Stockwatch: why I rate this exciting gold share a buy

As the price of gold continues to rise, this special situation has grabbed the attention of analyst Edmond Jackson, attracted by radically improving fundamentals.

15th April 2025 10:52

by Edmond Jackson from interactive investor

Gold continues to explore record highs from around US$2,000 per ounce in early 2024 towards $3,250 currently, adding around 1% yesterday and 0.2% early today despite stock markets rallying over the past 36 hours.

This underlines gold as a hedge against uncertainty in general, not simply episodes such as a week ago when risk assets took a big hit amid shock events. Yesterday saw most shares enjoy a relief rally, the apparent catalyst being Trump sparing technology from “reciprocal” tariffs despite also signalling this as temporary. Perhaps traders were simply due a mood shift of sorts.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Gold buyers recognise there is no capable check on Trump for the next four years beyond the US Treasury bond market selling off when his actions get truly bad. Yet the 10-year Treasury yield is back around 4.5% – where it should be – and there are still big taxes on consumers and businesses (by way of tariffs) and no one has a clue what stunt Trump could pull next.

Yes, technically gold looks overbought and is chiefly due to sentiment boosting demand rather than fundamentals of practical use.

Source: TradingView. Past performance is not a guide to future performance.

One way to engage this risk/reward conundrum for gold, however, is via mining shares able to benefit from the metal’s essential rerating – assuming that now lasts a few years – even it runs into short to medium-term volatility. Let us assume, for example, that gold does not drop below $2,500, at least for long.

This, I believe, is why the AIM-listed shares in Greatland Gold (LSE:GGP) have been the best performer on the junior market, up 145% from 6p mid-January. Higher gold prices should radically transform its loss profile, especially as production kicks in from two West Australian gold-copper acquisitions from Newmont Corp (NYSE:NEM) last December.

- Watch our video: Gold: what the mining experts say

- Watch our video: Five mining stocks to watch in 2025

- Watch our video: Mining stocks, Trump, tariffs, China and critical metals

- Watch our video: China and its grip on African mining

Despite a current share price of 14.2p mid-point, this £1.8 billion company has over 13 billion shares in issue, which hints at dilution over the near-20 years Greatland has been listed in London.

