Stockwatch: is this well-known small cap share a recovery play yet?

19th July 2022 10:46

by Edmond Jackson from interactive investor

After a poor five years that has included profit warnings and a pandemic crash, companies analyst Edmond Jackson examines the case for buying these shares on the cheap.

Despite its AGM trading update affirming forecasts, the small-cap shares of Saga (LSE:SAGA), the insurance and travel group for the over-50s, remain indifferent. Its chart is currently trying to hold 160p versus an October 2020 low of around 130p. But is pessimism warranted by a difficult consumer outlook?

Some years ago, well-off older people – “Woopies” – were heralded as the next hot prospect for marketing, being asset-rich and with gold-plated pensions.

Yet Saga’s capitalising on this became torturous for shareholders and, as troubles mounted, the management blamed former private equity owners and vice versa.

Hopes were raised two years ago when the founder’s son – himself a septuagenarian – returned to the business he ran for 20 years, as chairman. He put in £100 million of new equity as part of a re-capitalisation.

Last September, and with the stock at 340p, I found its interim results mixed. Good to see near 81% retention levels for insurance policies and cruise bookings were ahead of pre-pandemic levels. But with £6 million monthly cash burn on the travel side, linked chiefly to two new cruise liners, losses were up nearly 50% to over £51 million.

Yet there was optimism, these “boutique” cruisers – offering exclusive travel relative to the big liners – could help Saga could achieve record profits once the pandemic eased.

- ii view: shares fail to reflect Saga travel improvement

- Jeff Prestridge: my message to investors

- Stockwatch: director puts big money into this AIM growth share

Cash flow from insurance helped keep the group viable, but while Saga proclaimed a coup with three-year fixed price policies, rivals were already introducing aspects of price-fixing. This is a relatively expensive insurer, possibly because it’s helped by older customers who prefer a familiar name and are less inclined to shop around online. Like others, however, Saga was releasing reserves set up when Covid first hit, hence an underwriting profit of over £30 million was not a good indicator.

I concluded with a “hold” stance given upside was speculative – according to what kind of new normal might evolve for travel, and competition in insurance.

Saga fell quite like other small caps, to 285p at the year-end, recovered to 315p by mid-February this year, but has slumped amid a loss of confidence in consumer stocks.

The Ukraine crisis then meant fuel price inflation, which is liable to impact cruising margins and people’s willingness to spend. Higher living costs may also prompt Saga customers finally to seek cheaper insurance renewals.

I am quite surprised that Saga does not say in this AGM update how it is managing cost issues and whether it has engaged in fuel price hedging.

Are hopes for the 2023 and 2024 too high?

Consensus expectations for years ending January 2023 and January 2024 actually appear to have risen, from £36 million net profit this year and £66 million next, to £41 million and £74 million respectively. On this basis the stock trades on a 5.1x price/earnings ratio (PE), falling as low as 2.9x.

Although on the basis of trading since last February, the AGM update specified annual pre-tax profit in a £35-£50 million range.

Given this period has involved much higher fuel prices, implicitly Saga is coping, but clarification would help.

Insurance continues to come across as mixed. Travel policy sales for June are said to be in line with pre-pandemic levels, albeit 2% behind the prior year. Motor and home are down 9% year-on-year due to a decline in new business; more positively, there is an 83% retention rate and a £73 margin per policy. Reserves releases continue, mind, and are expected to remain above long-run levels. Will we ever see insurers normalise profits down for this? I doubt it.

Many companies separate “exceptional” costs to focus attention on normalised earnings, but you typically have to dig in notes to insurer accounts to see what extent reserves releases boost profit. In Saga’s last interim results, it was at least clear - 54% of underwriting profit was derived from reserves releases, but in the January 2022 annual accounts I could not find this specified.

Insurers may say that this is part of normal operations, but it feels more like accounting games than real profit.

Expected full-year load factor for cruises of 75%

Management is pleased with a load factor – a measure of how well its cruise ships are filled – of 75%, but it does not sound exciting given relatively smaller liners are involved. The 2023/24 cruise season is said to be “well ahead of expectations” at 34% booked.

When Saga cites “holidays expected to report a small first-half-year loss albeit much improved on the prior year” it needs to be clear whether they’re referencing cruise tours or other holidays, or both.

