Stockwatch: what I’d do with BT and Vodafone shares

Both these household names operate in a fiercely competitive sector, and investors have been waiting patiently for a recovery at both. Analyst Edmond Jackson gives his opinion following latest results.

26th July 2024 12:23

by Edmond Jackson from interactive investor

Was there much sense in yesterday’s stock price reaction to trading updates from Vodafone Group (LSE:VOD) and BT Group (LSE:BT.A), or chiefly reflecting yo-yoing across the wider market?

Both initially traded weaker, Vodafone down around 1.5p to below 69p, BT, a worse reaction, down 5p to 134p, but each improved throughout the day to close at around 72p and 140p respectively. You wonder why bother with company specifics if stocks appear to track the global mood, although I suggest they prevail in the longer run.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top UK Shares

Both CEO’s assert “much remains to be done”, which can be interpreted positively as scope to improve, albeit involving time, hence this remains a favoured message in challenging turnarounds.

Plethora of reactions to Vodafone’s first quarter

Reporting of quarterly results to 30 June ranged yesterday from “growth slows” to “posts solid gains” – not too surprising given the mixed details.

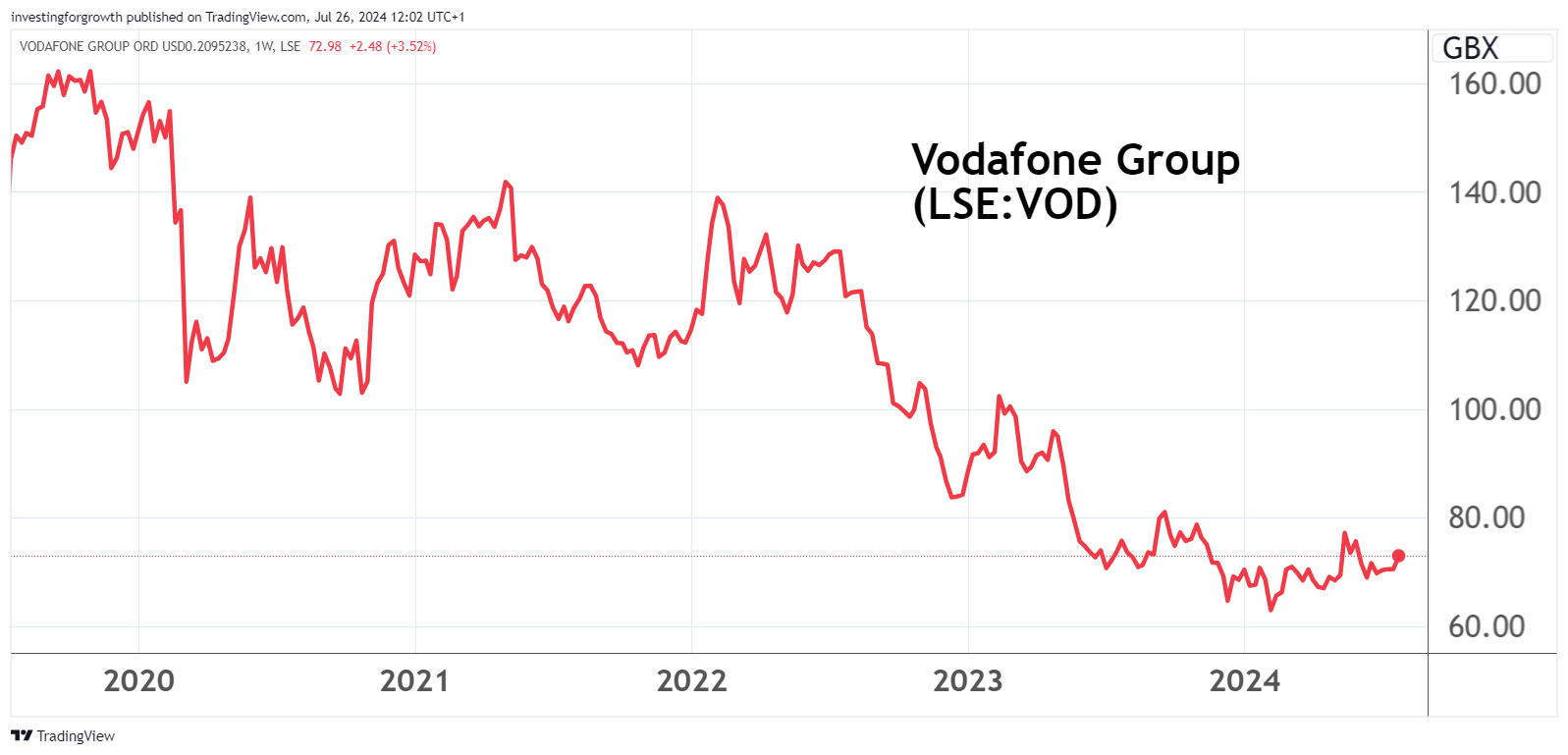

I made a “buy” case last March at 67.7p, on the back of substantial director buying: the finance director acquired over £1.7 million of stock at 69.6p and the chair £568,000 at 69p. This seemed too big to ignore despite the likelihood Vodafone’s turnaround will take time.

Source: TradingView. Past performance is not a guide to future performance.

Price advanced to over 77p, with the mid-May annual results to 31 March proclaiming numbers slightly ahead of expectations. The group’s organic service revenue growth was 6.3% and the business division rose 5.4% - a contrast with BT whose business side continues to drag. In this latest quarter, Vodafone’s service revenue is up 3.2% albeit compromised by adverse foreign exchange.

Geographically, the latest story on Vodafone’s revenue is mixed: Turkey and Africa are relatively strong, but Germany (over a third of group revenue) saw the effect of a TV law change, that blocks housing associations from bundling TV and broadband subscriptions with rent. It meant the loss of some 700,000 customers; otherwise it would have been just a 0.3% slip revenue slip in Germany. This offset gains in other continental European markets.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Why Centrica and Vodafone shares are going different ways