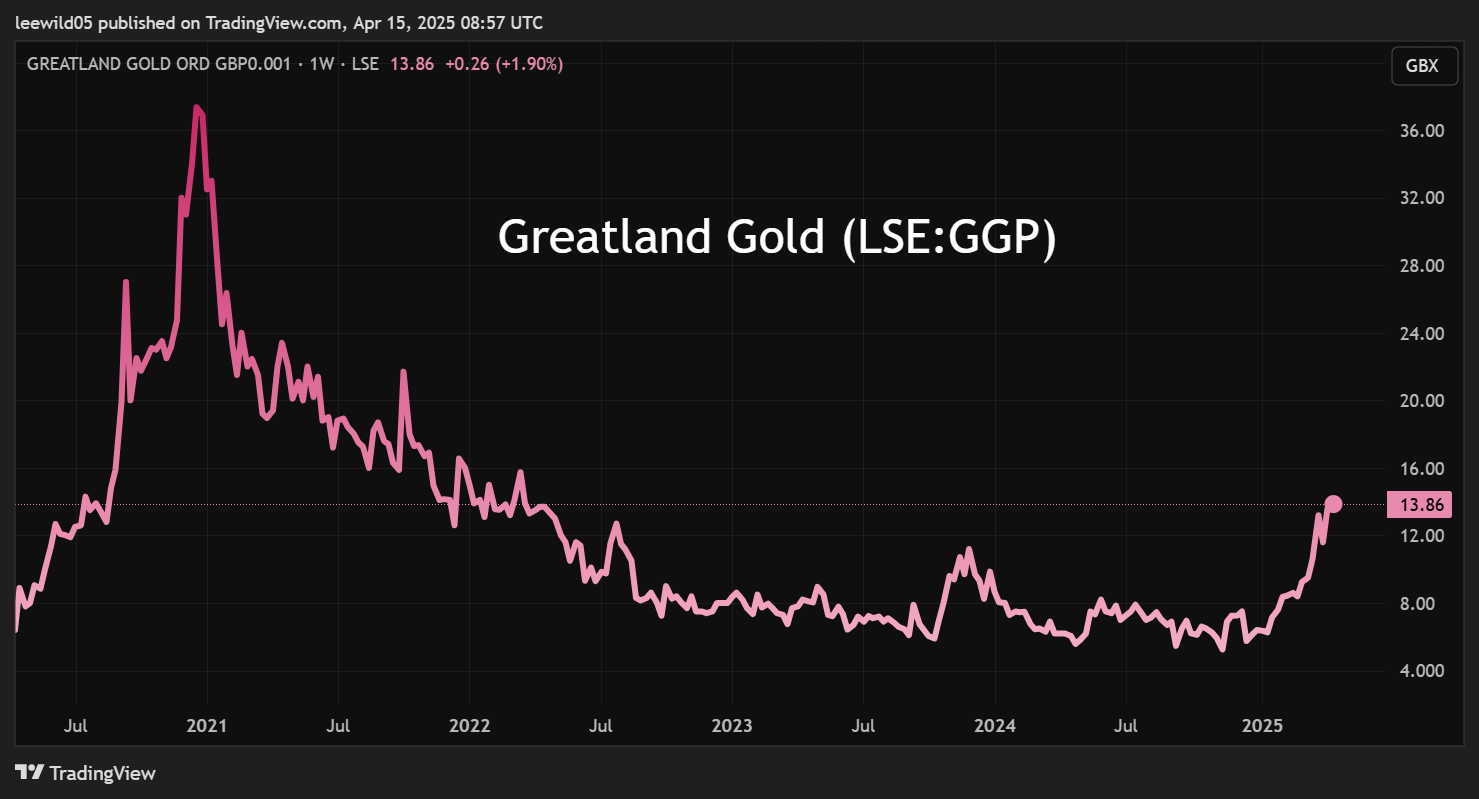

In a medium to longer-term context, the current rerating recovers some ground after prolonged falls following a pandemic-driven spike:

Source: TradingView. Past performance is not a guide to future performance.

Yet this time around the acquisitions plus high gold prices imply a radical change in Greatland’s financial record that otherwise portrays a highly speculative share, due to having been a pure explorer:

Greatland Gold - financial summary

Year-end 30 Jun

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Revenue (£ million) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Operating profit (£m) | -3.3 | -5.2 | -5.7 | -8.4 | -20.8 | -14.9 |

| Net profit (£m) | -3.3 | -5.1 | -5.5 | -11.4 | -21.1 | -14.9 |

| Reported EPS (p) | -0.1 | -0.1 | -0.1 | -0.3 | -0.4 | -0.3 |

| Normalised EPS (p) | -0.1 | -0.1 | -0.1 | -0.3 | -0.4 | -0.3 |

| Operating cashflow/share (p) | -0.09 | -0.13 | -0.07 | -0.15 | -0.24 | -0.24 |

| Capital expenditure/share (p) | 0.02 | 0.00 | 0.35 | 0.46 | 0.30 | 0.24 |

| Free cashflow/share (p) | -0.12 | -0.13 | -0.42 | -0.60 | -0.54 | -0.48 |

| Dividend/share (p) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Return on capital (%) | -141 | -90.9 | -27.7 | -16.6 | -21.6 | -17.6 |

| Cash (£m) | 2.8 | 6.0 | 10.4 | 18.8 | 43.7 | 6.3 |

| Net debt (£m) | -2.8 | -5.6 | 2.1 | 24.6 | -1.8 | 35.5 |

| Net asset value (£m) | 2.3 | 5.3 | 4.2 | 5.7 | 52.5 | 41.0 |

| Net asset value/share (p) | 0.1 | 0.1 | 0.1 | 0.1 | 1.0 | 0.8 |

Source: company accounts.

Completion of two acquisitions last December better balances the financial risk/reward profile because one – the Telfer mine – is already in production, with 2028 targeted for the Havieron project.

