however long it takes - has intrigue. US private equity is not interested in a few per cent gains; it leverages value often with a hands-on approach besides capital. Moreover, a Warren Buffett adage is properly to buy shares on the basis the market might close down the next 10 years. I dare say General Atlantic will crystallise a gain for shareholders before then.

It would be possible to follow progress by downloading accounts from Companies House, fostering a better perspective on LTG’s intrinsic value than the shares’ volatility.

Bottom line: a leading US private equity house perceives value at 100p and scope exists to tag along with what they do.

Not even LTG’s advisers and independent directors back this offer

The advisers - one leading US investment bank (therein another surprise) and German-owned bank - are not prepared to advise LTG’s independent directors that a 100p per share is fair and reasonable. It’s said to be due to significant and variable upshots for private shareholders (as I have alluded to) and also the advisers not being party to financial projections.

It does rather conveniently exonerate the independent directors from giving any opinion.

Quite whether a shareholder rebellion ensues is unclear; more likely is a quiet, if possibly frustrated, acceptance by most. Without doubt, it is another setback in the London stock market’s standing as a beacon for growth company financing.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.