The UK remains stable although you could say slightly down in inflation-adjusted terms.

Constituting 19% of group revenue, the UK fixed broadband base grew by 44,000 to over 1.4 million customers (partly due to being available via both the Openreach and CityFibre networks) although mobile slipped 71,000 to 18.6 million. In broadband, this was relatively better than BT’s worst-ever drop in customers on its Openreach network over the same period.

Vodafone is not much to get excited about in revenue terms, but such is the nature of a keenly competitive telecoms market. The declared game plan for the year ahead involves “investing in customer experience, improving performance in Germany and further boosting momentum in business, while simplifying group operations”.

Vodafone - financial summary

year end 31 Mar

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Revenue (€ million) | 49,810 | 47,631 | 46,571 | 43,666 | 44,974 | 43,809 | 37,010 | 37,672 | 36,717 |

| Operating margin (%) | 2.7 | 7.8 | 9.2 | -2.2 | 9.1 | 11.7 | 15.5 | 38.4 | 10.0 |

| Operating profit (€m) | 1,320 | 3,725 | 4,299 | -951 | 4,099 | 5,129 | 5,740 | 14,451 | 3,665 |

| Net profit (€m) | -5,405 | -6,297 | 2,439 | -8,020 | -920 | 59.0 | 2,237 | 11,838 | 1,140 |

| Reported EPS (euro cents) | -20.3 | -7.8 | 15.8 | -16.2 | -3.1 | 0.2 | 7.1 | 43.5 | 4.4 |

| Normalised EPS (cents) | -18.0 | -9.8 | 16.3 | -6.7 | -7.9 | 2.6 | 7.8 | 13.3 | 6.8 |

| Ops cashflow/share (cents) | 53.7 | 50.8 | 48.8 | 47.0 | 59.1 | 58.0 | 62.1 | 65.0 | 61.0 |

| Capex/share (cents) | 52.0 | 31.7 | 29.3 | 29.5 | 25.8 | 29.1 | 31.1 | 33.2 | 25.3 |

| Free cashflow/share (cents) | 1.7 | 19.2 | 19.5 | 17.5 | 33.2 | 28.9 | 31.0 | 31.8 | 35.7 |

| Dividend/share (cents) | 14.4 | 14.8 | 15.1 | 9.2 | 8.9 | 9.2 | 9.0 | 9.0 | 9.0 |

| Earnings cover (x) | -1.4 | -0.5 | 1.1 | -1.8 | -0.4 | 0.0 | 0.8 | 4.8 | 0.5 |

| Return on capital (%) | 1.0 | 3.3 | 4.0 | -0.8 | 3.0 | 4.1 | 4.8 | 11.9 | 3.0 |

| Cash (€m) | 18,259 | 14,955 | 13,469 | 26,649 | 20,646 | 14,980 | 15,427 | 18,722 | 11,275 |

| Net debt (€m) | 38,793 | 31,314 | 29,512 | 26,306 | 54,279 | 52,780 | 54,665 | 47,668 | 45,712 |

| Net asset value (€m) | 83,325 | 72,200 | 67,640 | 62,218 | 61,410 | 55,804 | 54,783 | 63,399 | 59,966 |

| Net asset value/share (cents) | 314 | 271 | 254 | 228 | 229 | 198 | 193 | 235 | 221 |

Source: historic company REFS and company accounts.