Consensus expects near £400 million revenue in the current year to 30 June 2025 and over £600 million to 2026. Net profit is tipped to kick in remarkably at over £100 million this fiscal year, then near £170 million to June 2026. Perhaps we should not be too surprised at the potential effect of rerated gold prices on miners given operational gearing is also a driver of profit.

Mind, such a scenario of earnings per share at around 0.43p and 0.5p implies a forward price/earnings (PE) ratio of around 30 times and there is no dividend. The end-2024 balance sheet (inclusive of the acquisitions) shows net assets just shy of £500 million, or 3.75p per share.

Greatland teases with positive updates this week

Yesterday, a quarterly review to end-March beat production expectations at Telfer by 21%, cited £122 million equivalent free cash flow plus mine-life extension opportunities. Guidance for the current year to 30 June involves gold production of 196,000 to 210,000 ounces, with an “all-in sustaining cost” of around £1,000 to £1,080/ounce equivalent.

Today, it upgrades Telfer’s two-year production outlook and cites Havieron ore processing to begin during the June 2028 financial year.

It’s unclear why a lot of detail could not have been integrated for one key announcement as there appears some overlapping; also, mind the production target for Telfer includes a cautionary statement about geological reliability.

From years if not decades past, I am inured to mining companies bombarding impressive updates thus feeding suspense with the story, which can indeed work well for the shares so long as financial proof supports it thereafter.

Amid record gold prices, you could say there has never been a better context for vigorous actions like the Greatland management is pursuing , such as tripling the number of underground drill rigs at Telfer to six.

It can look as if Newmont discarded these assets, but scavenging off majors and astute development actions is a proven strategy in the resources industry.

Mind, there is a way to go before profit dynamics get established as a genuine base for projections. Interim results to 31 December showed maiden revenue of £8.3 million and £2.8 million gross profit. Then, even normalising for £6.8 million acquisition and integration costs, there were £7.1 million administrative expenses and £2.4 million for exploration and evaluation. Net profit of £18.0 million – reflected also in the cash flow statement – benefited from a remarkable £22.2 million income tax benefit (from past losses), although £15.3 million of adverse currency translation dragged total income down to just shy of £1 million. All this needs to settle down before forecasts are reasonably reliable.

In the meantime, upgraded production and resource scope, and also a dual share listing in Australia, appear the kind of classic showcasing that miners undertake. However, I don’t want to be cynical, and it is positive how integrating Telfer and Havieron production in the medium term should enhance efficiency.

Acquisition costs near £400m vs £1.8bn market value

Conservative investors might say last December’s acquisitions for a total possible £390 million equivalent – if the upper end of production in a five-year earnout is achieved – needs to prove a very substantial discount to fair value relative to £1.4 billion for the rest of the group and its financial record to date. Mind the aspect of momentum trading this year as gold prices have soared.

These are twin resource projects: copper prices reached an all-time high of $5.23/kilo last March, but this is a highly cyclical commodity, hence has fallen back to January levels at around $4.14 in response to Trump’s tariffs. It seems early days to speculate on the balance of output, but presumably management will adapt to gold and copper markets.

Last September, £255 million was raised in an institutional placing and retail offer at 4.8p, although companies are at the behest of market pricing and this was against a gold price around $2,600/ounce. It left £72 million cash at the end of last year, which looks adequate in support of investment.

- Stockwatch: let’s see how tariff chaos affects company profits

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Bulls therefore need confidence that gold prices will be sustained high enough for operational gearing to bring down the forward PE multiple already around 30x. They’ll also want to see how the rest of Greatland’s project portfolio can be usefully monetised, and that it can avoid the classic risks of mining such as operational setbacks.

Normally I would be averse to a speculative play like this, but it looks worthy of attention due to gold’s rerating and scope for ongoing attractive news from these acquisitions.

Broadly I conclude with a “buy” rating because if one seeks exposure to gold, then Greatland’s projects plus operational gearing could make it a preferred play on both the London and Australian markets in due course. Care needs to be taken after the six-week spike, yet speculators may interpret this as a classic break-out in context of radically improving fundamentals.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.