It is crucial to know just how well the cruise operations are doing, plus their sensitivity to higher oil, as they provide leverage for Saga equity – and what is now in its value equation.

- Read further content by Edmond Jackson here

- Dividend investing: three tips for a comfortable retirement income

Possibly, the stock has been dragged down with all other consumer-related businesses but, lacking some aspects of clarity, I suspect it is why the share price continues to ease back towards October 2020’s low at around 130p.

No firm case for investment value exists because higher living costs may result in insurance customer attrition, and cruising profits are speculative according to medium-term demand versus energy costs.

Yes, there has been pent-up demand for travel as Covid has abated, but even that may change as infections soar once again. Will enough older folks want to commit to going on a premium holiday if Covid continues to rise heading into this autumn?

Stagflation could cause even well-off older people to pause spending, although a recession could be what is required to reduce oil prices.

While Russia remains antagonistic, its oil & gas sales substantially embargoed by all but a few countries, it is otherwise hard to envisage energy/fuel prices de-rating.

Saga - financial summary

Year end 31 Jan

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Revenue (£ million) | 901 | 963 | 871 | 860 | 842 | 797 | 338 | 377 |

| Operating margin (%) | 12.6 | 18.3 | 22.2 | 21.0 | -16.0 | -37.7 | -18.1 | -6.2 |

| Operating profit (£m) | 114 | 176 | 194 | 181 | -135 | -301 | -61.2 | -23.5 |

| Net profit (£m) | -134 | 141 | 157 | 139 | -162 | -313 | -67.8 | -28.0 |

| Reported EPS (p) | 117 | 180 | 191 | 179 | -198 | -382 | -67.0 | -20.1 |

| Normalised EPS (p) | 129 | 183 | 193 | 185 | 51.5 | -56.3 | -17.3 | -15.2 |

| Operating cashflow/share (p) | 212 | 183 | 169 | 164 | 181 | 112 | -77.5 | 33.3 |

| Capital expenditure/share (p) | 36.0 | 41.2 | 53.4 | 100 | 76.9 | 360 | 282 | 13.5 |

| Free cashflow/share (p) | 176 | 142 | 115 | 64.1 | 104 | -248 | -359 | 19.8 |

| Dividend/share (p) | 56.0 | 98.4 | 116 | 123 | 54.6 | 17.8 | 0.0 | 0.0 |

| Earnings cover (x) | 2.1 | 1.8 | 1.7 | 1.5 | -3.6 | -21.5 | 0.0 | 0.0 |

| Cash (£m) | 199 | 107 | 109 | 83.2 | 123 | 97.9 | 102 | 227 |

| Net debt (£m) | 499 | 461 | 379 | 373 | 347 | 565 | 721 | 705 |

| Net asset value (£m) | 984 | 1,088 | 1,195 | 1,226 | 961 | 588 | 681 | 653 |

| Net asset value/share (p) | 1,210 | 1,330 | 1,460 | 1,495 | 1,170 | 716 | 486 | 465 |