Operating profit got a 43% boost to over €1.5 billion (£1.3 billion) albeit due to a €0.7 billion gain on a disposal; otherwise it would have been a 22% drop. Management tries to focus attention instead on adjusted EBITDA – the pre-amortisation and depreciation measure – up over 5%.

Full-year profit guidance is unchanged – which is at least positive in terms of €11 billion underlying cash profit and €2.4 billion underlying free cash flow.

Investors will be most interested in how this translates for medium-term dividend prospects after the 9 cents a share total payout has been halved to 4.5 cents in respect of the current financial year. It implies 3.8p, hence a prospective yield of 5.3% which slightly lags BT at 5.7% assuming an 8p payout there.

Vodafone is however also engaged in a €2 billion share buyback programme by way of “returns” from asset disposals, equivalent to around 9% of its market value.

- Trading Strategies: a FTSE 100 company with solid fundamentals

- The Week Ahead: Barclays, HSBC, BP, Shell, Rolls-Royce, IAG

Excluding the (sold) Spanish and Italian operations, net debt held at €33.2 billion year-on-year, which meant a hit of just over €2 billion net to last year’s income statement, by way of net interest. Yet from various disposals this figure should soon be coming down meaningfully.

Overall, I find the update affirms a “steady as she goes” turnaround, the chief near-term uncertainty looking like the regulatory outcome of the proposed merger between Vodafone UK and Three UK. Announced in June 2023, the objective remains to close it by end-2024 with 51% control and CK Hutchison owning 49%.

Vodafone has referred to constructive discussions with the UK Competition and Markets Authority (CMA), however its first-state investigation published last April asserted both businesses are viable and would continue to invest (in customers’ interests) absent any merger.

This countered a claim by Three’s CEO about how a first operating loss since 2010 is unsustainable. The CMA has also cited inconsistencies in what Vodafone and Three had told it in submissions. Call me cautious but I am steeled for the CMA potentially to disrupt this merger.

Overall, I retain a patient “buy” stance on Vodafone as the various strands of operational improvements, debt reduction and a return to dividend growth, come together.