Source: historic company REFS and company accounts

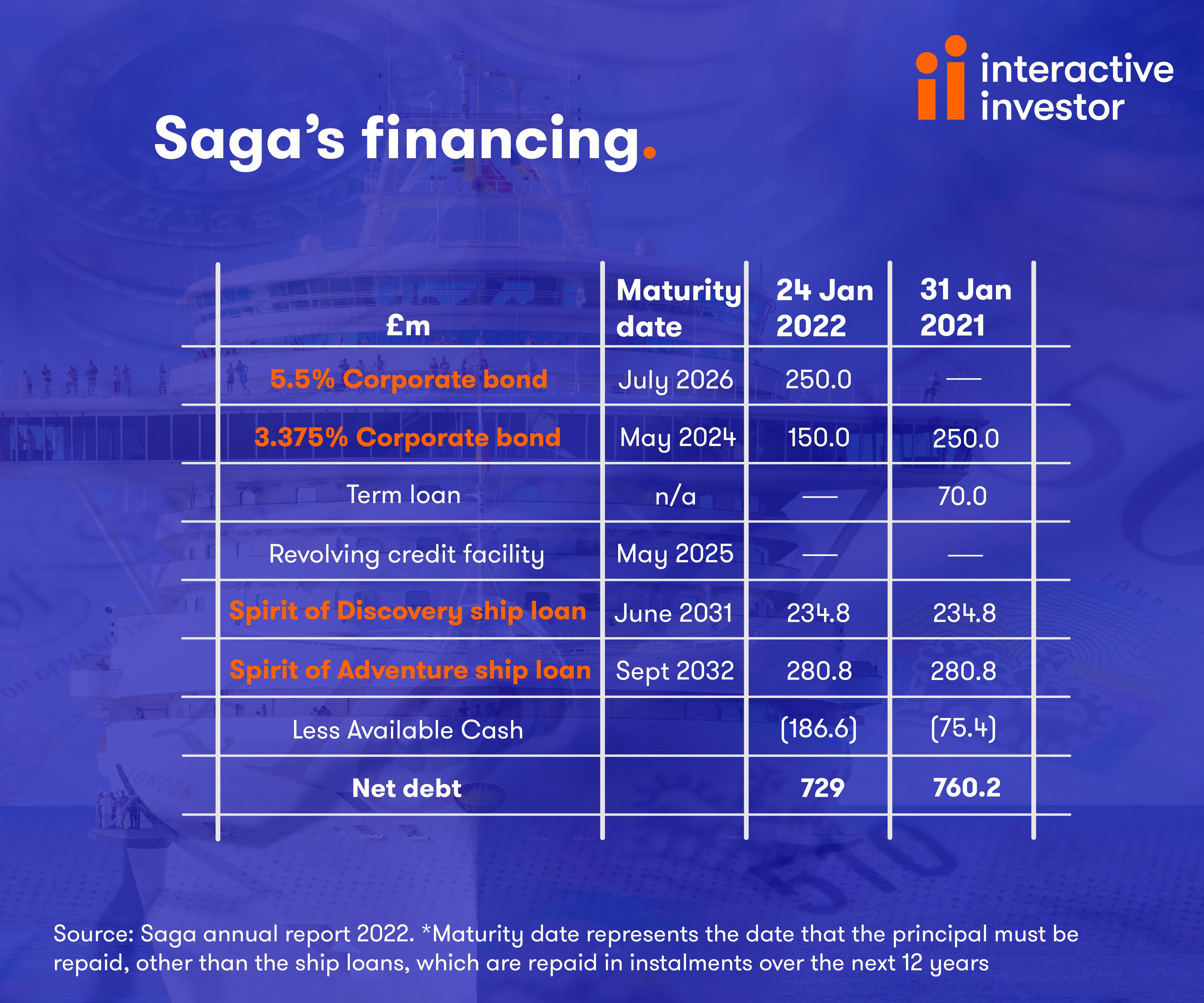

Net gearing of 109% is high but manageable

The 31 January balance sheet cited £227 million cash and £936 million financial liabilities - note 30 of the report broke it down as £400 million bonds and £516 million ship loans.

The ship loans are being paid down by instalments up to June 2031 and September 2032; and are the only debt to which covenants apply.

Within the bonds, £250 million at a 5.5% fixed rate of interest is repayable in July 2026.

Barring some kind of catastrophe, Saga should be able to navigate its debt repayments. Its equity is not exposed like peer company Carnival (LSE:CCL) with 440% net gearing.

Where is there a prop for the shares?

The debt repayments appear to thwart a resumption of dividends unless any improvement in trading proves sustainable, and any sense of asset-backing assumes recognising an extent of goodwill. Goodwill comprised £719 million at 31 January, and there were also £47 million intangibles within £653 million net assets (465p a share). Otherwise, Saga has negative net tangible assets. Perhaps something should indeed be recognised for brand value, if hard to quantify.

Everything therefore rests on an improvement in Saga’s commercial story, where shareholders may respect “steady as she goes” progress. More grist is needed, although the consumer environment is deteriorating.

Possibly, the stock bumps along in months ahead and the wider market attempts to begin pricing for economic recovery later this year. In this scenario then, yes, averaging into Saga now would pay off.

Regime change in Russia might improve energy supply, but if recession lies ahead and war on Europe’s fringe inhibits any significant drop in fuel prices, Saga’s mixed narrative is liable to persist. For patient investors: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.