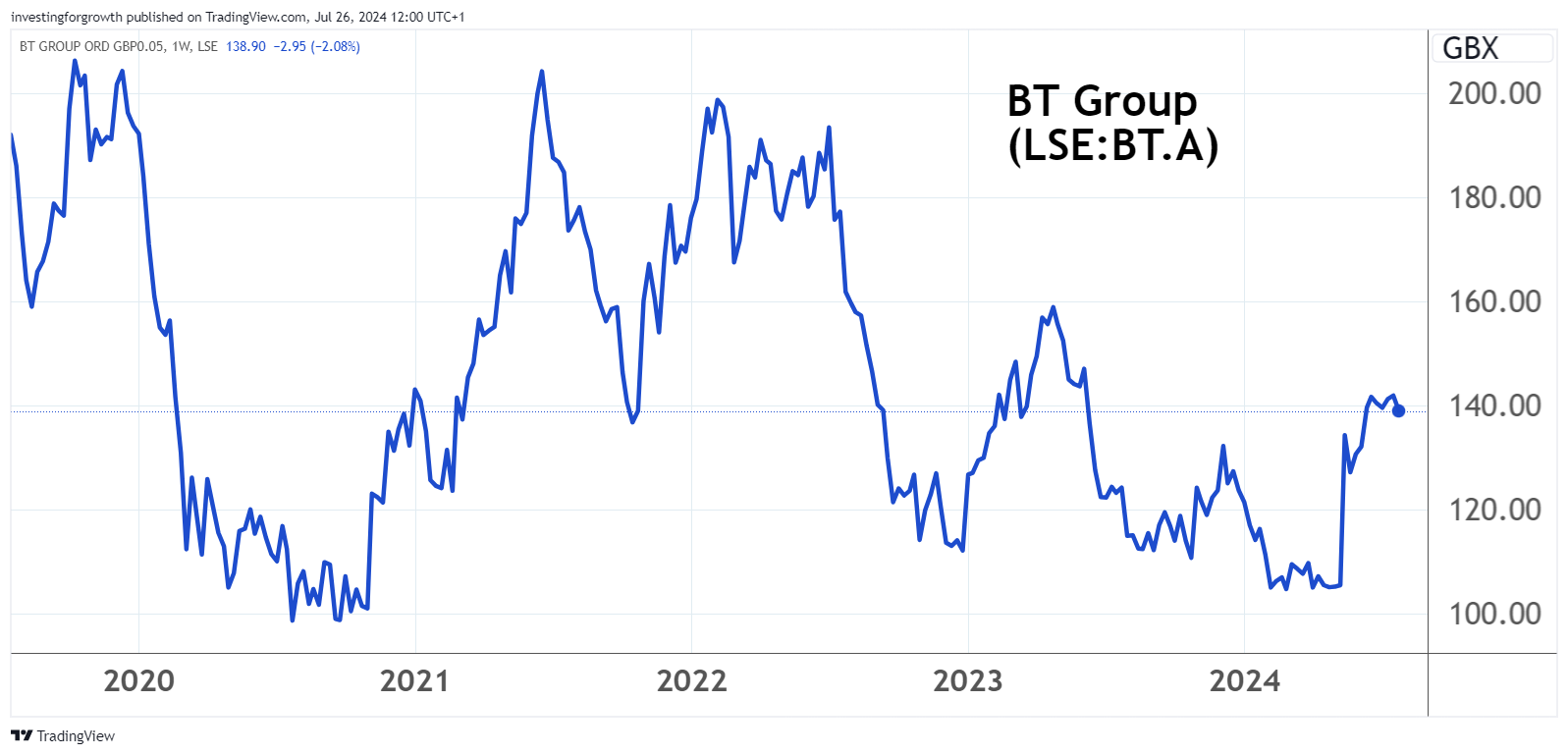

Financial proof on BT remains a way out

I rated the stock a “buy” at 124p last November although have done so on yield criteria since my tip at 102p in October 2020 – the market price having risen to 200p by June 2021 but down as low as 102p as recently as April this year.

Source: TradingView. Past performance is not a guide to future performance.

Yield remains a crux for market value at what remain historically low levels, the recent re-rating driven by chief executive Allison Kirkby’s bold proclamation at May’s annual results of “a path to more than double our normalised free cash flow over the next five years.” It raised the current total dividend per share prospect to 8.0p, although consensus is yet to feel optimistic enough to raise this any higher in respect of March 2026.

While BT is a major household name, there are plenty of stocks expected to yield over 5.7% - although in due regard to BT this does come with around 2.3x expected earnings cover.

The real question for total shareholder return, with the stock possibly on a forward price/earnings multiple of only 8x, is broadly similar to Vodafone. Can the operations narrative genuinely improve to reflect growth, or does tough competition and regulation compromise recovery in capital terms?

The CEO speaks of “a solid start to the year, with excellent growth in fibre build and connections, and increased EBITDA,” but it has only taken a 5% slip on the business side in the three months to end-June to see group revenue 2% easier at £5,052 million. The EBITDA growth is only 1% to £2,061 million, yet UK inflation probably still runs at around 3% if adjusting for recently low energy prices.

The number of customers on the Openreach network fell by 196,000 in the three months, much bigger than the previous quarter. Competition from Virgin Media 02 and “alt nets” such as CityFibre are blamed, as well as a weaker overall market for broadband.

- Stockwatch: three shares to buy after industry warning

- DIY Investor Diary: 10 private investors share their top tips

- UK dividends hit record quarterly high, but 2024 outlook cut

As a BT broadband customer, I am a tad surprised. The package keeps me loyal: consistently good performance, free Norton antivirus and a commitment to continuous connection via unlimited minutes to a tethered mobile if a fault does need sorting. Billing has been the only let-down, taking months to resolve contract recognition, but which still doesn’t prompt me to leave BT.

A constraint on BT’s latest numbers, however, seems Ofcom’s lately banning bill increases mid-contract – pegged to retail price inflation plus 3.9%. In my case, BT made such a pig’s breakfast of moving to a new contract from last autumn, that terms were implemented only last March hence did not involve any increase from April.

The CEO reassures investors that: “We remain on track to deliver our financial outlook for this year and cash flow inflation to around £2 billion in 2027 and £3 billion by the end of the decade.”

That sums it up. Holders are going to need patience. Yet, given it’s a similar situation at Vodafone, I think it possible to diversify between the two, hence I retain a “buy” stance on BT. At least it does not have Vodafone’s regulatory uncertainty in the UK, and challenges in Germany.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.